FW

Stäubli, a leading textile machinery manufacturer, will present at the upcoming Dhaka Int’l Textile & Garment Machinery Exhibition (DTG) that takes place from 9-12 January, with its machinery and system solutions for optimising workflows in mills that seek to capture benefits like time savings and increased overall efficiency.

Stäubli invites textile industrials to visit the booth of its agent, Spintex Technology. A range of Stäubli products will be displayed, offering weavers and knitters solutions that are adapted to their specific needs and requirements: from automation of weaving preparation to ultra-reliable shedding solutions for frame and Jacquard weaving to an innovative device that shortens the sock-knitting process – D4S.

“The recently launched D4S toe-linking device is becoming indispensable in more and more knitting mills. This ingenious device sews the toe closed while the sock-knitting machine simultaneously produces the next sock. The precise operation of the device ensures perfect linking quality,” the company says.

“Thus, the D4S answers several key challenges in knitting: minimising idle time, delivering higher-quality and higher-volume output, and reducing waste material, the increasing price of which eats into profit margins.”

Installing the D4S device on a sock-knitting machine promises a quick return on investment for the mill. In addition to more efficient production, the mill will also benefit from enhanced operator convenience and expanded functionality, especially thanks to the independent 2900SL electronic controller.

Rieter, a Switzerland-based Leading supplier of systems for short staple spinning, held a Com4 Yarn seminar in India's textile city of Ahmedabad. At the end of the seminar, attendees gained detailed technological knowledge of the 4 established yarn spinning systems and the the effect of yarn characteristics on downstream processes. They also had experienced the feel of fabrics made out of all the 4 different end spinning systems.

Technicians and other downstream processing specialists from various companies were informed on the yarn characteristics of the 4 spinning systems and were able to draw conclusions on the downstream behaviour and the influence on the final product appearance and its properties.

The ring yarn spun on Rieter ring spinning machines is marketed under the name Com4 ring, the compact yarn produced on the compact spinning machine is marketed as Com4 compact, the rotor yarn from the rotor spinning machine under Com4 rotor and the air-spun yarn from the air-jet spinning machine under Com4 jet.

"Yarns spun on Rieter spinning machines fulfill the most challenging requirements. Outstanding properties and constant high-quality safeguard the competitive edge in a dynamic market. Each of these yarns is distinguished by a special yarn character and its related yarn properties. The yarns have different qualitative or economic advantages, not only for downstream processors but also for end users," the participants were informed during the course of the seminar.

Additionally, information was also shared about Rieter's yarn marketing and the Rieter Com4 yarn family. Samples of various fabrics and international reference list of all Com4 licensed yarn manufacturers was also provided to the participants.

IEPER, Belgium — December 12, 2018 — This event will take place from January 9-12, 2019, in Dhaka, Bangladesh, and Picanol will be present at the booth of our agent, Spintex Technology (Booth 7-126).

Bangladesh has been a very important market for Picanol over the last decade. Picanol is proud to be the most important weaving machine supplier to the Bangladeshi market, this was made possible thanks to the combination of a complete & competitive product portfolio as well as top class service.

The main investments are being made in denim, bottom weights, shirting and bedsheeting fabrics. Picanol offers both rapier (OptiMax-i, TerryMax-i) and airjet weaving machines (OMNIplus Summum and TERRYplus Summum) for these applications. Our valuable and loyal customers can be assured of Picanol’s commitment to this market in the future.

For a number of years, Picanol has been represented in the region by Spintex Technology, our local agent. The agency is very well-organized, which ensures excellent local service via a pool of trained technicians and an excellent after market service for spare parts and Weave-Up packages.

At least once a year, all of the technicians travel to the Picanol headquarters in Belgium in order to receive training on all of the latest developments.

Picanol hopes to supply its products and excellent service to Bangladeshi Textile Mills for many years to come. Let’s grow together.

This year’s edition of Irantex, a comprehensive international trade fair for textile machinery and textile products that concluded in Tehran last week, featured a significant number of Italian textile machinery manufacturers. Among them 14 companies exhibited in the Italian Pavilion, the common area set up by the Italian Trade Agency and ACIMIT (the Association of Italian Textile Machinery Manufacturers).

The following ACIMIT members companies were presenting their latest developments at the Italian Pavilion: Arioli, Caipo, Cognetex, Fadis, Ferraro, Fk Group, Laip, Lgl, Marzoli, Mesdan, Savio, Sicam, Smit, and Stalam.

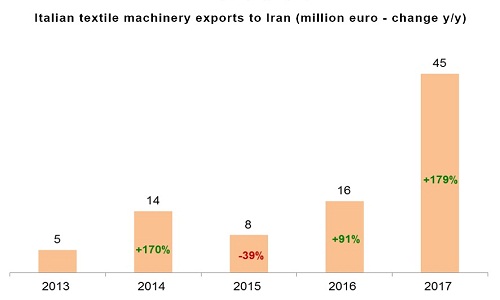

Italian textile machinery exports to Iran (million euro - change y/y). © ACIMIT

“Despite the concern for the restoration of international sanctions against the country, Iran remains a market of absolute importance for Italian textile machinery manufacturers,” commented Alessandro Zucchi, President of ACIMIT.

“Irantex is a further opportunity to strengthen the links between the Iranian textiles industry and Italian technology suppliers. Indeed, the Italian textile machinery offer is already well-known by Iranian textiles companies. The value of Italian sales in 2017 – equal to EUR 45 million – is proof of this. In 2018 first half the Italian exports to Iranian market totalled a value of EUR 15 million.”

ACIMIT represents an industrial sector comprising around 300 manufacturers employing close to 12,000 people and producing machinery for an overall value of about EUR 2.7 billion, with exports amounting to more than 85% of total sales.

"For the last two and a half years, Brexit has consumed the entire United Kingdom. The UK’s negotiations with the EU have dragged on through multiple déjà vu moments, and the consensus is that the economic fallout will be felt far more acutely in Britain than in the EU, let alone in countries elsewhere. Still, the rest of the world is facing profound challenges of its own. Political and economic systems are undergoing far-reaching structural changes, many of them driven by technology, trade, climate change, high inequality, and mounting political anger. In addressing these issues, policymakers around the world would do well to heed the lessons of the UK’s Brexit experience."

For the last two and a half years, Brexit has consumed the entire United Kingdom. The UK’s negotiations with the EU have dragged on through multiple déjà vu moments, and the consensus is that the economic fallout will be felt far more acutely in Britain than in the EU, let alone in countries elsewhere. Still, the rest of the world is facing profound challenges of its own. Political and economic systems are undergoing far-reaching structural changes, many of them driven by technology, trade, climate change, high inequality, and mounting political anger. In addressing these issues, policymakers around the world would do well to heed the lessons of the UK’s Brexit experience.

For the last two and a half years, Brexit has consumed the entire United Kingdom. The UK’s negotiations with the EU have dragged on through multiple déjà vu moments, and the consensus is that the economic fallout will be felt far more acutely in Britain than in the EU, let alone in countries elsewhere. Still, the rest of the world is facing profound challenges of its own. Political and economic systems are undergoing far-reaching structural changes, many of them driven by technology, trade, climate change, high inequality, and mounting political anger. In addressing these issues, policymakers around the world would do well to heed the lessons of the UK’s Brexit experience.

No immediate repercussions

When Britian decided to leave the EU, experts predicted that the UK economy would suffer an immediate and significant fall in output following the 2016 referendum. However, Brexit was different. There was no immediate break in British-EU trade. In the absence of clarity on what type of Brexit would ultimately materialise, the economic relationship simply continued “as is,” and an immediate disruption was averted.

The question therefore, is not whether the UK will face a considerable economic reckoning, but when. The UK economy is already experiencing slow-moving structural change. Foreign investment is falling contributing to the economy’s disappointing level of investment overall. Moreover, this trend is accentuating the challenges associated with weak productivity growth.

already experiencing slow-moving structural change. Foreign investment is falling contributing to the economy’s disappointing level of investment overall. Moreover, this trend is accentuating the challenges associated with weak productivity growth.

Maintaining global norms difficult

Companies with UK-based operations have also begun to trigger their Brexit contingency plans after a prolonged period of waiting, planning, and more waiting. In addition to shifting investments out of the UK, firms will also start to relocate jobs. And this process is likely to accelerate even if British Prime Minister Theresa May manages to get her proposed exit deal through Parliament.

The Brexit process thus provides a preview of what awaits an increasingly fractured global economy if this continues: In this context, costly self-insurance will replace some of the current system’s pooled-insurance mechanisms. And it will be much harder to maintain global norms and standards, let alone pursue international policy harmonisation and coordination. Tax and regulatory arbitrage are likely to become increasingly common as well. And economic policymaking will become a tool for addressing national security concerns (real or imagined). How this approach will affect existing geopolitical and military arrangements remains to be seen.

Uncertain outlook for liquidity growth

Lastly, there will also be a change in how countries seek to structure their economies. In the past, Britain and other countries prided themselves as “small open economies” that could leverage their domestic advantages through shrewd and efficient links with Europe and the rest of the world. But now, being a large and relatively closed economy might start to seem more attractive. And for countries that do not have that option—such as smaller economies in East Asia—tightly knit regional blocs might provide a serviceable alternative.

Brexit holds important lessons for and about the global economy. We live in an era of considerable technological and political fluidity. The outlooks for growth and liquidity will likely become even more uncertain and divergent than they already are.

Export Promotion Council for Handicrafts (EPCH) is holding the 22nd edition of awards for outstanding performance in exports of handicrafts for the year 2015-16 and 2016-17 on December 18, 2018. Around 70 handicrafts exporters are being awarded for their performance in 2015-16; and 66 for their performance in the financial year 2016-17. The function will be held at state-of-the art India Expo Centre & Mart, Greater Noida. Smriti Zubin Irani, Union Minister of Textiles will be the chief guest and Ajay Tamta, Union Minister of State for Textiles (Independent Charge) will be the guest of honour.

The export awards are given based on export performance and are selected by Export Awards Selection Committee chaired by Development Commissioner (Handicrafts). The categories of awards include: top export award trophy, merit certificates, woman entrepreneur, regional awards, hat trick awards, Life time achievement awards. For the first time, a new category of Platinum Performer Award has been created to honour the company that has registered growth in its fourth year and has been awarded for its export performance in 5th year.

Overall 31 awards will be given to exporters from Moradabad, 17 to Rajasthan exporters, 39 will be conferred to exporters from Delhi NCR, 19 awardees from Kolkata will be the recipients of awards for their excellent performance in exports of handicrafts.

Hamma Kwajaffa, Director-General of The Nigerian Textile Manufacturers Association (NTMA) has revealed the association has set a 1.7-billion metre finished fabric production sector target for 2019 to resuscitate the industry and increase its contribution to the nation’s gross domestic product. The association has also set a target to capture a short to long-term local market share of between 35 to 70 per cent in finished fabrics, and 100 per cent off take of locally produced raw cotton.

To achieve these targets, Kwajaffa has advocated the extension of gas pipelines to the North alongwith supply of low pour fuel oil (LPFO) at concessionary price until gas pipelines were extended to the region.

Kwajaffa also urged government to harmonise power tariff for textile mills from DISCOs across the country and consider supply of power to textile manufacturers at globally competitive tariff of eight US cents per kilowatt. The government should also enforce compliance with local sourcing of uniforms and other textile goods in line with Executive Order 3, and extant law should be made punitive to recognise smuggling as a criminal economic offence.

Sri Lanka’s apparel exports during January to October grew 4.4 per cent year on year. Exports to the US grew 4.5 per cent year on year and exports to the European Union grew 4.2 per cent year on year.

October apparel export earnings declined one per cent year on year. In October, apparel exports to the US slowed down 6.5 per cent year on year. Apparel exports to the EU recorded a growth of 3.1 per cent year on year. Sri Lanka’s apparel exports were impacted by sluggish retail markets in the EU and US as well as fierce competition among global suppliers. It is estimated that there’s four per cent oversupply in the global apparel market. Sri Lanka is not able to fully capitalise on the US-China trade war, as Sri Lankan manufacturers don’t have the capacity to cater to the export orders that China is losing.

The country expects apparel export earnings would average around $450 million in November and December, enabling the industry to cross the $5 billion mark. Apart from Bangladesh and Vietnam, some African nations such as Ethiopia are also emerging as major apparel exporters to the US and EU, as they have the capacity to manufacture garments at a lower cost while meeting the necessary sustainability standards demanded by US and EU retailers.

Kitex has been allotting regular capex for improvement of technology and infrastructure and is in the process of upgrading its current facilities so as to expand its capacity. Kitex, based in Kochi, is a manufacturer of specialized infant apparels. Its products are sold in over 18 countries. The key market for the company is the US followed by Europe.

The facility at Kochi covers an area of 1,80,768 sq.ft. The process line is equipped with a digital dispenser system for error-free, automatic and computer-controlled preparation of color guidelines, high quality knitting machines, modern dyeing, printing and finishing systems that use cutting-edge technology. Its garmenting unit uses the latest machinery for pattern computer-aided design, plotting and grading. It has automatic spreader machines which enhance the speed of spreading and automated cutting machines for faster and precision cutting.

Kitex has a daily capacity to manufacture 3,60,000 units of infant garments. Having an integrated and traceable value chain which meets global standards at various stages of the product supply chain is the key global differentiator at Kitex. The company buys yarns, dyestuffs and chemicals from approved sources. The dye recipes, dye dispensing and yarn dyeing are done using robotic technology for accuracy and quality.

A recently released apparel trade statistics by OTEXA indicates, India will surpass both Bangladesh and Vietnam in next six months to become the second largest kidswear supplier to USA after China. India clocked in $157.86 million from kidswear exports to the US from January to October ’18, growing at 6.52 per cent.

In volume-terms, India saw a surge of 16.53 per cent and shipped 7.94 million kg worth of kidswear to the US market. During the 10-month period, US managed to grow only 1.33 per cent in volumes and 2.10 per cent in kidswear import values which are quite low as compared to India’s escalation in its respective export.

Simultaneously, all top Asian exporting nations fell in their respective value-wise exports in kidswear segment to the US. China, Bangladesh and Vietnam dwindled by 3.23 per cent, 2.50 per cent and 2.52 per cent respectively and the declining trend of these countries helped India capture shift especially from China which caters to 47 per cent of kidswear demand in US.

Markedly, India emerged as the only country which increased its value-wise share, while all other countries declined their share on y-o-y basis.