FW

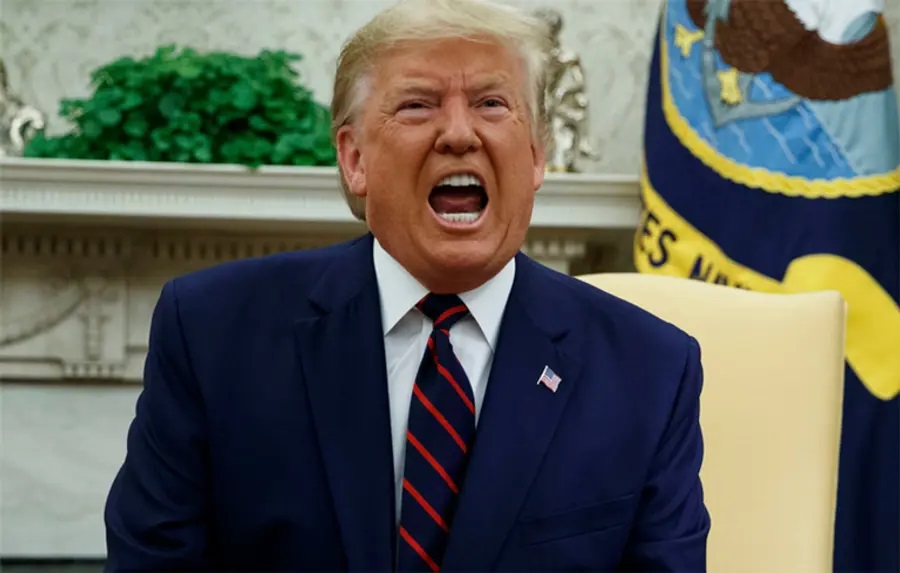

The Trump administration's decision to impose sweeping tariffs on imports from China, Canada, and Mexico has sent ripples of uncertainty throughout the global economy. This move has sparked fears of an all-out trade war, with potentially devastating consequences for businesses and consumers worldwide. However, amidst this turmoil, some countries are expected to benefit from the shifting trade landscape.

The tariffs and their impact

The US has imposed a 25 per cent additional tariff on imports from Canada and Mexico, and tariffs on Chinese goods have been doubled from 10 to 20 per cent. These actions have triggered a wave of retaliatory measures. China has responded with tariffs on a range of US agricultural products, including soybeans, pork, and cotton. Canada has announced tariffs on US goods worth billions of dollars, and Mexico is prepared with its own retaliatory measures.

These tariffs and counter-tariffs are expected to have significant economic consequences. Businesses and consumers will face costs escalation due to higher prices on imported goods. Global supply chains will be disrupted, affecting manufacturing and distribution. There is a risk of job losses in industries reliant on international trade, and financial markets are likely to experience heightened uncertainty and volatility.

Textiles and apparel caught in the crossfire

The textile and apparel industry, with its complex global supply chains, is particularly vulnerable to the tariffs. The US Fashion Industry Association (USFIA) has voiced deep concern, emphasizing the interconnectedness of the Western Hemisphere's textile and apparel supply chain. They warn that tariffs will harm American farmers, retailers, and consumers. For instance, US cotton is a crucial input for Mexico's textile production. The industry already faces high tariff rates, and additional tariffs will exacerbate cost pressures.

On the other hand, India's textile industry sees the US-China trade war as a potential opportunity to expand its market share in the US. With tariffs on Chinese goods rising, Indian exporters could gain a competitive edge. Industry experts suggest that India should pursue a ‘Zero-for-Zero’ trade agreement with the US to further boost exports. This potential benefit for India extends beyond finished garments. With disruptions to the supply of raw materials like cotton from the US, India could also see increased demand for its own cotton exports.

Companies like Abercrombie & Fitch have already indicated that the tariffs will negatively impact their profit margins. The company has warned of softer demand and increased costs due to tariffs and other economic factors. The rise in shipping costs is an additional burden for many businesses.

The impact is being felt beyond the immediate players in the trade war. Bangladesh, for example, is seeing a rise in garment export orders, attributed in part to the US tariff policies that are making Chinese and Mexican exports more expensive. This is giving a boost to Bangladesh's economy, which is facing internal challenges. Vietnam, another major textile and apparel exporter, is also likely to benefit as businesses seek alternative sourcing destinations to avoid higher tariffs on Chinese goods.

A call for dialogue and solutions

Industry associations are calling for dialogue and solutions to mitigate the negative impacts of the tariffs. The National Council of Textile Organizations (NCTO) has expressed concern over the tariffs on Mexico and Canada, highlighting the importance of the North American textile and apparel co-production chain. They are also calling for the closure of the de minimis loophole, which allows small shipments to enter the US duty-free.

The American Apparel & Footwear Association (AAFA) has warned of the ‘crushing burden’ of the tariffs on American businesses and consumers. They emphasize the uncertainty and instability created by the tariffs, which could undermine the economy. They are seeking discussions with government officials to establish guardrails and promote smart trade policies.

Global economic implications and supply chain disruptions

The US tariff actions have triggered concerns about a potential global trade war, with far-reaching consequences for the world economy. The tariffs are disrupting intricate global supply chains, affecting businesses across various sectors. They could lead to a decline in global trade, hindering economic growth and development. Furthermore, the trade disputes could escalate geopolitical tensions between the US and its trading partners.

The disruption to supply chains starts with raw materials. The tariffs on Chinese goods, including cotton, will impact the availability and cost of fibers for textile production. This will have a ripple effect throughout the supply chain, affecting yarn manufacturers, fabric producers, and ultimately garment manufacturers. Companies may need to seek alternative sources for raw materials, potentially leading to increased costs and logistical challenges.

The long-term impact of the US tariffs is uncertain. Much will depend on how the situation evolves and whether the US and its trading partners can reach a resolution. There is hope that negotiations will lead to a resolution of the trade disputes. In the meantime, businesses and consumers should prepare for continued uncertainty and volatility in the global economy.

While the tariffs present challenges for many, they also create opportunities for countries like India and Vietnam to increase their share in the global textile and apparel market. The ability of these countries to capitalize on these opportunities will depend on their ability to adapt to the changing landscape and meet the demands of the global market.

United Arab Emirates-based fashion retailer Apparel Group, which distributes over 80 brands like Adidas, Asics, and Levi’s, exposed nearly 2.4 million files due to a misconfigured AWS bucket, reports Cybernews.

The leaked files included shipping labels with customers names, addresses, phone numbers, and order details. Cybernews researchers, who found the exposed data in October, warned that cybercriminals could use it for phishing and malware attacks.

Experts urge companies to enhance AWS security by restricting access, monitoring logs, and using AWS Key Management Service. Cybernews warns that cloud misconfigurations remain a major cybersecurity risk, emphasizing the need for stricter data protection measures.

Australian fashion retailer Ally Fashion has shut 51 stores and laid off 250 employees after being forced into liquidation by the Federal Court.

The brand, founded in 2001, operated 160 stores and an online shop before its financial troubles. Liquidators Jeff Marsden and Duncan Clubb of BDO Australia were appointed on February 28, citing outstanding rent as a key issue.

To improve viability, they closed underperforming stores, with Queensland losing 19 locations, followed by New South Wales (11), Victoria (8), South Australia (7), and Western Australia (6).

The remaining 109 stores continue under a licence agreement with a related entity of director David Dai. Marsden stated that the closure and restructuring efforts aim to secure the brand’s future.

Ally Fashion, known for its fast-fashion offerings, had previously thrived but struggled amid rising costs. The retailer joins others, including luxury brand Harrolds and designer Dion Lee, in succumbing to economic pressures. The cost of living crisis has significantly impacted consumer spending and retail jobs across Australia.

Big Lots is making a comeback after last year’s bankruptcy, with the first wave of store re-openings set for April 10. Variety Wholesalers, which acquired 200 locations from liquidator Gordon Brothers, is overseeing the relaunch.

Nine stores across Kentucky, Louisiana, Mississippi, North Carolina, Tennessee, and Virginia are undergoing cleaning, remodeling, and re-merchandising ahead of their reopening. Work began on March 3 to prepare these locations.

Jeff King, Variety Wholesalers vice president of sales and marketing, confirmed that a second wave will follow on May 1, featuring 70 more stores. Additional re-openings are planned through early June.

Big Lots, which closed all 870 stores in December, is getting a second chance under Variety Wholesalers, known for operating discount chains like Roses and Bargain Town. States such as Alabama, Florida, Georgia, Ohio, Michigan, Pennsylvania, South Carolina, and West Virginia are expected to see re-openings in later phases.

The retailer’s revival aims to bring back budget-friendly shopping while preserving jobs. With its phased relaunch, Big Lots is poised for a fresh start in the discount retail sector.

Women cotton farmers are revolutionizing cultivation with advanced techniques, backed by CITI-CDRA’s expertise. Embracing innovations like High-Density Planting Systems (HDPS), regenerative agriculture, and improved pest management, they are driving productivity while ensuring sustainability.

With hands-on training and continuous support, these farmers enhance fiber quality and adopt eco-friendly practices that safeguard soil health. Their adaptability is reshaping cotton farming, making it more efficient and resilient to climate challenges.

CITI-CDRA’s initiatives empower women with knowledge, modern tools, and market access, fostering self-reliance and economic growth. As they integrate sustainable practices, they not only improve yields but also contribute to a greener cotton ecosystem. Their success showcases the potential of innovation-driven farming led by women, setting new benchmarks for the industry.

On track for rapid expansion, the global technical textiles market is set to grow to a value of $241.5 billion by 2035, according to a report from market research and consulting firm Future Market Insights (FMI). This represents a substantial increase from the estimated $230.9 billion in 2025, with a compound annual growth rate (CAGR) of 6.2 per cent from 2025 to 2035.

This industry's growth is being fueled by the increasing use of technical textiles in a wide range of sectors, including healthcare, construction, automotive, aerospace, agriculture, and the military.

Technical textiles are leading the way in modern industrial development, driven by the rising adoption of smart textiles, fire-resistant materials, antimicrobial fabrics, and biodegradable fibers. Government initiatives, environmental regulations, and technological advancements are all playing a crucial role in the market's expansion, motivating manufacturers to develop high-performance, sustainable materials.

India is emerging as a global leader in technical textile production, with government programs like the National Technical Textiles Mission (NTTM) actively promoting market growth.

The United States is a frontrunner in the medical textiles sector, specializing in biodegradable surgical fabrics. Additionally, the US automotive industry is increasingly incorporating lightweight and recyclable textiles into vehicle manufacturing.

Luxury retailers across the world are rapidly withdrawing from China, closing stores in high-end malls across major cities. This comes as consumers reduce spending, and analysts predict sluggish sales will continue throughout the year.

French luxury group Kering closed two Gucci stores in Shanghai last month – one in Réel Department Store near the landmark Jing’an Temple, and another in New World Daimaru on the city’s busiest shopping street, Nanjing Road – after more than a decade at those locations. Prada ended its two-year presence at Shanghai’s Hongqiao International Airport.

These closures follow eight others in the fourth quarter of last year and two in the preceding quarter by various luxury retailers, including brands like Louis Vuitton, Chanel, Tiffany & Co., and Bulgari, according to data compiled by industry tracker Linkshop.com.

Most brands have seen steep declines in sales in mainland China, affected not only by depressed consumer sentiment domestically but also by Chinese nationals shopping more abroad, says Jelena Sokolova, Senior Equity Analyst, Morningstar.

To emphasize the urgency, Beijing prioritized ‘boosting consumption’ as the top policy task at the National People’s Congress meeting this week. The government doubled state subsidies for consumer-goods purchases to 300 billion yuan ($41.4 billion) for this year.

Confederation of Indian Textile Industry (CITI) projects, India’s T&A exports to the US will rise to $16 billion within the next three years if it pursues a ‘zero-for-zero’ trade agreement with the country. The proposed agreement would also help the industry eliminate all tariffs on textile and apparel products exchanged between the two nations.

Currently, India is the third-largest T&A supplier to the US market, trailing only China and Vietnam. From January to November 2024, the US accounted for 28.5 per cent of India's total textile and apparel exports.

In FY 2024, India exported $10.8 billion worth of goods to the US, while imports from the US amounted to a mere $0.41 billion.

While US textile imports from China have declined by 9.4 per cent CAGR over the past five years, imports from India have grown by 9.1 per cent CAGR, indicating a substantial opportunity for India to strengthen its presence in the US market.

However, recent trade tensions have prompted US companies to partially shift away from China, with the market shares of Vietnam and Bangladesh increasing by 7.8 per cent and 3 per cent, respectively. Both Vietnam and Bangladesh enjoy preferential trade agreements with the US for textiles, which include duty concessions.

To achieve this, India should pursue a zero-for-zero trade agreement with the US for textile and apparel products, incorporating necessary safeguards for sensitive items, states CITI. This agreement would provide a level playing field for Indian exporters, enabling them to compete effectively with Vietnam and Bangladesh, the trade body adds.

Furthermore, to ensure a balanced trade relationship given India's reliance on cotton imports from the US, CITI recommends a duty-free access mechanism with quota safeguards.

India’s rich fashion heritage, known for its handwoven textiles and intricate craftsmanship, is set to gain global momentum with the upcoming India-UK Free Trade Agreement (FTA). The deal aims to eliminate restrictive tariffs, creating new opportunities for designers, entrepreneurs, and artisans.

Sanjay Nigam, founder of the Fashion Entrepreneur Fund and the India Fashion Awards, views this as a pivotal moment for the industry. He highlights how trade barriers have long restricted Indian fashion’s competitiveness and believes the FTA will provide much-needed recognition and opportunity.

With negotiations in their 15th round, the agreement is expected to level the playing field for Indian brands, allowing them to compete without pricing disadvantages. While renowned designers like Sabyasachi Mukherjee and Gaurav Gupta have made a mark internationally, high tariffs have hindered broader industry growth.

India’s textile sector supports millions of artisans, weavers, and designers. The removal of trade barriers could drive investment, job creation, and supply chain expansion. The deal also aligns with the global shift toward sustainable and ethical fashion, an area where India has a natural advantage due to its eco-friendly textile traditions.

As the FTA moves closer to finalization, the Indian fashion industry is preparing for expansion. Emerging designers and heritage brands alike stand to benefit, making this agreement a potential breakthrough for India’s global fashion presence.

Intertextile Shanghai Apparel Fabrics - Spring Edition is set to take place from 11 to 13 March at the National Exhibition and Convention Center (Shanghai), bringing together over 3,100 exhibitors across seven halls. As one of the world’s leading textile trade fairs, the event will highlight fashion fabrics, accessories, functionality, sustainability, and digital transformation.

Wilmet Shea, General Manager of Messe Frankfurt (HK) Ltd, stated that the fair reflects market demands, covering four key industry segments on-trend fashion, functionality, sustainability, and digitalisation. She noted that visitors will have access to cutting-edge products and expert insights into design, technology, and eco-friendliness.

The fair’s fringe programme will feature key discussions on sustainability, technology, and fashion trends. The Econogy Talks will focus on circularity in the textile industry, supply chain legislation, and sustainability challenges. Speakers from Ecocert, Lenzing, Redress, and the Taiwan Textile Federation will share insights on how regulations are reshaping global supply chains. TextileGenesis will lead a seminar on supply chain traceability, and an Econogy Tour will showcase eco-focused exhibitors.

Another important panel discussion, ‘Shaping the Future of Sustainability Through Innovation,’ will include speakers from Eastman, High Fashion, HKRITA, and TextileGenesis, addressing ways to foster cooperation and drive impact in sustainability. The International Textile Industry Digital Application Forum will explore digital transformation in textiles.

Fashion trends will also be a key focus. Ornella Bignami of Elementi Moda will present the Intertextile Trend Forecast for Spring/Summer 2026, highlighting emerging colors, fabrics, and fashion directions. Laurie Pressman, Vice President of Pantone Color Institute, will discuss color influences in her session, "Mind: Blending the Balanced and Bold for a Mind-Bending Vision for Spring/Summer 2026." Bignami will also lead guided tours of the Intertextile Directions Trend Forum, offering visitors a deeper look into the international S/S 2026 I-dentities theme. Additionally, four domestic trend forums will showcase China’s evolving fashion landscape, covering denim, sustainable fashion, fashion focus, and functional textiles.

The exhibition will span 190,000 square meters, with exhibitors from 25 countries and regions. The International Hall (5.1) will feature key zones and pavilions, including France, Hong Kong, Italy, Japan, Korea, Taiwan, and Turkiye. Group pavilions will include Ecocert, Korea Textile Center (KTC), and Lenzing.

Domestic exhibitors will be organized by product categories, including ladieswear, suiting, shirting, functional wear, sportswear, casualwear, denim, lingerie, and children’s wear. The fair is co-organized by Messe Frankfurt (HK) Ltd, the Sub-Council of Textile Industry, CCPIT, and the China Textile Information Centre. It will run alongside Yarn Expo Spring, Intertextile Shanghai Home Textiles - Spring Edition, CHIC, and PH Value.