Benzene prices went up in February till April and after that, remained sluggish till June this year. Caprolactum, which had been following benzene values, lagging behind by only a month, continued doing so. Contract prices for benzene in the US plunged 21 per cent to $2.25 per gallon. The equivalent contracts in Europe also declined 14 per cent to €707 a ton. Spot prices, meanwhile moderated in early June, then jumped in the second week and fell again in the third week, finally bouncing in the last week across regions.

Asian markets remained strong

The Asian markets tracked firmer downstream styrene monomer and had active discussions. Asian marker, the FOB Korea gained 5 per cent in June, but was down but 40 per cent on the year. Prices had touched a 12-month low in January to just above US$600 a ton. Since then, it has recovered about US$200 a ton till June.

In Asia, caprolactam prices eased last month, which was driven by falling benzene prices and lusterless demand by the end of June, particularly from the textile filament sector. As demand was disappointing, several caprolactum units decided to shut for maintenance over the next two months this may balance out the weak demand. As for Europe, the May caprolactum contract was settled at an increase of

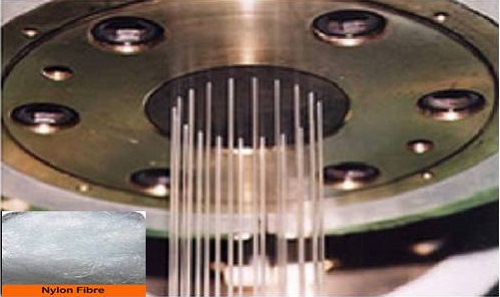

Demand for Nylon filament yarn dips

In late May, demand for nylon filament yarn began to dip, showing that the busy season was over earlier than expected and normal business cycles had emerged. Thus, prices dipped last month as the cost of raw material eased with lower caprolactum and nylon chips prices, and lack of demand. Downstream converters faced liquidity issues and limited fresh order intakes. As downstream sectors had entered the seasonal lull, nylon FDY markets swayed from stable to weak.

US too was struggling in the nylon filament segment, with slow demand and polyester as a substitute in some applications. The pressure from polyester was experienced by both markets.