FW

The textile industry should look at reviving technology and skills to recapture higher share in the global trade, said Kavita Gupta, Textile Commissioner, while speaking at the inauguration of joint technological conference of textile research associations.

“The future of textile industry is going to be technical textiles,” she said, adding, “In the last five years, there had been 20 per cent growth year-on-year in this segment. The sector should aim to be 40 per cent of the country’s textile industry. The centres of excellence created for technical textiles should look at having joint annual conferences as done by the research associations. The Union Government had allocated Rs 200 crores under the technology mission for technical textiles and there is still some fund that is not spent. The centres should come forward with proposals”.

D. Krishnamurthy, Chairman of the council of administration of South India Textile Research Association, while speaking on the occasion informed that the association conducted 19 training programmes in the last one year. He also elaborated on the projects taken up and completed by the four textile research associations in the country.

The South India Textile Research Association has also launched a website where the companies can register to get a consolidated report on the quality of fibres and yarn. Initially, it will be for 40s, 60s, 80s and 100 count yarn. The industry experts are of the opinion that this effort by SITRA will help in establishing standards for quality of yarn.

www.sitra.org.in

After Accord on Fire and Building Safety in Bangladesh, a platform of European retailers, and Alliance for Bangladesh Worker Safety, a consortium of North American buyers, accused Bangladeshi factories of no progress on remediation work, the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) has decided to personally look into the matter.

Accord has stopped work with almost eight garment factories for their failure to meet the conditions of remediation in time and it has also warned over 120 factories of cutting business ties over slow progress in corrective action plan. Even Alliance has cut relations with 23 factories from its supplier list and warned 12 more for the same reasons. Now the BGMEA started collecting information from its member factories regarding factory inspection and remediation progress.

It has created a format for updating inspection status. Around 46 factories have already provided their inspection status. Once BGMEA receives status from all the factories in question, it would compare them with that of the Accord and Alliance to appear at a conclusion and find a way out.

www.bgmea.com.bd

TRENDSPOTTING 2016: "The industry has a ‘buyer-driven chain.’ This means that the big retailers and marketers, and traders drive the market (i.e. they determine where to produce, what to produce and at what prices). Hence, retailers and brands, typically situated in developed countries in Europe, Japan and the US. These brands do tasks such as branding, design, marketing and they outsource the production of the garments".

Today the textile and garment industry is a global one and supply -value chains are spread across many countries and continents. Currently the garment industry plays such a role in many least developed and developing countries.Textile and garment industry is one of the key sectors contributing to a country’s overall economy and human resource development. After agriculture, garment industry is the second highest manpower intensive industry. World Garment Market is pegged at almost1.7 trillion USD by 2012. About 60 million to 75 million people are employed in the textile, clothing and footwear sector worldwide (2014 ) whereas to compare in 2000 only 20 million people were employed in the industry and about three quarters of garment workers worldwide are female.

The late 20th century saw a period of significant change in the concentration of the garment market: since that time, the main producing and exporting countries have almost completely changed.In 1970, among the biggest exporters to US were: Japan, United Kingdom, Canada, Italy, France, etc. By 2011, the USA was receiving most imports from countries like China, Cambodia, Pakistan, Mexico, Bangladesh, etc. While even in 1970 countries Production has, in general, shifted to least developed or developing countries. The bulk of production remains in Asia, although the production market in some non-Asian developing countries is growing: e.g. Panama, Chile Egypt. Countries like Turkey, Morocco and Tunisia have emerged as key players when it comes to exports to the European countries.

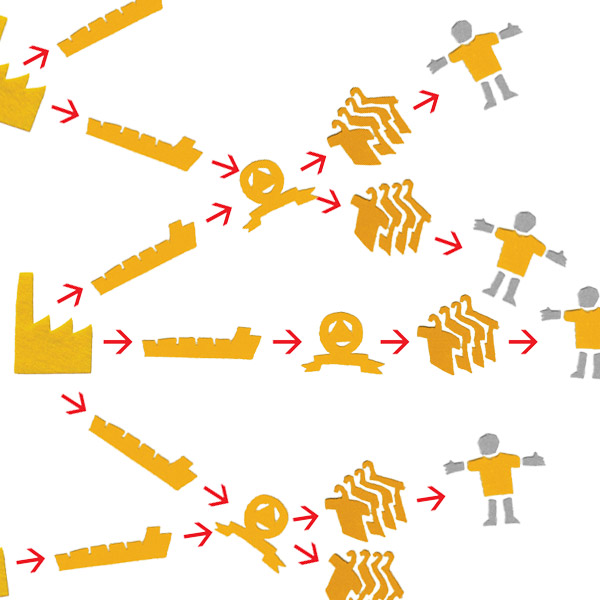

Developing countries in the buyer driven chain

The industry has a ‘buyer-driven chain.’ This means that the big retailers and marketers, and traders drive the market (i.e. they determine where to produce, what to produce and at what prices). Hence, retailers and brands, typically situated in developed countries in Europe, Japan and the US. These brands do tasks such as branding, design, marketing and they outsource the production of the garments. While production: covered by the laws of the state where it is executed (e.g. Bangladesh) and by international human rights, labour law and commercial law standards (e.g. human rights treaties, ILO Conventions, codes of conduct). The most labour intensive parts of the chain are in developing countries, whilst most knowledge intensive parts remain in developed countries.

In recent years there has been a change in how garments are sourced: there has been a move towards consolidation of supply chains to be able to keep up with ‘fast fashion’ concept. However the disparity in the wages in different countries is a major impediment for this. Many garment workers (particularly women and migrant workers)50 in developing countries work in what is known as the informal economy. In 2004, it was estimated that the informal economy generated 35% of global GDP; the figure is likely higher now. Whilst there is no universal definition of the informal economy, the ILO has identified some key factors: informal workers ‘are not protected under the legal and regulatory frameworks’ and are, ‘characterised by a high degree of vulnerability. Informal workers are not typically recognised by the law and hence do not have access to social security, and most forms of labour protection. The ILO has acknowledged that there is ‘no clear dichotomy or split between the ‘informal economy and the ‘formal economy. States (represented by their respective governments) can play an influential role in impacting change in the garment industry. The creation of the International Labour Organisation (ILO) has been instrumental in the international recognition of fundamental minimum labour standards. The creation and development of many international human rights treaties have enshrined certain internationally guaranteed rights which can positively affect labour conditions in the garment.

In equality in wages & infrastructure

However international treaties are binding on the states that have ratified them. These states are obliged to comply with them; however, there is no mechanism for enforcement unless the state has also ratified the optional protocol to the respective treaty. Major garment producing countries that are party to the optional protocols against which individuals can invoke their human rights: Philippines (ICCPR), Cambodia (CEDAW), Thailand (CEDAW). However in the remaining countries like Laos, Pakistan, India, Bangladesh, China) there are no enforcement mechanisms for any of the abovementioned treaties available. The United Nations has guiding principles for companies to conduct business in a human rights respecting way. In these guiding principles, states and corporations are urged to take measures to uphold and enforce human rights. Moreover, these principles state how to access remedies as individuals in case of a human rights violation. Regional Efforts have also been there to Focus- Supply Chain.

However the countries like Cambodia, Bangladesh, India are riddled with informal economy .Many factories lack adequate nursing facilities or child care which effectively discriminates against women, making it very difficult for them to continue working once they have children. Unfortunately, women get paid less for the same work as men do. Child Labour Child Labour is an issue of much concern in the garment industry and can be found in many parts of the industry, e.g. child labourers have been found working as cotton pickers in Uzbekistan , India. In India where young girls are hired into Sumangali schemes who are exploited . In Bangladesh, Pakistan, Thailand and India during peak season, excessive overtime is common because factory owners are reluctant to hire additional.

Changing trend in labour laws in lease developed nations

The complex global supply and value chains mean that the demands of consumers in Europe or America have an effect on the conditions and wages of workers thousands of miles away. But it has been seen that Governments are not interested in improving conditions for employees, as it increases costs for employers as well and might encourage outsourcing companies to take their business elsewhere. Here it should be noted, for example, that the textile industry in Bangladesh makes a substantial contribution of 10 to 15 % to national GDP Gross National Product and employs around four million people, mainly females In turn the companies themselves are rather keen to make sure there are no accidents, as it could seriously harm their reputation, image or brand, but the persistent competitive pressure in the garment industry ensures that production chains are continuously adapted, which not drives down costs, but also exacerbates the problems. After months of unrest and unsettled pay rates, Cambodia’s Labor Committee said in November it would increase the monthly minimum wage for garment workers by 28 percent to $128.Strikes in the sector were rampant—and at times violent this year as at least three were killed when military police fired on protestors demanding higher wages in January. But the Cambodian government had been hesitant to raise the rate despite the ongoing unrest in fear that factory owners would be unable to pay and that factories might have been forced to relocate.Unions were originally fighting to see the wages go from the previous $100 per month to $177, but settled on $140 as their lowest acceptable offer. The rate was below what the unions wanted and members from eight labor unions were reportedly planning to meet in November to discuss their next course of action. The renewal of the AGOA expected to give a strong impetus to textile and garment shipments from Africa to the U.S., as some Turkish textile manufacturers eye Kenya and Ethiopia for manufacturing operations, butAfrican countries urgently need to upgrade infrastructure and simplify customs procedures

Africa's textile and garment industry is optimistic that its shipments to the United States, the world's biggest market for such products, will surge following the 10-year renewal of the African Growth and Opportunity Act (AGOA) - under the United States' General System of Preferences that allows duty-free imports of a wide range of African products, which was signed by President Barack Obama on June 11, 2015.

This is also driving many Turkish, Indian and Chinese textile companies to African countries, particularly Ethiopia and Kenya, to not only flee the rising production and labor costs at home but also to avail of the duty-free exports under the AGOA to the United States.

"Exhibitors present at ITMA such as Sei Laser, the Curno, Italy-based company introduced Flexi Denim, a digital laser machine that can replace traditional, manual methods for discolouration, abrasion, decoration, marking, engraving and cutting of jeans and other finished garments. Flexi Denim safeguards the environment by reducing water consumption by 80 per cent and eliminating the use of toxic chemicals."

Sustainability is the buzzword today. And apparel and textile companies around the world too are doing their bit, initiating efforts to go green. Denim production has traditionally been one of the unsafe processes. However, now denim makers are trying to make their production processes less harmful to the environment.

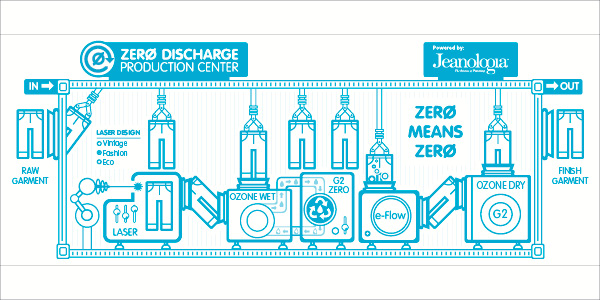

Jeanologia introduces Zero Discharge Technology

Denim production requires high water and energy. Companies are especially working on these areas to reduce usage. Jeanologia from Valencia, Spain, for instance recently launched its latest innovation in sustainable technologies at ITMA in Milan.

The 22-year-old, family-owned company demonstrated ‘The Zero Discharge Production Centre’, which it said is the first denim treatment plant that “guarantees zero contamination or waste.” To achieve this, the center combines three technologies it has developed over the years: a laser, which is used to create a vintage effect; Ozone G2, a machine that uses air to reproduce ozone gas conditions to give garments a worn look; and eFlow, a waterless system that transforms air into nano-bubbles, which help produce a soft hand and reduces shrinkage.

The company claims that combination of these technologies reduces the use of water and chemicals by 90 per cent and energy consumption by 50 per cent and the technology recycles 100 per cent of the water it uses, eliminating the need for water treatment and also the use of pumice stone, which produces unhealthy dust particles and requires several post-production washings.

Reducing carbon footprint a priority

Archroma, a global colour and specialty chemicals producer is keenly following the green movement. The Reinach, Switzerland-based firm has developed an Advanced Denim concept, that “seamlessly unites technology, ecology and fashion in a single, sustainable package.” In one of its latest announcements in the denim finishing area, Archroma reported that its partner, clothing company Patagonia of Ventura, California, US, is using a dyeing and manufacturing process developed by Archroma.

The process uses Diresul RDT dyestuffs that bond more easily to cotton, minimizing the resource-intensive and environmentally destructive indigo dyeing, rinsing and garment washing process used to create traditional denim, according to Archroma. As a result, Patagonia is now said to be using 84 per cent less water, 30 per cent less energy and emitting 25 per cent less CO2 than conventional synthetic indigo denim dyeing processes, Archroma said.

Other exhibitors present at ITMA such as Sei Laser, the Curno, Italy-based company introduced Flexi Denim, a digital laser machine that can replace traditional, manual methods for discolouration, abrasion, decoration, marking, engraving and cutting of jeans and other finished garments. Flexi Denim safeguards the environment by reducing water consumption by 80 per cent and eliminating the use of toxic chemicals And the first ITMA Sustainable Innovation Award winner Levi Strauss collaborated with ITMA exhibitor Tonello of Italy to develop NoStone, a new finishing technique that provides a mechanical alternative to pumice stones.

The part of Paris agreement is countries’ committed to raise $100 billion a year by 2020, to help developing nations mitigate and adapt to the consequences of climate change. And large fashion groups such as H&M are doing their bit to bring awareness among their suppliers to better the supply chain with clean and green practices. The companies now need to work in unison to tackle the challenges across borders and the Paris global agreement is considered a first step towards the green future.

More than a hundred textile mills in Pakistan may close if they do not get sales tax refunds. These mills are facing liquidity issues and a high cost of doing business. The industry has been compelled to borrow from banks. The view is that timely refunds payment will help in increasing the country’s exports by $4 to $5 billion.

A working capital blockage creates difficulties for exporters to complete orders on time. If the government is unable to immediately settle the amount, the industry wants bonds to be released against refunds. An alternative is to bring the export sector back in the zero-rate sales tax regime to minimise the refunds pendency.

Under law refunds have to be released within 45 days, but there have been complaints of delayed refunds for the last one year. In many cases, refund processing orders, which were to be honored in a certain time, were issued but cheques were not issued for six months. Some of the refunds were deferred in cases where invoices were issued by persons, who later became defaulters. The industry requests refunds of genuine taxpayers to be cleared forthwith. It says it is already facing a shortage of power and higher utility rates.

Textile mills in India want the duty structure on manmade fibers to be rationalised. They say this can propel the textile industry toward a higher growth rate. The convoluted duty structure in manmade fibers has for long been a major irritant in the development of textile sector. At present, while manmade fibers attract 12 per cent excise duty, cotton fibers attract none. Similarly, imports of some of the raw materials for producing manmade fibers are taxed heavily, while those of their finished products are taxed lower.

The industry has long been demanding a reduction in excise duty on manmade fibers, saying such a disparity is preventing domestic producers from scaling up operations. Consequently, India’s textile market continues to be cotton-driven. Such a situation hurts India’s export competitiveness in the manmade textile segment. While manmade fibers account for around 70 per cent of the world’s total fiber consumption, they make up for less than 30 per cent of domestic demand.

Moreover, raw materials such as purified terephthalic acid — used for making polyester staple fiber, filament yarn and film — attract a five per cent import duty. Recent initiatives like interest equalisation scheme, export incentives and duty drawback have helped the industry to improve export competitiveness and also increase its market share across the globe.

Pakistan’s cotton production has fallen to its lowest in 17 years because of poor weather and pest outbreaks, leaving the country reliant on imports. Adverse weather, increased pest pressure from whitefly and pink bollworm, and the high cost of inputs discouraged farmers from better crop management.

The worsened production outlook represents a fall of nearly 30 per cent year on year, to the weakest since 1998-99. Pakistan’s imports in 2015-16 are estimated at 2.70 million bales, more than triple those of last season. Pakistan is in fact the world’s fourth ranked cotton producer after China, India and the US. It normally relies on imports for only a small portion of its needs, and often on quality grounds. It purchases, for instance, long staple cotton from the US, but will be forced this year to turn for extra supplies to India and West Africa.

Pakistan’s cotton yield this season represents a drop of 22 per cent year on year. The country’s production hopes have been hurt by weak prices, with poor weather adding to crop woes. Cotton and cotton products contribute about 10 per cent to GDP and 55 per cent to the foreign exchange earnings of the country. Nearly 30 to 40 per cent of the cotton ends up as domestic consumption. The remaining is exported as raw cotton, yarn, cloth, and garments.

Birla Cellulose, the fibre business arm of Aditya Birla Group, brought together LIVA Accredited Partners Forum (LAPF) partners and international brands at Noida on January 8, 2016, which is the country’s garment industry capital. This event is held in collaboration with the Society of Noida Apparel Export Cluster. It is part of the Group’s efforts to create a one-stop platform for fabric makers to reach out directly to women’s wear exporters and international brands.

This is part of the Group’s ongoing efforts to nurture various textile chain partners in the garment export sector amid struggling garment exports from India. A tough competition is posed by cheap imports from China and South Asian countries.

The conference is being be attended by around 40 LAPF partners who will showcase their products to 160 garment exporters including international brands such as Marks & Spencer, Macy’s and Gap as well as national exporters like Shahi Exports, Orient Craft, Pearl Global and Richa & Co. Leading buying houses such as Triburg, Impulse, Li Fung and Asmara as well as Biba and ITC will also attend the conference. This LAPF conference is the third in the series, the first one was held in Jaipur and the second in Coimbatore.

The volume of US clothing and fashion imports from all sources grew 4.8 per cent year-on-year in September 2015. Despite rising wages and a strong currency, China continues to be the largest exporter to the US, as no country can match China in terms of the size of its supply base, range of skills, quality levels, product variety and the completeness of its supply chain.

However, Vietnam’s clothing and textiles industries are increasingly receiving encouraging responses from western buyers. So while shipments from China were up 1.48 per cent, nearest rival Vietnam grew at a much faster rate, jumping 10.6 per cent compared to September 2014.

Vietnam is clearly benefiting as transnational and domestic producers operating within the country’s borders are diversifying their supply chains in a bid to position themselves to take advantage of the opportunities the Trans Pacific Partnership might open for them.

The US economy is predicted to grow at an average of three per cent as of 2016, which, if true, bodes well for domestic consumption and imports of clothing and fashion items produced in Vietnam. China, anticipating the after-effects of the TPP, has already started moving a large volume of its investments to Vietnam to boost its garment sector and take advantage of the TPP, should the trade pact become a reality.

SP Apparels, manufactures and exports of knitted garments for infants and children and force behind menswear brand Crocodile has launched. Established in 1989, it operates 20 manufacturing facilities and reported a net profit of Rs 10.1 crores in fiscal 2014-15. It is a fully integrated textile company with operations spanning from spinning to retail and fiber to fashion.

The company has filed draft papers with capital markets regulator Sebi to raise at least Rs 215 crores through its initial public offer. SP intends to garner up to Rs 215 crores through a fresh issue of shares, while its existing shareholders will offload 9,00,000 equity shares.

Proceeds from the fresh issue will be utilised for repayment of debt, expansion and modernisation of its manufacturing facility at Salem in Tamil Nadu and opening of new stores for the sale of Crocodile products. The funds raised will be also used for addition of balancing machinery for its existing dyeing unit and other general corporate purposes. As of November 2015, its aggregate outstanding debt was Rs 251.8 crores comprising long term borrowings, short term borrowings and current maturities of long term borrowings. The company expects to realise the benefits of listing of the equity shares on the stock exchanges.

www.spapparels.com/