FW

China National Textile and Apparel Council (CNTAC), the voice of the textile industry in China, issued a survey report on Friday April 3 for a close look at the reignited production status due to the impact of coronavirus outbreak this year. CNTAC organized a series of online surveys to monitor the production graph, and this new report covers the period from March 3 on the onset to April 1 , after the previous report that was shared in February.

Nearly all the big companies fully operational now

The situation in the latest week (March 25-April 1) is given as bellows:

On company fronts, the 193 member companies responded to the online survey, 1.3 percent higher than its previous week with 98.4% of them starting up their production. There are 293,000 workers already at work in 190 companies, accounting for 94.6 percent of total employment in pre-crisis period, 3.2 percent more than that reported the week before.

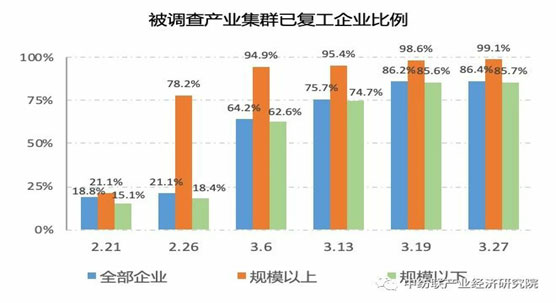

On industrial cluster fronts, there were 28 important manufacturing clusters in 13 provinces responding to the survey. According to the questionnaire, there were 66,000 companies inside these clusters already at work, representing 86.4 percent of the number of companies in total textile and apparel manufacturing clusters. Out of which, there were 3954 above-designated-scale companies (Chinese statistics system considers a company with its annual income amounting to 20 million Yuan or more, as big scale company, any companies above this designated scale are taken into national statistical system for understanding economic performance in the country) reported that the production has restarted across the board at 99.1 percent rate.

Over 71 percent workers operational at SMEs

(Note: Blue color for all companies, orange for big companies, green for SMEs)

There are 62,000 SMEs in these 28 important manufacturing clusters already in operation with 1.01 million workers busy on streamline, taking up 71.2 percent of the total number of employees in these production hubs, 5.2 percent point over that recorded in its foregoing week.

A quarter of units face half their business volumes

So, what do we know from the online survey? They are confronted with problems as it goes without saying. In the above-mentioned 190 companies that already restarted operations, only 33.7 percent out of these companies have their business orders at 80 percent of their normal business level while 23.2 percent of them ran into a poor business volume at the level below 50 percent of their normal business orders. So far as export business is concerned, the international orders that fall short of 50 percent or more have happened to 61.2 percent of all the companies surveyed, only 9 percent of all the companies have 80 percent of their normal business volume from their international clients.

Exports to the USA hit hard

The COVID-19 ballooned into global pandemic at an amazingly fast rate and the important markets for China’s export shipments are all hit hard, and the United States is one of them, which resulted in a plummet in importing textiles and apparel from China as is seen from the import data sheet –Major Shippers Report provided by Textile and Apparel Office, Department of Commerce, U.S.A..

In January 2020, the United States import of Chinese textiles and apparels decreased by 31.68 percent with $2472.293 million as against $3619.914 million in January last year and apparel import dropped by 36.09%.

It is not a surprise to see a global slowdown in export business while the number of people infected with the virus is breaking through a million in no time, and it is most likely that it has already outnumbered one million cases at the time when this news is posted on line and it is spreading far and near to affect more than 200 countries, regions and sovereignties. There is no question striving to fight the coronavirus in a way that is properly guided by the government and practically executed by the companies, and the question is how to react to the export situation that goes pretty sure to get worse than that in the years already gone by?

Contributed by Mr. ZHAO Hong

He is working for CHINA TEXTILE magazine as Editor-in-Chief in addition to being involved in a plethora of activities for the textile industry. He has worked for the Engineering Institute of Ministry of Textile Industry, and for China National Textile Council and continues to serve the industry in the capacity of Deputy Director of China Textile International Exchange Centre, V. President of China Knitting Industry Association, V. President of China Textile Magazine and its Editor-in-Chief for the English Version, Deputy Director of News Centre of China National Textile and Apparel Council (CNTAC), Deputy Director of International Trade Office, CNTAC, Deputy Director of China Textile Economic Research Centre. He was also elected once ACT Chair of Private Sector Consulting Committee of International Textile and Clothing Bureau (ITCB)

Debabrata Gosh, Oerlikon, General Manager India

“Once everything normalizes there will be a big momentum. The advantage is that we have a huge potential and such big domestic market hence we are not dependent on exports alone. I don’t see any threat for the textile industry. As for opportunities, we are expecting more export orders in future because the same has happened in the yarn segment and it will happen in the fabric segment also and the world will take India more seriously as a manufacturer. So far everybody was dependent on China. Since they offered cheaper rates, people switched to China but now the world will think in a different way to keep the supply chain active from India.”

“Once everything normalizes there will be a big momentum. The advantage is that we have a huge potential and such big domestic market hence we are not dependent on exports alone. I don’t see any threat for the textile industry. As for opportunities, we are expecting more export orders in future because the same has happened in the yarn segment and it will happen in the fabric segment also and the world will take India more seriously as a manufacturer. So far everybody was dependent on China. Since they offered cheaper rates, people switched to China but now the world will think in a different way to keep the supply chain active from India.”

How do you foresee your business prospects in India?

Most customers have closed their plants except bottle grade polyester units, which is an essential item. So they are still operative and a lot of PTA and MHE raw material stock is getting piled up and there is no movement of finished products, which is affecting adversely. Most knitting and weaving units, MSME’s, SME’s have closed. Garment manufacturers are facing order cancellations both in India and Bangladesh. Of course it is challenging and once the situation normalizes demand will very high and everything will start in full gear. Hopefully by June-July things will improve and definitely textiles being such a big industry will start producing in full capacity both in India and Bangladesh. We also foresee a lot of foreign companies and other garment brands coming to India, making the country their second manufacturing base and not depend only on China. So, for the Indian textile industry there will be significant change in the next two to three years.

Since most countries are dependent on China for their economic load and raw materials is the current situation an eye opener to look for other partners and not to depend on China alone?

This is definitely going to happen but as of today, all industries in China are doing well. Oerlikon factories in China are working at 100 per cent capacity and all our Chinese orders are on schedule. So, China is actually doing very well at their end but definitely many other countries who source from China will definitely think of a second supply source and hence, India has good advantage.

With abundant raw material, is India in a position to compete with China in terms of pricing and product quality?

Definitely, it will take some but India’s product quality, especially in textile is also equally good, only volumes are lacking. The quality of Indian textile is at par with the world but volumes are less and products are not as diversified as China. Moreover, China’s raw material capacity, spinning capacity is 10 times that of India. So there is no comparison.

With the ongoing lockdown in India what are the threats and opportunities from the current situation?

Many of our small customers are facing difficulties. However, some small knitters and weavers in Kolkata running small factories at home among them 20 per cent are still running and buying yarn but of course 80 per cent don’t have their operators and are facing problems. Once everything normalizes there will be a big momentum. The advantage is that we have a huge potential and such big domestic market hence we are not dependent on exports alone. I don’t see any threat for the textile industry. As for opportunities, we are expecting more export orders in future because the same has happened in the yarn segment and it will happen in the fabric segment also and the world will take India more seriously as a manufacturer. So far everybody was dependent on China. Since they offered cheaper rates, people switched to China but now the world will think in a different way to keep the supply chain active from India.

Indian government has been extending support to entrepreneurs in a fractional manner in different sectors. Do you think the government has really come all out for the textile industry and given required benefits?

Indeed, the government has done a lot. They have given a lot of support to the industry but our entrepreneurs and businessmen need to be more responsible in utilizing funds and perform their duties. They also have to work on developing better quality and in-house R&D and not just copy products and utilize our own strengths and not keep blaming the government for everything. Every industry is asking for support from the government at present and some are more affected than the manufacturing industry.

At this point, what is Oerlikon foreseeing in 2020? How are you responding to this?

Fortunately most of our manufacturing facilities worldwide are totally booked. We have big orders from China and other parts of the world and our factories in China and Germany are running in full capacity. Oerlikon has developed a fantastic machine for non wovens to manufacture masks at this critical time. It is very high quality non woven which will be used to manufacture effective and functional masks. We have brought this technology to the market now and it will help in mass production of masks. Oerlikon as a group is doing very well and is not affected by the pandemic.

Last month, the European Commission partially withdrew tariff preferences granted to Cambodia under the EU’s ‘Everything But Arms” (EBA) scheme. EBA grants least developed countries such as Ethiopia, Bangladesh and Myanmar, duty- and quota-free access to the European single market. According to Drapers, this withdrawal will affect a few garment and footwear products in the country. However, these preferences will soon be replaced with EU standard tariffs from August.

Last month, the European Commission partially withdrew tariff preferences granted to Cambodia under the EU’s ‘Everything But Arms” (EBA) scheme. EBA grants least developed countries such as Ethiopia, Bangladesh and Myanmar, duty- and quota-free access to the European single market. According to Drapers, this withdrawal will affect a few garment and footwear products in the country. However, these preferences will soon be replaced with EU standard tariffs from August.

Withdrawal to result in job losses

Tristan Haddow, Chief Executive of clothing supplier Haddow Group points out, withdrawing tariff preferences will pose serious problems for the Cambodian economy. Thousands of workers are likely to lose their jobs, warned Garment Manufacturers Association in Cambodia (GMAC). The association believes this decision will incentivise buyers to source from countries with far weaker legacies of trade union rights. It will increase poverty in the country and make it more difficult to improve wages and benefits for other workers.

Exports to suffer most

The impact is likely to be further worsened by the current COVID-19 pandemic. As Cambodia’s Labor Ministry spokesman Heng Sour said, Cambodia’s garment sector is either suspending operations or slowing production as nearly 200 factories face a shortage of raw materials from China. One of the biggest casualties of the tariff changes will be Cambodia’s clothing export sector warns Leonie Barrie, apparel analyst at GlobalData, as retailers will move their production to other countries that still benefit from duty-free access – for example, Bangladesh and Vietnam.

garment sector is either suspending operations or slowing production as nearly 200 factories face a shortage of raw materials from China. One of the biggest casualties of the tariff changes will be Cambodia’s clothing export sector warns Leonie Barrie, apparel analyst at GlobalData, as retailers will move their production to other countries that still benefit from duty-free access – for example, Bangladesh and Vietnam.

Consequences of this decisions are already been seen as high street heavyweight H&M recently announced a decision to review its sourcing strategy in the country. The retailer has sourced from Cambodia since the 1990s, and currently works with around 50 factories and suppliers based in the country.

An opportunity in disguise

However, Laura Moroll, Senior Manager at consultancy BearingPoint, who specialises in retail, opines retailers currently sourcing from Cambodia can take this opportunity to streamline their own processes in order to mitigate the cost impact of higher tariffs – as long as they ensure working conditions are up to scratch. They can also identify the areas where they are eroding margins and quite quickly recoup some of the higher tariff costs.

These price-conscious retailers can also look to shift production to other sourcing hubs, such as Vietnam – which agreed a free trade deal with the EU in February – and Bangladesh. The top priority for them currently is to ensure a fair and ethical treatment of factory workers besides making working practices more efficient.

With the current Coronavirus pandemic, Italy has locked down all nonessential manufacturing businesses. And as per Confindustria Moda, this will have a tremendous impact on the country’s fashion supply chain as it will drag down companies that supply to many local and international brands.

With the current Coronavirus pandemic, Italy has locked down all nonessential manufacturing businesses. And as per Confindustria Moda, this will have a tremendous impact on the country’s fashion supply chain as it will drag down companies that supply to many local and international brands.

Initiatives to continue supplies

To minimise looses, textile firms in the country are planning to relocate manufacturing closer to their clients. They are developing new products; and most of the entrepreneurs, including Stefano Albini, President, Albini Group, shipped goods ahead of the lockdown in order to pave way for what is hoped to be a brisk return to business.

Another textile company, Vitale Barberis Canonico, is leveraging its stock service to provide three-day delivery of goods to those companies that manufacture in countries that are not under lockdown. It is trying to build a structure that will enable it to provide quick solutions to its customers. Despite these initiatives, these companies face several concerns, including the survival of smaller, often family-run third-party suppliers have little to no access to credit and liquidity.

manufacture in countries that are not under lockdown. It is trying to build a structure that will enable it to provide quick solutions to its customers. Despite these initiatives, these companies face several concerns, including the survival of smaller, often family-run third-party suppliers have little to no access to credit and liquidity.

The Italian government’s measures issued with the March decree are not enough to support those businesses. Therefore, Andrea Crespi, Managing Director of Italian high-performance fabrics company Eurojersey has called for European intervention to directly inject cash flow and offset the costs during this two- to three-month shutdown period.

Barberis Canonico is allowing its clients to postpone payments given its solid financial situation. The company forecasts orders to decrease roughly by 20 per cent and sales to drop from March also because the lockdown in the rest of Europe might stretch beyond April 6.

Barberis Canonico also forecasts merchandise for spring 2021 to be reduced as the warehouses of the firm’s apparel clients are now packed with potentially unsold spring 2020 fashion items,

Botto Paola, however makes optimistic projections for fall 2021 season. The company expects high-performance man-made fabrics to benefit from the new scenario he forecast. According to the company a revenge spending attitude will boost the sector’s performance when health concerns are over. The company predicts a return to tailoring as a reaction to the long period of quarantine. Barberis Canonico adopts a more cautious approach as she is skeptical if customers will need formalwear that is primarily linked to social occasions, including work, travel and ceremonies. According to the company, the current scenario calls for even more innovations.

On, the other hand, Crespi views companies that have genuinely implemented eco-friendly initiatives will continue to do so. Eurojersey will continue to focus on the industry’s environmental costs. The company hopes China’s recovery will help offset losses in the first two months of the year which amounted to at least 50 percent for luxury brands.

Mohammad Ali Khokon, President of Bangladesh Textile Mills Association (BTMA) has demanded withdrawal of VAT on all kinds of yarns and fabrics sold between March 20 and June 30 this year. He also sought exemption of interest on term loans for six months and extension of term loan repayment period by two years for the affected millers.

He demanded enabling payment of utility bills like gas and electricity for the next six months starting from March in 12 monthly installments while withdrawing associated VAT, interest and surcharge. He demanded the government facilitate duty free import of textile dyes and chemicals until June 30 this year.

The BTMA chief also urged the government for withdrawing all demurrage fees for imports at the Chattogram port between March 20 and June 30 this year. Khokon revealed that yarn and fabrics worth Tk 3,500 crore have piled up in around 250 spinning and weaving mills in Bangladesh because of the ongoing movement restriction to curb the spread of coronavirus.

These millers had manufactured targeting two upcoming festivals Pahela Baishakh and Eid-ul Fitr. The affected millers mainly produce yarn and fabrics for the local market, Khokon said in the letter, which he prepared to submit to the finance ministry and other government offices next week.

This year, the government imposed a ban on large gatherings to celebrate the first day of the Bangla calendar, when clothing items worth around Tk 1,500 crore.

Italian luxury fashion suppliers are plunged into uncertainty as the Italian government imposed a lockdown on the national territory until at least April 3. The lockdown previously only included key manufacturing provinces in the North, representing as much as 60 per cent of Italy’s textile and clothing manufacturing, and had already sounded alarm bell for the country’s economy, which will now be further affected.

Italian luxury brands are directly supporting the fight against the virus. Giorgio Armani has donated €1.25 million to hospitals in Milan and Rome and the Civil Protection Institute, while Bulgari has delivered a new-generation microscope to the Lazzaro Spallanzani hospital in Rome.

Giorgio Armani’s cruise show, scheduled for April 19-20, 2020 in Dubai, has been shifted to October. Versace and Gucci both cancelled their shows in the US, originally planned to take place in May. Prada scrapped its May resort show in Tokyo.

The list of trade shows affected by Covid-19 includes Luxe Pack Shanghai, an important packaging show, and Esxence, an art perfumery show in Milan, shifted their dates from April to July and late May respectively. SXSW, the tech, film and music conference and festival in Austin, Texas, planned for 13-22 March, was cancelled one week before it was due to open, representing a significant blow to the city’s economy.

Over million workers in Bangladesh’s garment industry have either been fired or furloughed as global fashion companies have canceled or suspended orders in Bangladesh due to COVID-19 crisis, reports Penn State University’s Center for Global Workers’ Rights and the Worker Rights Consortium (WRC), an independent labor-rights monitor.

A number of suppliers in Bangladesh have abandoned these workers and refuse to even cover the costs of work already done. Many factories expect to close unless something changes. The dire situation has come about as Covid-19 has forced companies to shutter stores as part of social-distancing measures while demand for new clothes has simultaneously plunged as shoppers stay home and stop buying anything that isn’t essential. Retailers are doing all they can to avoid adding to their mountain of unsold inventory.

Fashion companies have already canceled or put on hold at least $3 billion in orders from Bangladesh’s garment factories, according to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). That’s roughly equivalent to a full month of exports, based on previous BGMEA data. Without the orders, many factories are unable to pay workers

A national team of six Taiwanese textile manufacturers are modifying their production lines and ramping up output to help meet the rising demand for surgical masks and other personal protective equipment (PPE) amid the COVID-19 outbreak. The team is being led by Makalot Industrial, who had the advantage of research and development conducted 17 years ago when the severe acute respiratory syndrome (SARS) epidemic hit Taiwan.

Taiwan mostly imported protective hospital gowns then and the government began encouraging domestic manufacture to start making PPE. So the company filed an application in 2003 for a license to manufacture protective gowns. The company's research team came up with a design, which it patented three months later.

The company is now on its way to produce 100,000 protective gowns by late April and is aiming to manufacture another 220,000 at its factory in Vietnam. It also plans to set up a production line in Chiayi in southern Taiwan, which will manufacture 10,000 gowns per month initially and gradually raise its monthly output to 50,000, he said.

The team of five manufacturers has been contracted by the government to deliver 1.1 million isolation and protective hospital gowns by April. Meanwhile, Kang Na Hsiung Enterprise, a manufacturer of hygiene products and synthetic textiles, has revived its production lines for melt-blown non-wovens—the main raw material used to make surgical masks—which had been mothballed for at least five years. The company has ramped up its daily production of melt-blown non-wovens to 2.4 tonne, which can make more than 3 million face masks.

Milan Women’s Fashion Week, which is scheduled to be held in September, will become the first season to combine men and women’s collections! Fashion freaks can definitely feel ‘fruit of patience is really sweet!’

Earlier, Milan Men’s Fashion Week was scheduled for June this year. The announcement was confirmed by Camera Nazionale della Moda (The National Chamber of Italian Fashion). Men’s shows due to run from June 19 to 23, will now run alongside Milan Women’s Fashion Week, planned from September 22 to 28 this year.

Spanish fashion brand Mango opened a new new logistics centre in Llicà d’Amunt, a picturesque town outside Barcelona. Approximately 600 people work six days a week at this highly automated facility, where around 400 operations are machine-driven, to process items for store deliveries.

The company has so far invested €232 million in the 186,000-sq. mt. facility, which can stock up to 7 million hung garments and 20 million folded garments and accessories at the same time. It was completed in 2016 but became fully operational last summer. By incorporating the latest automation technologies, the centre is able to process 75,000 garments an hour, tripling the retailer’s former capacity.

As soon as hung garments arrive at Llicà d’Amunt, they are unloaded onto one of nine automatic loading bays, which can process 27,000 garments an hour. Each bay is equipped with a classifier that separates the garments by size and style. They then travel along a 24-kilometre rail to be shipped out to stores or held in the warehouse. According to Mango, its hanging garment installation is one of the most automated in Europe.

On the opposite side of the logistics centre are automatic loading docks that can process 1,000 boxes of folded garments and accessories per hour. The boxes are passed through a weighing and labelling area and identified with a tracking ID so they can be located at any time. Like the hung garment area, the folded garment warehouse prepares boxes to be either shipped or stored based on in-store sales information.