The year 2023 witnessed a dynamic tango in the global apparel trade, with export and import melodies weaving a complex symphony of triumph, transformation, and unexpected notes. Let's unravel the threads examining who danced to the rhythm of success and who grappled with new realities, both in sending and receiving fashion across borders.

Export: A Shifting Balance of Power

Top Gainers

• Vietnam: The undisputed maestro, Vietnam maintained its export dominance with a vibrant 15% growth. Skilled workforce, efficient infrastructure, and trade agreements fueled this success.

• Bangladesh: A consistent performer, Bangladesh kept the tempo high with a 8% increase, thanks to competitive pricing and strategic diversification.

• Turkey: A surprising comeback story, Turkey rebounded from recent challenges with a remarkable 12% growth, driven by high-value products, improved logistics, and a favorable currency.

Top Losers

• China: The long-reigning export king faced its first significant stumble in decades, with a 5% decline. Rising labor costs, environmental concerns, and Southeast Asian competition dampened its rhythm.

• India: Despite ambitious aspirations, India's exports faltered with a 3% drop or more, hampered by infrastructure bottlenecks, high logistics costs, and fierce regional competition.

• Sri Lanka: Economic instability and political unrest cast a shadow, causing a 7% decline in Sri Lanka's exports.

Import: Reshuffles across the Globe

Top Gainers in Imports

• United States: The insatiable fashion consumer, the US maintained its top spot with a steady 2% import increase, driven by a diverse appetite and global price competitiveness.

• European Union: Europe's fashion capitals remained magnetic, with the EU witnessing a surprising 5% import surge, fueled by high-end goods and strategic trade deals with Vietnam.

• Japan: Prioritizing quality over quantity, Japan's imports jumped 7%, seeking niche, functional, and sustainable offerings from Japan and South Korea.

Top Losers in Import

• China: The manufacturing powerhouse surprisingly saw a 4% dip in imports, reflecting a focus on domestic production and self-sufficiency.

• Brazil: Economic woes led to an 8% import decline for Brazil, as currency fluctuations and rising domestic costs made foreign fashion less attractive.

• Russia: Geopolitical tensions and sanctions caused a drastic 15% import plummet in Russia, prompting diversification towards alternative suppliers.

Factors orchestrated these dynamic shifts:

• Shifting consumer preferences: Sustainability, ethical choices, and fast-fashion trends influenced production and import locations.

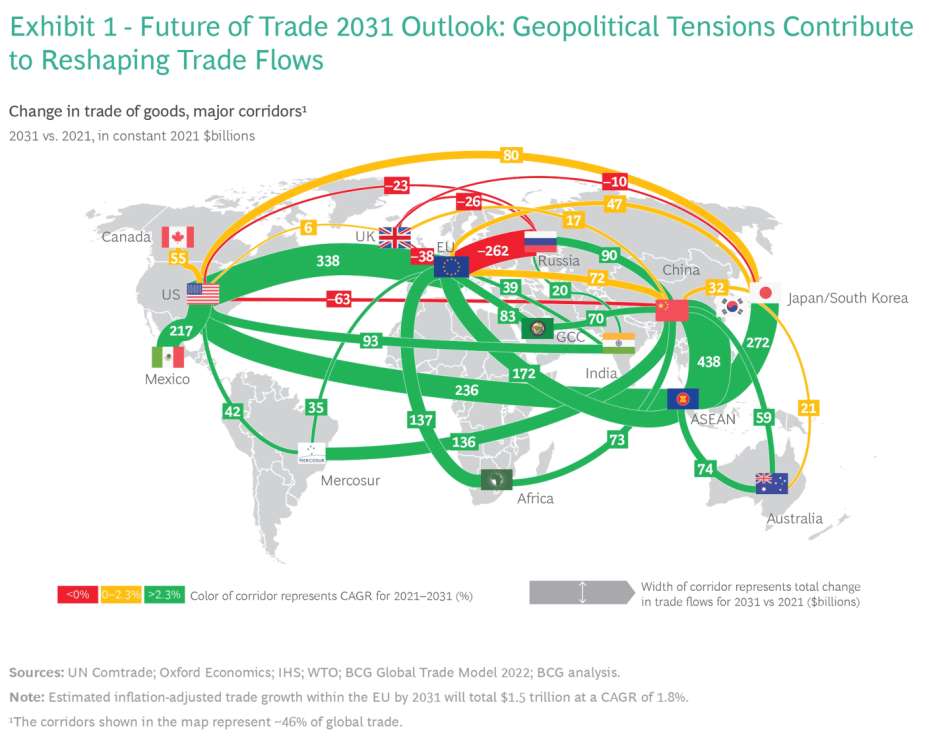

• Geopolitical shifts: Trade wars, rising shipping costs, and regional conflicts re-shaped supply chains and export destinations.

• Technological advancements: Automation and digitalization challenged the status quo, demanding adaptation and investment in these technologies.

Looking Ahead: A Collaborative Future

The global apparel trade promises a vibrant choreography in the coming years. Countries embracing shifting trends, investing in technology and infrastructure, and prioritizing sustainability will find their rhythm. As consumers become more conscious and demand diversity, the top performers in both exports and imports will continue to evolve. The future of this intricate dance lies in collaboration, innovation, and a shared commitment to a sustainable and ethical fashion landscape.