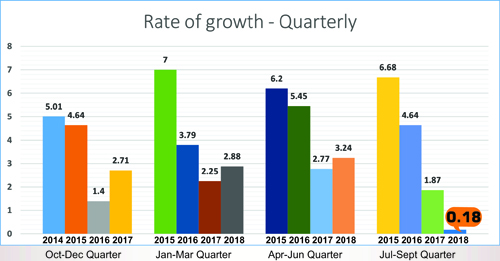

"CMAI’s Apparel Index for Q2 (July-Sept FY 2018-19) indicates growth has fallen to almost a no growth level and touched 0.18 points. It is the lowest ever, in last five years. Small brands are the big losers with negative growth of -1.71 points. However, big brand’s (Mid, Large and Giant together) cumulative growth of 3.39 points (much lower than 6.55 points in the last quarter) also failed to pull up the index significantly. It is important to observe, if Sales Turnover was to be considered as the only parameter for determining Apparel index, this quarter overall Apparel Index would have been negative at -1.80 ."

CMAI’s Apparel Index for Q2 (July-Sept FY 2018-19) indicates growth has fallen to almost a no growth level and touched 0.18 points. It is the lowest ever, in last five years. Small brands are the big losers with negative growth of -1.71 points. However, big brand’s (Mid, Large and Giant together) cumulative growth of 3.39 points (much lower than 6.55 points in the last quarter) also failed to pull up the index significantly.

CMAI’s Apparel Index for Q2 (July-Sept FY 2018-19) indicates growth has fallen to almost a no growth level and touched 0.18 points. It is the lowest ever, in last five years. Small brands are the big losers with negative growth of -1.71 points. However, big brand’s (Mid, Large and Giant together) cumulative growth of 3.39 points (much lower than 6.55 points in the last quarter) also failed to pull up the index significantly.

It is important to observe, if Sales Turnover was to be considered as the only parameter for determining Apparel index, this quarter overall Apparel Index would have been negative at -1.80 .

CMAl's Q2 Apparel Index recorded a meagre growth of 0.18 points, whereas Small brands (turnovers of Rs 10 to 25 crores) is negative at -1.71points. For Mid brands (turnover of Rs 25-100 crores), growth stands at 1.03 points, almost five-times that of overall index; Large brands’ growth is 3.61 points, 20-times that of overall index. Whereas, last quarter Large Brands growth was just three-times (2.95 times) that of overall index.

As usual, it’s the Giant brands that grew the most at 8.36, 46-times that of overall index. Giant brands have consistently been doing well every quarter, their rate of growth this quarter is much more than others while being higher than the previous quarter.

At 0.18 points, overall Q2 index is much lower than previous quarter’s (April-June FY 2018-19) 3.24 points and Q2 of previous year, which was 1.87 points. While Big brands together have grown at 3.39 points, individually Mid, Large and Giant brands have grown at 1.03, 3.61 and 8.36 points respectively (previous quarter figures were: 6.35, 5.95 and 8.07 points). Only Large brands have shown some buoyancy. Mid and Large brands grew much lesser than previous quarter.

year, which was 1.87 points. While Big brands together have grown at 3.39 points, individually Mid, Large and Giant brands have grown at 1.03, 3.61 and 8.36 points respectively (previous quarter figures were: 6.35, 5.95 and 8.07 points). Only Large brands have shown some buoyancy. Mid and Large brands grew much lesser than previous quarter.

Much like all previous quarters, the biggest brand group -- Giant brands are continuously growing at the highest level, outgrowing any kind of recessionary trends. The gap this quarter is huge, in fact, its the highest ever.

Small brands, at -1.71 points, seem to be in a bad phase unable to pull along and reflect growth. They are not in a position to outsmart their business practices. Overall growth index is being pulled down by small players. In fact, Small brand’s continuously falling index is certainly a point of concern.

Sales Turnover dips but investment on the rise

The cumulatives Sales Turnover in Q2 reflected a dip for the first time at -0.72 (previous quarter was 1.88 points). Around 32 per cent brands reported an increase this quarter. Perhaps for the first time almost 45 per cent brands have reported a loss in sales turnover. Incidentally, besides Large and Giant brands, both other Small and Mid Brand groups reported sales losses. A whopping number of respondents who reported a loss in Sales Turnover were among Small brands. ‘’We were able to get a good number of bookings. This has helped us increase Sales Turnover,’’says Cantabil’s head of marketing Deepak Singla .

Sell Through recorded an Index growth of 1.14 this quarter, lower than 1.23 in previous quarter. Maximum growth in Sell Through was reported by Giant brands, followed by Small brands. ‘’Sell through has increased as cost realization is less. We were not able to make great profits as raw materials have become costlier but we have kept our prices constant. Hence, Sell Through has increased,’’ explains Manu Chawla, Propreitor, Taiga Kids .

While 53 per cent brands reported an improvement in Sell Through. However, 37 per cent brands saw no change and around 10 per cent recorded a dip in growth. As Dare Jeans owner Paresh Dedhia points out ‘’There is an increase in expenditure as everything is correlated. Inventory Holding and Sell Through has gone up as the prevailing market is slow. Buying and placing orders has come down and the cash flow is slow, hence, expenditure has increased.’’

Inventory Holding growth was at 2.1 points, higher than 1.58 points recorded in Q1. Almost 64 per cent respondents across brands have said their Inventory Holding moved north this quarter, indeed a significant number and they were responsible for pulling down overall apparel index value. Increase in Inventory Holding impacts overall index negatively. Higher Inventory Holding indicates longer holding of inventories in warehouses or shop shelves.

Investments one positive aspect of Q2 is that fresh Investments have gone up by nearly 1.80 as against 1.70 points last quarter. Highest investments came from Mid brands, followed by Giant brands. Overall nearly 86 per cent respondents reported a rise in Investments which is much higher than 77 per cent in previous quarter, indicating most brands had to invest to manage and grow which means growth is not coming easily. ‘’We are expanding and since we are venturing new markets, we need to advertise to make our presence felt and this incurs cost. There are also some fixed expenditure in opening a new store etc, hence the expenses have gone up compared to last year,’’ points out Mayank Jain, GM, Monte Carlo.

Outlook for next quarter

Around 50 per cent brands say the outlook for next quarter is ‘average’, while 38 per cent believe it will be ‘good’. Only 6 per cent feel the quarter will be ‘excellent’. However, another 6 per cent believe it will be ‘below average’. Comparatively the outlook recorded in previous quarter was ‘Good to Excellent’. Generally, in Q3 of the financial year a number of festivals come up with sales picking up, the overall mood is positive. However, this doesn’t seem to be reflected this time due to the lacklustre performance of Q2.

CMAl's Apparel Index aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policymakers the index is a useful tool offering concrete and credible information, and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building.

The Apparel Index research is conducted by DFU Publications.