FW

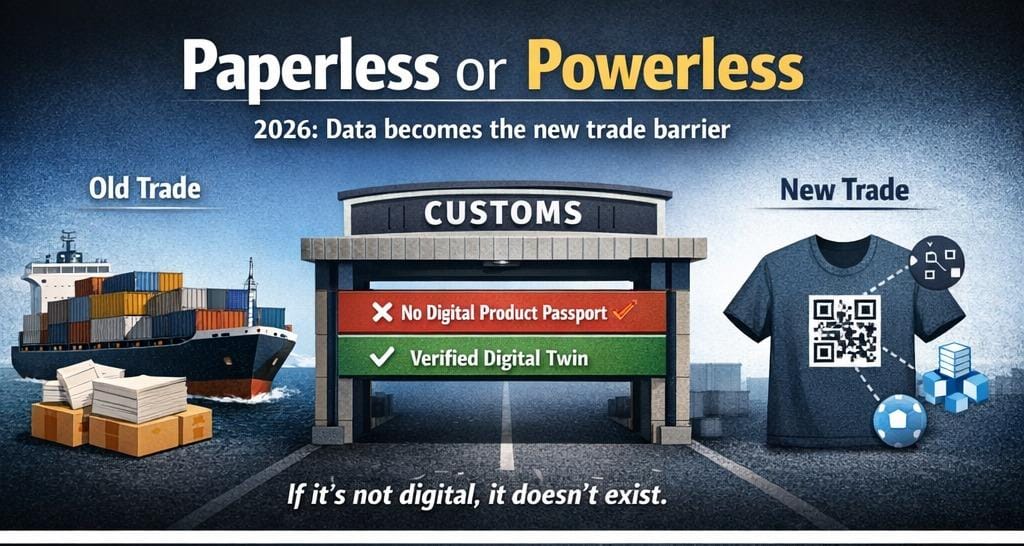

As we present this feature as part of our year-end series, 'Wrap Up 2025, Outlook 2026', the global textile and apparel industry is clearly moving beyond a simple calendar change. We are entering a period of "Radical Transparency" where the core of international trade is being rewritten. For decades, the primary hurdles in global trade were physical: quotas, shipping bottlenecks, and tariff brackets. However, as 2025 closes, a new barrier has emerged between manufacturing hubs like Dhaka and retail shelves in Paris. This wall is not made of brick or taxes, it is made of data.

The European Union’s Digital Product Passport (DPP), the regulatory centerpiece of the Ecodesign for Sustainable Products Regulation (ESPR), has moved from a boardroom concept to a mandatory operational requirement. With the EU’s central digital registry scheduled to become operational by July 2026, the mandate for global exporters is absolute: if a garment lacks a "Digital Twin"—a blockchain-verified record of its journey from fiber to finish—it is effectively invisible to customs authorities. In the high-stakes trade environment of 2026, being paperless increasingly means being powerless.

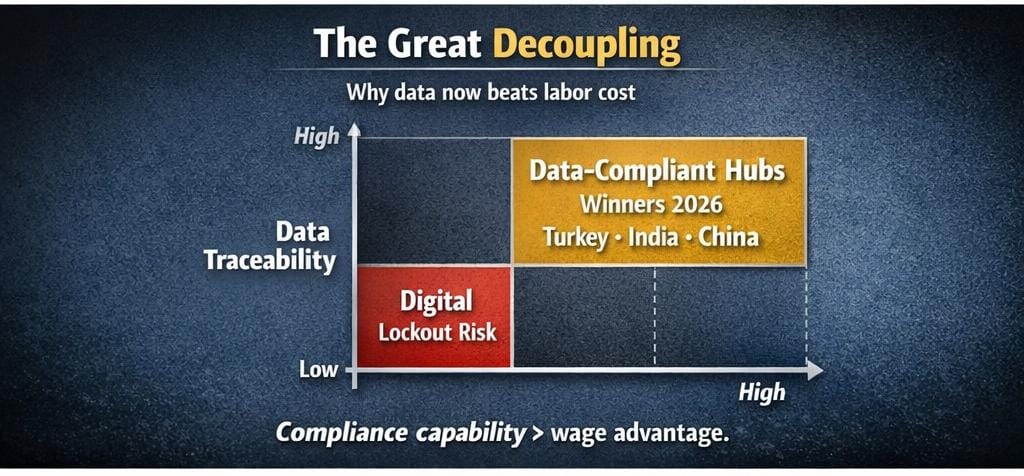

The Great Decoupling: Why data infrastructure outweighs labor cost

For thirty years, sourcing was a drive to minimize labor costs. In 2006, the industry moved toward speed; in 2016, toward quality. But as we map the 2026 trade landscape, a fundamental separation has occurred. Geography and proximity are being superseded by "Data-Traceability." Today’s C-Suite leaders recognize that a factory’s digital infrastructure; its ability to feed real-time, granular ESG metrics into a brand’s API, is now a more critical asset than its hourly wage rate. This has birthed the "Data-Compliant Hub." Countries like Turkey, with its integrated "Smart Mills," and India, leveraging its IT prowess to offer "DPP-as-a-Service," are emerging as the new victors. Conversely, regions that failed to digitize their Tier 2 and Tier 3 suppliers during the 2024-2025 transition are facing a "Digital Lockout."

The 2026 Macro-Indicator dashboard

The transition toward a data-centric trade model is reflected in the following market premiums and risk indicators observed as we enter the new year. These figures represent the emerging "Transparency Premium" that now dictates contract negotiations.

|

Indicator |

Market Impact (2025 Wrap Up) |

Forecasted Impact (2026 Outlook) |

|

Transparency Premium |

8-10% for verified organic cotton |

12-18% for full blockchain-traceable fiber |

|

Customs Rejection Risk |

<1% (Physical non-compliance) |

5-7% (Digital data discrepancies) |

|

Resale Value Multiplier |

15% for brand authentication |

35% for garments with full DPP history |

|

Non-Compliance Penalty |

Financial fines/Audit failures |

Total Market Exclusion / Port Impoundment |

Global Trade Scorecard: Winners, losers, and strategic outlook

The 2026 trade map is being redrawn based on a nation’s ability to prove its "Rules of Origin" through digital threads. Sourcing destinations are no longer judged solely on output volume but on the integrity of their data exports.

|

Country / Region |

2026 Trade Outlook |

Key Indicator: DPP Readiness |

Trade Policy & FTA Situation |

|

Turkey |

Winner |

High: Native blockchain integration in integrated mills. |

Near-shoring advantage; leveraging EU Customs Union for seamless data flow. |

|

India |

Rising |

Medium-High: PM MITRA parks and PLI 2.0 mandated for digital tracking. |

FTA with EU/UK hinges on digital verification of "Technical Textiles." |

|

Vietnam |

Vulnerable |

Medium: Automated at Tier 1; significant "Data Gaps" in raw material Tier 3. |

EVFTA benefits at risk if sustainability metrics cannot be digitally audited. |

|

Bangladesh |

Critical |

Low-Medium: High "Green Factory" count but lacks mid-stream data stacks. |

Transitioning from LDC status; urgent need for "Compliance-first" capex. |

|

China |

Pivot |

High: State-led green supply chains and proprietary "Trace-Tech." |

Moving from "World's Seamstress" to "World's Textile Tech Provider." |

The Regulatory Landscape: From voluntary to verified

The transition into 2026 is marked by the hardening of voluntary standards into strict legal frameworks. Beyond the DPP, the industry is grappling with the Corporate Sustainability Due Diligence Directive (CSDDD), which now mandates that companies take legal responsibility for environmental and human rights violations within their entire value chain. This regulatory pressure is amplified by the EU’s Carbon Border Adjustment Mechanism (CBAM), which has begun its data-collection phase for high-impact textiles. These regulations work in tandem to create a "triple threat" of compliance: the DPP tracks the product, the CSDDD tracks the process, and CBAM tracks the carbon. For manufacturers, this necessitates a complete overhaul of internal auditing. Compliance is no longer a periodic check but a continuous stream of verified data points.

Strategic Leadership: The CCO as the new power broker

This regulatory shift has fundamentally altered the organizational chart of the modern apparel house. The Chief Compliance Officer (CCO), once a back-office administrator, has emerged as the most influential broker in the boardroom. In 2026, the CCO often holds veto power over the Procurement Director; if a supplier cannot meet the "Data Package" requirement, the contract is dead on arrival, regardless of the price.

Strategic leadership is now defined by "Active Governance." CEOs are no longer satisfied with annual audits. They are deploying AI-augmented GRC (Governance, Risk, and Compliance) systems—digital agents that monitor the "digital shadow" of the supply chain in real-time. These systems can detect a "red flag"—such as an unverified cotton shipment or a spike in carbon intensity at a dyeing house—long before the physical goods reach a port of entry.

The "DPP Gold Rush" and the Tech-Sourcing nexus

The 2026 deadline has birthed a multi-billion dollar "Traceability Tech Stack" industry. Startups like Fashion Data (France) have moved beyond simple tracking; they use predictive algorithms to align DPP data with inventory, slashing the "guesswork" that led to the overproduction of the early 2020s. Retailers are no longer just selling clothes; they are selling "Data Packages" attached to garments. Consumers now scan QR codes not just for a "Made in" label, but to access repair instructions, recycled content percentages, and carbon footprint scores. This transparency has turned compliance into a competitive advantage: brands that embraced DPP early are reporting 15-20% higher customer loyalty scores, as traceability becomes the new hallmark of luxury and trust.

Editor’s Conclusion: The dawn of the "Trust Currency"

As we wrap up 2025, the narrative of the textile industry has changed from volume to veracity. The Digital Product Passport is not merely a bureaucratic hurdle; it is the new "Trust Currency" of global trade. For the C-Suite, the mandate for 2026 is clear: the era of "don't ask, don't tell" sourcing is officially over. The leaders who will thrive are those who stop viewing compliance as a cost center and start viewing it as the ultimate business intelligence tool. In a world where every stitch is recorded and every fiber is followed, the most successful brands will be those whose digital stories are as seamless as their physical seams. The 2026 trade map is being redrawn, and the ink is made of data.

The fashion world is witnessing a tectonic shift as Prada Group moves to integrate its recent acquisition of Versace, a merger that pits Prada’s trademark ‘intellectual minimalism’ against Versace’s ‘unapologetic glamour.’ Industry analysts, including Luca Solca, suggest this ‘New Italian Order’ is a calculated effort to back Versace’s immense cultural power with Prada’s legendary operational efficiency. While Versace has long dominated pop culture with its logo-heavy, Mediterranean aesthetic, it has recently struggled with a "shaky present" and an over-dependence on outlet malls. Patrizio Bertelli, Chairman, Prada Group has emphasized that the goal is not to dilute Versace’s voice but to provide a ‘strong platform reinforced by years of ongoing investments,’ effectively using discipline to save decadence.

Navigating the high-stakes path to global premiumization

The road ahead is defined by a rigorous ‘premiumization’ strategy, aiming to transition Versace away from discounted retail and toward high-margin, exclusive positioning. Andrea Guerra, CEO, Prada has signaled a three-year window to prove whether this organizational discipline can sharpen Versace's spectacle or if it will inadvertently dull its edge. The group is eyeing aggressive expansion in underpenetrated markets like Southeast Asia and the Middle East, leveraging a revenue base that is currently diversified across EMEA (42 per cent) and the Americas (31 per cent). However, the journey faces immediate hurdles, most notably the ‘sudden exit’ of creative lead Dario Vitale, which complicates Prada’s promise of stability. As the Prada-Bertelli family maintains an 80 per cent stake in the group, the focus remains on vertical integration and consistent product identity to ensure this Italian luxury renaissance yields long-term financial growth.

Established in 1913 by Mario Prada, the Prada Group is a global leader in luxury leather goods and ready-to-wear fashion. The company is currently executing a massive portfolio expansion, fueled by a verticalized global network and streamlined supply chains. With a goal of re-establishing heritage brands like Versace as premium icons, the group is targeting high-growth markets to secure its financial future.

The International Association of Department Stores (IADS) 2025 review reveals a stunning reversal for the ‘traditional’ format, with members reporting record-breaking profits by prioritizing luxury and digital agility. Bloomingdale’s led the pack with a 9 per cent surge in comparable sales - its strongest performance in 13 years - while Mexico’s El Palacio de Hierro saw revenues jump 12 per cent to $1.47 billion in H1. This growth significantly outpaces the broader retail sector, which averaged just 3.2 per cent growth in same-store sales globally. ‘Discipline meets creativity when stores operate with a purpose beyond the shelf,’ notes IADS leadership, highlighting a shift where digital sales now contribute up to 60 per cent of GMV for leaders like Germany's Breuninger.

The flagship as a living brand universe

The physical store is being reborn as an ‘experiential destination,’ exemplified by Galeries Lafayette’s 90,000 sq ft Mumbai debut in November 2025. Developed with Aditya Birla Group, the site hosts 250+ luxury brands, blending French heritage with Mumbai’s cultural vitality. Meanwhile, Breuninger’s 13,000 sq m Hamburg flagship serves as a case study in ‘phygital’ fusion, integrating AI-driven personal shopping suites. Despite these successes, the sector faces the hurdle of skyrocketing operational costs for high-density mall footprints. However, the resilience of TSUM Kyiv - which added 52,000 new clients and exceeded 2021 pre-war performance - underscores that when retail serves communities through crisis, brand loyalty becomes unshakeable.

Digital sovereignty and AI-driven retail media

Beyond the sales floor, retailers are monetizing data through premium retail media propositions, a move championed by John Lewis & Partners. The Chalhoub Group has further disrupted the landscape with ‘Alia,’ its proprietary GenAI platform, automating customer engagement across 39 new store openings. This transition from ‘merchant to landlord and media hub’ represents a fundamental sector shift. As El Corte Inglés deploys its €3 billion investment plan, the 2025 data confirms that the department store’s future lies in its ability to act as a cultural anchor, blending high-fashion exclusivity with hyper-personalized digital convenience.

Founded in 1928, the International Association of Department Stores (IADS) is the oldest international retail body, representing giants from Bangkok to Paris. It facilitates strategic exchange on digital transformation and sustainability, guiding members toward record profitability. The association drives growth by future-proofing the department store model through experiential innovation.

The global fashion retail landscape is witnessing a structural shift as Bangladesh’s ready-made garment (RMG) sector moves beyond its traditional identity as a low-cost volume hub. While fiscal year 2025 closed with a robust 8.84 per cent increase in apparel exports to $39.35 billion, the underlying narrative is one of rapid technological deepening and stringent environmental compliance.

Faced with a 33 per cent rise in industrial gas prices and a statutory wage review, manufacturers are aggressively integrating automated cutting, knitting, and sewing lines. This capital-intensive transition has boosted factory productivity several fold, allowing the sector to absorb rising overheads while maintaining its edge against regional competitors like Vietnam and China.

Green manufacturing as a competitive advantage

Sustainability has evolved from a boardroom buzzword into a prerequisite for market access. Bangladesh now hosts over 240 LEED-certified green factories, the highest globally, positioning it as the preferred partner for European and North American brands adhering to new circularity mandates. Led by BGMEA, the ‘Sustainability Vision 2030’ targets a 30 per cent reduction in greenhouse gas emissions, underpinned by a surge in rooftop solar installations and water-recycling technologies. This ‘green premium’ is attracting high-value orders in the athleisure and technical textile segments, which are projected to grow at a 6.7 per cent CAGR through 2030.

Navigating tariff shocks and LDC graduation

Despite the momentum, the industry faces immediate headwinds from shifting trade policies. In a significant diplomatic breakthrough in late 2025, a negotiated 20 per cent cap on US tariffs averted a more punitive 35 per cent rate, though duties remain higher than historical levels. The sector is also bracing for the 2026 LDC graduation, which will phase out preferential market access. Manufacturers like the DBL Group are responding by diversifying into synthetic fibers and recycled polyester - sub-segments expected to exceed $8 billion by 2030 - ensuring the ‘Made in Bangladesh’ tag remains indispensable in an era of ethical and high-performance fashion.

As the world’s second-largest apparel exporter, Bangladesh’s RMG sector accounts for 85 per cent of national export earnings. Dominating in knitwear and woven categories, the industry is currently transitioning toward high-value functional textiles and automation to offset rising labor costs. With a 2030 export target of $100 billion, the sector remains the bedrock of national economic stability and female workforce empowerment.

The Cambodian garment and textile industry has reinforced its status as the nation's primary economic engine, recording a robust 17 per cent Y-o-Y increase in garment exports, which reached $10.46 billion for the January–November 2025 period. While the sector maintains double-digit growth, the narrative is shifting from pure volume to strategic resilience. Despite a seasonal normalization in November - which saw knitted apparel exports dip slightly to roughly $540 million - the broader annual trajectory remains positive. This growth is increasingly buffered by a rise in raw material imports, with knitted fabric intakes rising significantly, signaling that manufacturers are preparing for a sustained production cycle into 2026.

Diversification and tariff pressures shape the 2026 outlook

The industry is currently navigating a complex ‘two-speed’ recovery. While demand from the European Union and ASEAN remains stable, uncertainty surrounding US trade policy and potential tariff hikes has prompted a rapid diversification strategy. Cambodia is aggressively leveraging the Regional Comprehensive Economic Partnership (RCEP) and bilateral FTAs with China and South Korea to reduce its 40 per cent export dependency on the American market. Our upward trend is now supported by new investment inflows from East Asia, which are helping us move into higher value-added functional wear, notes Thong Mengdavid, a prominent regional economic analyst.

Industrial upgrading ahead of LDC graduation

A critical challenge looms as Cambodia prepares for its 2029 graduation from Least Developed Country (LDC) status. In response, the sector is intensifying its "double transformation"—integrating digital automation with green manufacturing standards. The Ministry of Commerce has reported a 15.5 per cent increase in active factories, now totaling over 1,800, many of which are adopting energy-efficient technologies to meet global ESG mandates. This proactive upgrading is designed to maintain Cambodia’s competitive edge in the global retail supply chain, ensuring the sector remains the bedrock of employment for over 900,000 workers. The Garment, Footwear, and Travel goods (GFT) sector is Cambodia's largest foreign exchange earner, contributing nearly 10 per cent to the national GDP. Dominating the mid-market knitwear and outdoor apparel categories, the industry is currently expanding into electronics and high-tech textiles to ensure long-term stability beyond its 2029 LDC graduation.

The Bangladesh ready-made garment (RMG) sector is transitioning from a period of severe operational volatility toward a strategic stabilization phase. Fiscal Year 2024-25 concluded with apparel exports reaching $39.34 billion, a resilient 8.84 per cent growth despite a sequence of unprecedented disruptions. The industry weathered a ‘perfect storm’ in 2025, including a devastating airport cargo fire that caused an estimated $1 billion in losses, political transitions, and a 9 per cent statutory wage hike. While export momentum slowed to a 2.53 per cent increase in the January–November 2025 window, a decisive diplomatic breakthrough - capping US ‘reciprocal’ tariffs at 20 per cent instead of the feared 35 per cent - has significantly revived buyer confidence and order flows for the upcoming spring/summer 2026 season.

Modernization and high-value diversification

To counter rising overheads and the withdrawal of traditional export incentives, manufacturers are accelerating a move into high-margin segments. This shift is evident in the 9.73 per cent growth of knitwear exports ($21.15 billion) compared to the 7.82 per cent rise in woven garments. Leading players are diversifying into Man-Made Fibers (MMF) and functional outerwear to bridge the gap as Bangladesh prepares for its 2026 LDC graduation. The 2025 shocks acted as a catalyst for efficiency; we are no longer just a volume hub but a partner in complex, technical fashion, notes Senior Director, BGMEA.

Sustainability as a shield against global headwinds

Environmental, Social, and Governance (ESG) compliance has become the sector’s primary defense against intensifying competition from Vietnam and India. Bangladesh now leads the world with over 240 LEED-certified green factories, a status that attracted significant order diversions in late 2025 as European retailers tightened circularity requirements. Despite the closure of approximately 113 underperforming units over the last 15 months, the establishment of 128 sophisticated, automated factories signals a structural consolidation. Industry experts project a robust recovery starting in the second quarter of 2026, supported by eased inflationary pressures and a more stable domestic energy grid.

Bangladesh is the world's second-largest apparel exporter, with the RMG sector contributing 81 per cent of national export earnings. Dominating in knitwear and woven categories, the industry targets a $100 billion export goal by 2030. Originally built on low-cost basics, it is now a global leader in green manufacturing and sustainable fashion.

As the global textile industry moves through the final quarter of the year, this feature serves as a cornerstone of our "Wrap Up 2025, Outlook 2026" series, charting the transition from experimental sustainability to scaled industrial reality. While 2025 was defined by the pressure to decarbonize, 2026 is emerging as the year where circularity finally aligns with capital efficiency.

The Bio-Fabrication Leap: Can mushrooms compete with cotton?

For years, bio-fabricated fibers like mycelium (mushroom root) and algae were the darlings of experimental luxury—cool, avant-garde, and prohibitively expensive. However, 2026 marks the "Industrial Leap" where these materials hit the mainstream shelf. The bio-based textile market, valued at $54.21 billion in 2025, is projected to surge toward $113.43 billion by 2034, with a significant acceleration beginning this year.In 2026, the sector is witnessing a decisive transition: Bio-Industrialization. The narrative has moved from proving the science to perfecting the supply chain.

The most compelling metric for the C-Suite in 2026 is the closing price gap. For the first time, the "Green Premium" is eroding. While conventional cotton remains volatile—hovering around $0.70 to $0.85 per pound—bio-synthetic alternatives like PHA (polyhydroxyalkanoates) and microbial cellulose are achieving price parity in high-performance segments. By 2026, the cost to produce bio-fabricated leather alternatives has dropped by nearly 30% compared to 2023 levels, thanks to decentralized "fermentation hubs" that utilize agricultural waste as feedstock.

"Scalability is no longer a chemistry problem; it’s a capacity problem," notes a leading Material Science Officer at a Tier-1 mill. "In 2026, we aren't just buying a story; we’re buying consistent, high-tenacity fiber at a predictable volume."

The ‘Mono-Material’ Transition:Designing for the end

The most significant technical development for 2026 is occurring at the yarn level: the Mono-Material Revolution. Throughout 2025, the industry leaned heavily on "recycled blends"—typically a mix of recycled polyester and organic cotton. While these served a marketing purpose, they created an end-of-life bottleneck. These blended fibers are notoriously difficult to separate, making them a one-way ticket to a secondary landfill.

In 2026, the strategic focus is toward Polyester-based Mono-Stretch Yarns, valued at $1.04 billion in 2026, this segment is projected to grow at a 9.5% CAGR.

By replacing traditional spandex—a contaminant in the circular loop—with specialized elasto-polyesters, manufacturers are creating garments that can be recycled as a single unit without mechanical stripping. Analysts project that these mono-materials will capture nearly 38% of the performance yarn market by the end of 2026.This transition allows a garment to be shredded and pelletized back into virgin-quality yarn without the chemical nightmare of separating elastane from cotton. For the CFO, this isn't just an environmental win—it’s an insurance policy against the EU’s looming ban on the destruction of unsold goods, effective July 19, 2026, for large enterprises.

|

Material Segment |

2025 Market Share |

2026 Projected Share |

Growth Driver |

|

Traditional Blends (Poly/Cotton) |

58% |

42% |

Recycling Complexity |

|

Mono-Material Synthetic Stretch |

22% |

38% |

Circular Mandates |

|

Cellulosic Bio-Based Fibers |

9% |

14% |

Scaled Production |

Advanced Recycling: Closing the loop on post-consumer waste

While mechanical recycling has been the industry standard, 2026 marks the year Chemical Recycling achieves commercial viability. Unlike mechanical methods, which shorten fiber length and degrade quality, chemical depolymerization breaks fibers down to the molecular level, allowing them to be rebuilt into "virgin-quality" yarns.

The financial logic is compelling. While chemical recycling remains more capital-intensive than mechanical shredding, the output commands a "Virgin-Grade" premium. As one CFO recently stated during a 2026 strategy session, "Investing in chemical recovery isn't a cost; it’s our future feedstock security in a world where virgin resource prices are becoming increasingly volatile.

Monetizing the Redo: Reverse logistics as a profit center

If 2025 was the year of exploring resale, 2026 is the year of Integrated Reverse Commerce. For the first time, C-Suite leadership is viewing resale and repair not as PR stunts, but as critical margin-preservation strategies. The global resale market is projected to reach $338.4 billion by 2026, growing three times faster than the broader retail sector.

Brands are no longer handing off their secondhand business to third-party marketplaces. Instead, they are becoming their own secondhand competitors. By owning the "Take-Back" infrastructure, brands capture the data and the profit from the second, third, and fourth life of a garment.

Trade Barriers and Green Protectionism: The new global map

The 2026 trade landscape is being redefined by "Green Protectionism." Free Trade Agreements (FTAs) are no longer just about lowering tariffs; they are becoming instruments of environmental policy. Under the EU’s Carbon Border Adjustment Mechanism (CBAM), which enters a critical phase in 2026, importers will begin facing actual costs associated with the carbon footprint of their textile imports.

Various countries are adapting through "Green Corridors." India and Vietnam, for example, are leveraging their FTAs to incentivize circularity by offering "Fast-Track" customs clearance for products that utilize verifiable recycled or bio-based content. Conversely, "Linear" products—those with high carbon footprints and zero recyclability—are facing what many call "Carbon Surcharges," effectively a secondary tariff that erodes any cost advantage gained from low-cost labor.

|

Region |

Primary Trade Shift 2026 |

Key Indicator |

|

European Union |

Digital Passport Enforcement |

95% compliance required for entry |

|

United States |

Forced Labor & Transparency Audits |

Shift toward nearshoring (Mexico/CAFTA) |

|

India |

Scale-up of PM MITRA "Green Parks" |

11.4% growth in "circular-ready" clusters |

|

Vietnam |

Transition to Renewable Energy Mills |

25% reduction in mill carbon intensity |

C-Suite Strategic Leadership: The "Finance-Grade" ESG era

The final piece of the 2026 puzzle is the death of vague marketing. In 2025, marketing teams could lead with "eco-friendly" slogans. In 2026, Sustainability is a Financial Audit. Banks and institutional investors have tightened the screws; capital access is now directly linked to verifiable, "Finance-Grade" ESG data.

C-Suite leaders are now hiring sustainability accountants to map the "Residual Value" of inventory on the balance sheet. A warehouse full of 100,000 mono-material, recyclable jackets is now viewed as an asset of recoverable raw material, whereas a warehouse of non-recyclable blends is increasingly seen as a future disposal liability. This transparency gold rush is fueling a new tech ecosystem where blockchain-backed supply chain data is the price of admission for global trade.

Editor Concludes: The year the dividend arrived

The outlook for 2026 is one of pragmatic optimism. We are leaving behind the era of "doing less harm" and entering the era of "doing more business" through circularity. The companies that will dominate the 2026 landscape are those that have successfully transitioned from a volume-based mindset to a value-retention mindset.

As the CFO’s playbook changes to account for the secondary and tertiary value of every fiber, the divide between the "Circular Leaders" and the "Linear Laggards" will become an unbridgeable chasm. The circular yield is no longer a distant promise; it is the new bottom line.

The Indian textile engineering landscape is undergoing a fundamental transformation, shifting from legacy mechanical processes to a digital-first manufacturing ecosystem. At the third edition of the India ITME Technical Awards 2025 in Mumbai, industry leaders signaled that the sector has reached a critical inflection point where high-tech adoption is no longer optional. With the domestic textile market projected to reach $190 billion by 2025–26, the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) has emerged as the ‘third partner’ in production. This shift is designed to address systemic challenges such as labor-intensive quality control and energy inefficiencies, enabling Indian manufacturers to compete more aggressively in a global market that is increasingly demanding precision and speed.

Bridging heritage with advanced design

A significant news angle emerging from the summit is the strategic rebranding of traditional industries, specifically Khadi, as high-performance growth engines rather than philanthropic ventures. Roop Rashi Mahapatra, CEO, Khadi & Village Industries Commission (KVIC), emphasized, the future of traditional textiles lies in a ‘design-led’ approach that leverages modern engineering to create sustainable livelihoods. By combining ancient craftsmanship with contemporary machinery, the industry aims to create a circular economy where eco-friendly fibers like hemp and banana - standardized by 2025 - can meet the rigorous technical standards of international export markets. This convergence of heritage and technology is seen as a primary driver for the 10 per cent Y-o-Y export growth recorded in late 2025.

Recognizing the champions of sustainable engineering

The 2025 awards underscored a move toward "principled consumption" and localized innovation. Yamuna Machine Works was recognized as a champion in Processing and Finishing, while Zydex Industries took top honors for sustainability-centric initiatives. Notably, the industry is seeing a ‘startup mindset’ among young engineers who are developing cutting-edge solutions for fabric defect detection and thermal regulation. These innovations are critical as the sector faces rising raw material costs and shifting cotton sourcing patterns. The ‘Make in India’ vision was further solidified by Rieter India’s award for successful technology transfer, highlighting the country's growing capacity to manufacture world-class textile machinery domestically.

The India International Textile Machinery Exhibitions (ITME) Society is the apex non-profit industry body dedicated to promoting textile engineering and technology in India. Established in 1980, it serves as a global platform for technology transfer and trade. The Society currently focuses on the ‘Vision 2047’ roadmap, aiming to establish India as a global textile machinery hub. With the sector contributing 2.3 per cent to national GDP, the Society’s initiatives support a workforce of over 45 million by fostering academic-industry partnerships and accelerating the adoption of Industry 4.0 standards across the textile value chain.

In a strategic departure from the ‘fast-fashion’ frenzy, resale giant Depop is capitalizing on a fundamental shift in Gen Z behavior: the transition from algorithmic churn to personal authorship. According to Depop’s 2026 Trends Report, ‘The Edited Self,’ consumers are actively rejecting micro-trends in favor of ‘repeatable staples.’ This intentionality is not merely a stylistic pivot but a high-velocity business driver. Amidst a broader US retail landscape characterized by low single-digit growth and tariff-induced price hikes, Depop’s US market grew by 54 per cent in 2025. By prioritizing ‘Modern Uniforms’—sharp tailoring and dependable workwear—over disposable aesthetics, the platform has successfully positioned itself as a hedge against economic volatility.

Data-Driven Resilience and AI Integration

The fiscal impact of this ‘purposeful style’ is substantial. Depop’s Gross Merchandise Sales (GMS) hit $249.6 million in Q2, FY25, a 35.3 per cent Y-o-Y increase. To sustain this momentum, the platform is integrating "agentic commerce," using AI-powered tools that transform a single product photo into a professional listing. ‘We are seeing a cultural recalibration where taste is the new currency,’ says Peter Semple, CEO, Depop. This technological edge addresses the primary challenge of the resale sector: scalability. As 75 per cent of US shoppers now trade down to secondhand alternatives to offset inflation, Depop’s ability to offer "archival" reliability at a fraction of the cost of new apparel is reshaping the competitive hierarchy of the $82 billion resale market.

Recommerce as a strategic retail pillar

Beyond the digital storefront, Depop’s expansion into physical "pop-ups" in New York and other urban hubs reflects a move toward a ‘phygital’ retail network. This strategy leverages the ‘treasure hunt’ experience that 60 per cent of global consumers now seek when shopping secondhand. The environmental narrative remains a potent conversion tool; with 3 out of 5 Depop purchases displacing the need for brand-new items, the platform is converting "eco-anxiety" into brand loyalty. As traditional retailers struggle with overproduction, Depop’s model—fueled by a community of 43.5 million users - proves that in 2026, the most newsworthy growth is found not in the new, but in the newly rediscovered.

Depop is a global community-powered marketplace specializing in affordable, circular fashion for Gen Z and Millennials. Operating primarily in the UK and US, the Etsy-owned platform hit a peak GMS of nearly $800 million recently. Its 2026 strategy focuses on ‘Where Taste Recognizes Taste,’ scaling through AI-enabled listings and physical New York-centric retail experiences to dominate the booming global recommerce sector.

While much of the US retail landscape remains cautious amid shifting trade policies and low single-digit growth projections, a elite group of ‘agile’ brands is doubling down on expansion for 2026.

Leading this charge is Uniqlo, which is slated to open 11 new stores - including its first flagship locations outside New York City in Chicago and San Francisco. This growth is underpinned by a ‘true private-label model’ where the Japanese giant controls everything from fabric production to final sale. Industry analysts suggest this full vertical integration allows Uniqlo to offer high-quality ‘LifeWear’ at prices that traditional middle-market retailers, burdened by fragmented supply chains and a 25 per cent hike in grocery-driven inflation, simply cannot match.

Off-price resilience in a cautious climate

Parallel to the vertical giants, the off-price sector is emerging as a primary growth engine for 2026. Nordstrom Rack is executing a massive sprint, with over 21 new locations announced for the upcoming year. This ‘laser focus’ follows the Nordstrom family’s $6.25 billion move to take the company private, a transition designed to shield long-term retail strategies from short-term public market pressures. By positioning stores within 15 minutes of key suburban hubs, off-price leaders are capturing ‘cash-strapped but quality-conscious’ shoppers who are increasingly trading down from department stores but refusing to sacrifice brand-name reliability.

AI and the personalization paradox

The 2026 retail roadmap is not just about physical square footage; it is a battle for data-driven precision. While 75 per cent of consumers are reportedly trading down to cheaper alternatives, they simultaneously demand premium experiences, such as two-hour delivery and AI-guided styling. Retailers are responding by integrating Generative AI for ‘agentic commerce,’ where algorithms don't just recommend products but proactively manage inventory and hyper-personalize the shopping journey. This tech-enabled efficiency is expected to be the ‘structural pillar’ that separates the 2026 market leaders from legacy players struggling with margin erosion.

Uniqlo USA: The global LifeWear standard

Uniqlo is the flagship brand of Fast Retailing, offering functional, high-quality ‘LifeWear’ across 78 US stores. Celebrating its 20th year in America, the brand targets 200 North American locations by 2027. With $2.9 billion in recent international revenue, Uniqlo leverages RFID tech and a 100 per cent private-label model to dominate the global casual-wear market.