The global e-commerce apparel market is projected to reach $1.39 trillion by 2033, says a recent report. Its growing at 8.7 per cent CAGR from 2023's $602.3 billion, highlighting a fundamental shift in how consumers engage with fashion. This growth is due to factors like, ubiquitous smartphone use to the rise of influencer culture that is reshaping the fashion market and presenting both opportunities and challenges for businesses. “The e-commerce apparel market is poised for continued growth in the coming years. The ongoing shift toward digital-first shopping experiences is supported by factors such as increasing internet penetration, improved logistics infrastructure, and the growing popularity of smartphones, particularly in emerging markets," says the report.

The digital runway

The e-commerce apparel market covers the online sale of clothing, accessories, and footwear across men's, women's, and children's categories. The past decade has seen explosive growth, driven by increasing internet and smartphone penetration, coupled with evolving consumer shopping habits. The convenience of browsing a vast selection of brands and styles, coupled with easy returns, has made online shopping an increasingly preferred option. Brands like Zara and H&M exemplify how e-commerce enables rapid translation of runway trends into readily available online collections.

Several key trends are shaping this market.

The reign of marketplaces: Major players like Amazon and Alibaba dominate this space, providing platforms for countless brands to reach a global audience.

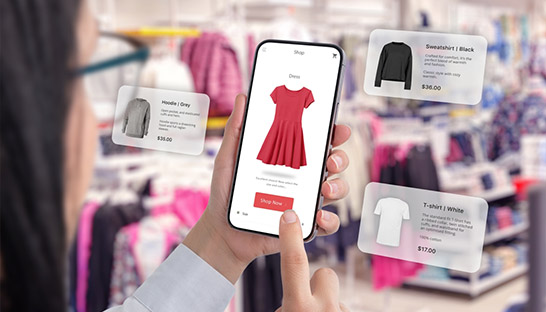

Mobile-first fashion: M-commerce is exploding, with consumers increasingly shopping via smartphones and tablets.

Social commerce takes center stage: Social media platforms are not just for browsing; they're becoming integral shopping destinations, with influencer marketing playing a pivotal role in driving sales.

Personalization is paramount: AI and machine learning are enabling personalized recommendations and seamless customer experiences, fostering brand loyalty. For example, services like Stitch Fix showcase the power of personalized styling and convenient subscription models.

Table: E-commerce market size and growth projections

|

Region |

Market size (2023) |

Projected market size (2033) |

CAGR (2024-2033) |

Growth drivers |

|

North America |

$210 bn (est.) |

(Data unavailable) |

8.7% (Global) |

Strong digital infrastructure, high consumer spending |

|

Global |

$602.3 bn |

$1387.1 bn |

8.70% |

Convenience, variety, personalization |

The report also highlights key segment trends. It shows women's apparel leads with 68.7 per cent market share in 2023. The category benefits from a wider variety of styles and sizes available online, coupled with the ease of home trials and returns. Women hold a 71 per cent share in the gender analysis, driven by their diverse product needs and more frequent purchasing habits. And the discounted pricing model remains popular, attracting price-sensitive shoppers in uncertain economic times. Meanwhile, platforms like ThredUp and Poshmark demonstrate the growing demand for second-hand and sustainable fashion.

Despite fast forward growth the e-commerce sector faces several hurdles and growth challenges. One major concern is the logistical hurdles. Delivery delays, high shipping costs, and complex return processes can negatively impact customer satisfaction. Size and fit inconsistencies are also a major concern, leading to high return rates. Moreover, intense competition necessitates strategic pricing models to maintain profitability. The fast-paced nature of fashion requires constant adaptation and product refreshes. Protecting customer data and ensuring secure transactions is also another concern for the e-commerce sector.