Europe is grappling with a colossal textile waste problem. Over 125 million tonnes of raw materials are devoured by the global industry each year, yet a mere fraction – less than 1% – of these fibres originate from recycled textiles. The majority faces an unsustainable fate in landfills, incinerators, or is exported. A pivotal new report by Systemiq, "The Textile Recycling Breakthrough," offers both a stark assessment and a strategic roadmap: Europe has the potential to amplify polyester textile recycling nearly tenfold by 2035, but this hinges on immediate, decisive action from policymakers and the industry.

The comprehensive study, backed by a 17-member Steering Group including industry giants like Arc’teryx, Eastman, Interzero, Textile Exchange, and Tomra, zooms in on polyester – a material constituting roughly 57% of global fibre demand. It champions advanced recycling technologies like depolymerisation, which can convert post-consumer polyester back into high-quality fibres with a reduced environmental impact compared to virgin material production.

The Steep Climb: Cost and accessibility challenges

Despite technological promise, the journey towards a circular textile economy is fraught with significant economic hurdles. The Systemiq report highlights a substantial "cost gap": producing recycled polyester via depolymerisation is currently estimated to be about 2.6 times more expensive than virgin polyester sourced from Asia. Shivam Gusain, Water Engineer, Dyestuff Chemist & LCA analyst in his linkedin post analysis suggests this gap could be even wider; with recent virgin PET prices in China hovering around €750-€800 per ton (lower than the report's €950 estimate), the premium for recycled content could be nearly threefold.

2025 Estimated Cost Comparison: Virgin vs. Recycled Polyester (per ton)

|

Feedstock Source |

Estimated Cost (Systemiq Report Basis) |

Potential Actual Market Cost Gap |

|

Virgin Polyester (Asia) |

€950 (report estimate) |

Base |

|

Recycled Polyester (T2T Depolymerisation) |

~€2,479 (implied 2.6x) |

Potentially >€1,600 (near 3x) |

(Note: This table contrasts the Systemiq report's cost gap with industry expert analysis suggesting a potentially larger current market gap.)

Critically, as the industry expert points out that the common assumption that scaling up T2T processes will dramatically lower costs is challenged by the report itself, which indicates that such scaling might only reduce costs by about 15 percent. This suggests that economies of scale alone may not be the panacea for the textile recycling cost dilemma.

Adding to the complexity, less than 1% of post-consumer textile waste is currently even suitable and accessible for these advanced recycling methods.

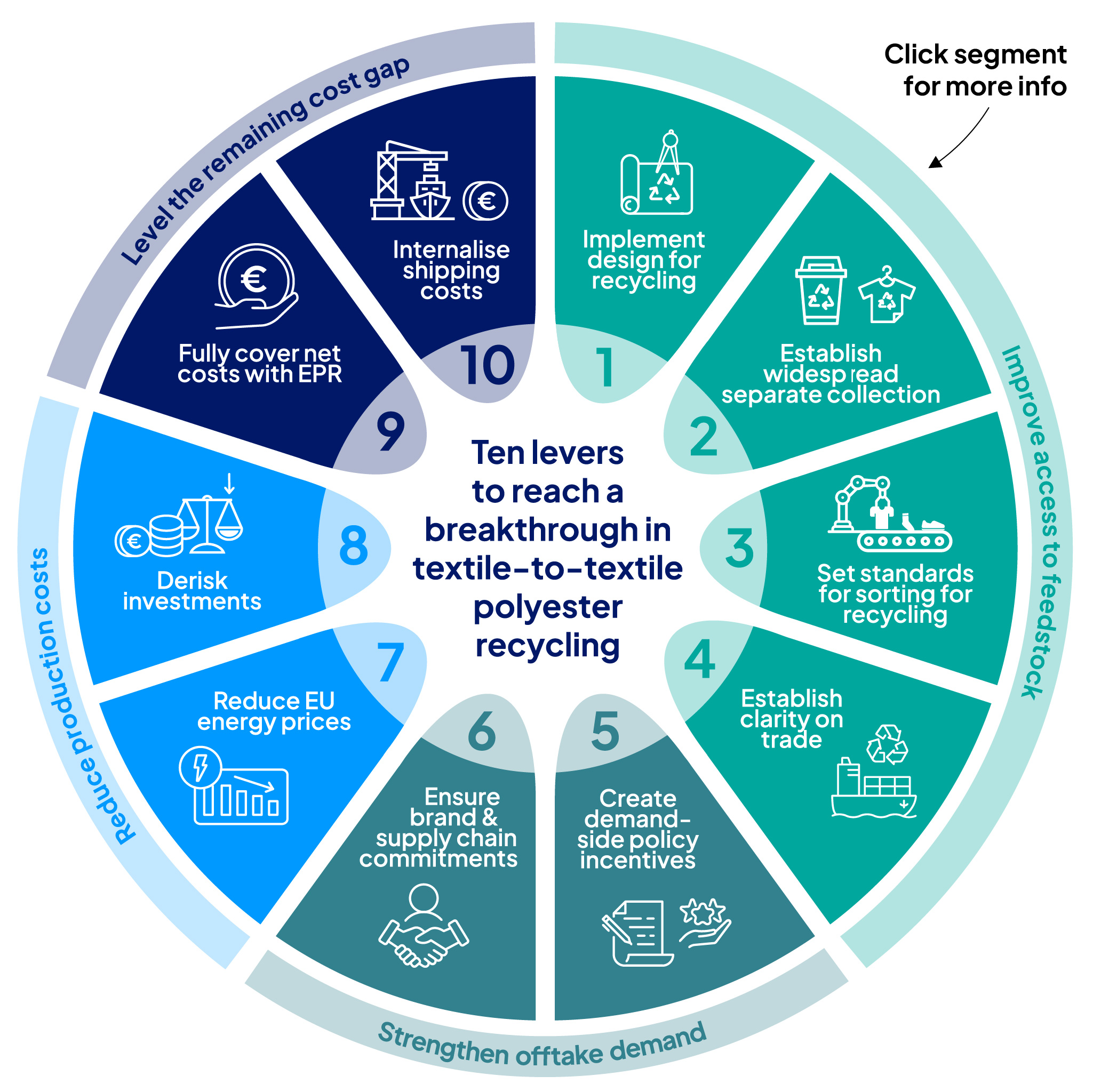

A Ten-Lever blueprint for a recycling revolution

"The Textile Recycling Breakthrough" proposes a strategic ten-lever approach across four key intervention areas, designed to steer Europe towards a "tipping point" where recycled polyester becomes the more viable and attractive option:

I. Unlocking feedstock:

● Implement design for recycling: Mandating designs that simplify end-of-life processing.

● Establish widespread separate collection: Ensuring textiles are diverted from general waste.

● Set standards for sorting for recycling: Creating clear, harmonised guidelines.

● Establish clarity on trade: Implementing responsible policies for textile waste exports.

II. Bolstering demand:

● Create demand-side policy incentives: Driving market appetite for recycled content.

● Ensure brand & supply chain commitments: Encouraging industry pledges. As Kyle Wood, Senior Director Strategy at Arc'teryx, notes, the report "helps chart a path forward for brands... It's also a powerful reminder that design does not exist in isolation, and must proceed in partnership with long term commitments and policy frameworks."

III. Optimising production costs:

● Reduce EU energy prices: Addressing a key operational expense for recyclers.

● Derisk investments: Providing financial safeguards for new recycling infrastructure.

IV. Bridging the financial divide:

● Fully cover net costs with EPR: Implementing Extended Producer Responsibility schemes, with the report suggesting fees around €250–€330 per tonne of polyester.

● Internalise shipping costs: Potentially via a ~5% brand-level green premium to make virgin materials reflect their true costs.

Julia Haas, Head of Commercial Partnerships at Interzero, emphasized the collaborative effort required: "Through the interplay of both political and industry-driven levers, Europe has a great opportunity to make circularity in textiles a reality... Bold, long-term policy action is needed to help create stable market conditions and reduce investment risks."

Scrutiny and Questions: EPR burdens and environmental data

The report's reliance on EPR fees to cover a significant portion of the cost gap – roughly 55% (€829 of the €1,529 per ton difference) – has raised questions among some industry observers. A key concern is whether using EPR fees to subsidize recycled materials essentially reroutes costs that brands would have incurred anyway, ultimately passing them down to consumers. This could mean end-users footing the bill for scaling recycled fibres for years before substantial volumes become available, effectively pre-paying for future output.

Further Shivam debate surrounds the environmental impact data. The report references CO₂ savings from a 2023 JRC study which, according to some analysts, predominantly focuses on general plastics like bottles and packaging, not the more complex textile-to-textile recycling processes. Extrapolating data from bottle-to-bottle recycling to textiles is seen as a potential oversimplification, suggesting the true CO₂ impact of T2T recycled fibres might be higher than reported.

One specific figure drawing scrutiny is the 0.4 kilograms CO₂ equivalent per kilogram reported for glycolysis, a chemical recycling method. For context, mechanical PET recycling typically registers around 0.45 kilograms CO₂ equivalent per kilogram. The notion that a more energy and chemically intensive process like glycolysis could have a lower footprint than mechanical recycling is being questioned by some experts, who anticipate further exploration of this data.

Projecting the Future: A transformed textile landscape?

Despite these debates, Systemiq's projections, if the ten levers are effectively deployed, are ambitious: depolymerisation capacity in Europe could surge nearly tenfold by 2035.

Projected EU Textile Waste Recycling: 2035 Vision (with Levers)

|

Metric |

Impact by 2035 |

|

Depolymerisation Capacity |

Near 10x increase |

|

Overall Recycled Volume |

Substantial Growth |

|

Landfill/Incineration/Export |

Significantly Reduced |

|

Consumer Cost (400g jumper) |

Approx. €0.15 (for EPR & green premium) |

|

Annual Value Generation (2040) |

€5.5 billion (broader PET/polyester system) |

|

Net New Jobs (2040) |

28,000 (broader PET/polyester system) |

(Source: Systemiq, The Textile Recycling Breakthrough)

Eric Dehouck of Eastman Circular Solutions France remains optimistic about the technological readiness: "Europe has the opportunity to lead the transition to circular textiles, and technologies like depolymerization are ready to play a central role."

The Path Forward: Beyond recycling

The Systemiq report, while championing a recycling breakthrough, also underscores that recycling alone is not a silver bullet. A truly circular textile economy, as noted by the Ellen MacArthur Foundation's Matteo Magnani, requires "deeper changes in how we design, produce, consume, and value clothing," alongside scaling circular business models like resale, rental, and repair.

The critical analysis emerging alongside the report's launch suggests that while the proposed levers offer a direction, the financial mechanisms and environmental accounting will be key areas for ongoing debate and refinement. The overarching question posed by some experts is whether the current trajectory, with its potential consumer costs and debated environmental gains, represents the most effective multi-billion-euro investment for Europe's textile future.

"The Textile Recycling Breakthrough" has undeniably ignited a crucial conversation, providing a data-rich foundation for the complex journey ahead. The challenge now lies in navigating the economic realities, refining the impact assessments, and fostering the multi-stakeholder collaboration essential to turn Europe's textile waste into a sustainable resource.