FW

Italian eyewear maker Safilo has renewed its licensing deal with German fashion house Hugo Boss till 2030-end.

The deal mandates the Safilo to manufacture and distribute glasses and sunglasses for the luxury firm's Boss and Hugo brands for the next seven years.

Angelo Trocchia, CEO, Safilo Group says, the rebranding of Boss and Hugo in the last two years ensures a bright and successful future for the brands in all of the company’s markets and distribution channels.

Having brands like Carrera, Polaroid, Smith, Blenders, Prive Revaux and Seventh Street in its portfolio also holds licenses for Banana Republic, Carolina Herrera, Dsquared2, Etro, Eyewear by David Beckham, Isabel Marant, Juicy Couture, Tommy Hilfiger, etc. The group recorded net revenues of €1.08 billion in 2022.

In its most recent trading update in November, Hugo Boss reported registered a 15 per cent rise in Q3 revenues at constant exchange rate. The brand aims to grow across all regions, touchpoints and brands, as well as in all product areas, says Daniel Grieder, CEO, Hugo Boss AG.

For the second consecutive year, global cotton production is expected to surpass consumption in the 2023-24 seasons, as per a projection by the International Cotton Advisory Committee (ICAC). Production during the season is expected to rise to 25.4 million metric tonne, while consumption is forecasted to decline marginally to 23.4 million metric tonne.

A rise in cotton production led to cotton prices declining marginally by 0.18 per cent to Rs 56,060 during the 2022-23 seasons.

Global cotton supply during the season surged as cultivation expanded and productivity increased. However, demand remained sluggish due to unfavorable economic conditions, resulting in elevated inventories and a subsequent reduction in cotton prices worldwide.

The Cotton Association of India (CAI) has maintained its estimate for the 2023-24 seasons at 294.10 lakh bales of 170 kg each. The decline in pink bollworm infestation in the cotton crop has led to CAI reducing damage estimates from 30.62 percent in 2017-18 to 10.80 percent in 2022-23.

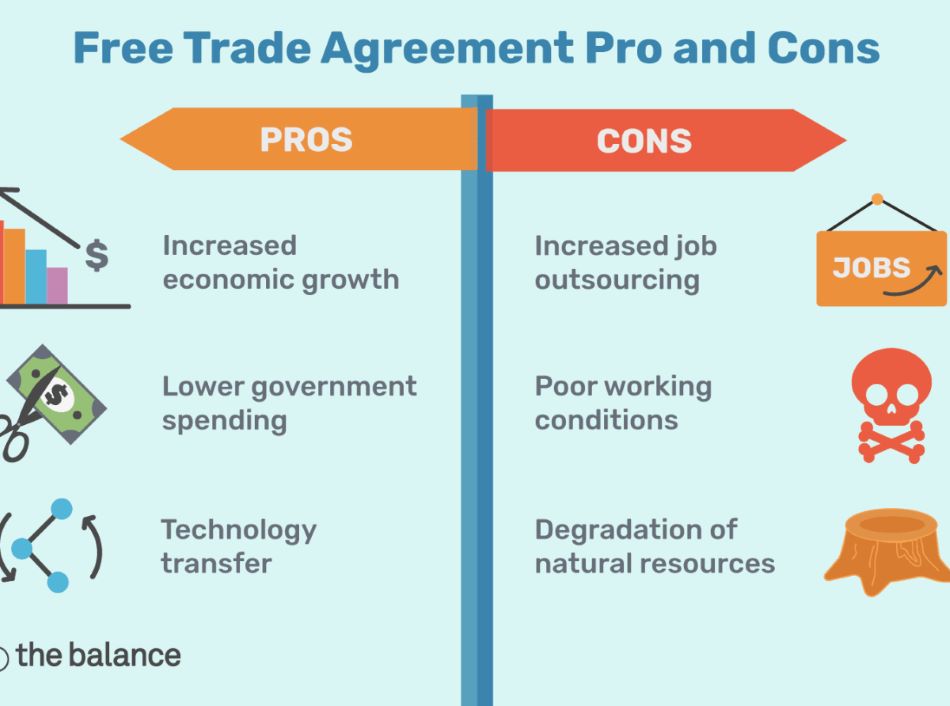

India's vibrant apparel industry, known for its intricate craftsmanship and dazzling patterns, stands at a crossroads. Free Trade Agreements (FTAs) with the UAE and Australia promise alluring export avenues, but beneath the surface, anxieties over heightened competition and domestic vulnerabilities simmer. Unraveling this complex tapestry demands a nuanced approach, acknowledging both the undeniable opportunities and potential pitfalls.

Booming High-Value Exports, Stalled Mass Production:

The 2019 UAE FTA proved transformative, with premium garment exports soaring 47% within the first year, fueled by a 50% tariff slash. A Deloitte report predicts a similar 30% boost for Australian high-value apparel with the AIECA. However, mass-produced garment exports haven't experienced the same growth, highlighting a need for differentiation strategies.

Vietnam: A Looming Threat:

Vietnam, leveraging FTAs and efficient production, casts a long shadow over India's dominance in mid-range and mass-produced segments. Dr. Anjali Sharma warns, "Without adapting, India risks losing market share." This underscores the need for focusing on innovation, niche segments, and value-addition to stand out in a crowded market.

Balancing Act: Domestic Market Concerns:

ICRIER studies suggest a potential 10% decline in domestic apparel production and 1.2 million job losses due to FTAs. Ms. Priyanka Singh emphasizes the need for balanced concessions that protect domestic players while maximizing export potential. Navigating this delicate tightrope walk presents a significant challenge for policymakers.

Weaving the Fabric of the Future:

To secure a vibrant future, experts propose a three-pronged approach:

1. Embracing High-Value Segments: India possesses a unique edge in intricate craftsmanship and premium materials. Capitalizing on this strength is crucial.

2. Investing in Skill Development and Technology: Enhancing efficiency and agility through skill development and technology adoption is key to competing with Vietnam.

3. Prioritizing Sustainability: The growing global demand for sustainable fashion presents a lucrative opportunity for India to tap into.

India's Renewed FTA Enthusiasm:

India, once a cautious player, has now signed 13 FTAs and 6 preferential agreements, reflecting a strategic shift. The CEPA with the UAE and ECTA with Australia are testaments to its global ambitions.

A Closer Look at Recent FTAs:

• UAE: A Gateway to Luxury: The 2019 FTA proved transformative, with premium garment exports soaring by 57% in 2022. Ajay Singh hails it as a "game-changer" that reduced trade barriers and boosted competitiveness.

• Australia: Down Under Opportunities and Challenges: The 2011 CECA presents mixed results. While high-value apparel exports increased by 12% in 2023, concerns linger about competition and stringent regulations. Dr. Aparna Mukherjee notes, "We need to address non-tariff barriers and invest in quality improvement to fully capitalize on the CECA."

The Double-Edged Sword of Competition:

FTAs with the UAE and Australia open doors, but also expose Indian exporters to fierce competition from Vietnam and Bangladesh in mid-range and mass-produced segments. Sunil Kumar cautions, "We need to focus on innovation, value-addition, and niche segments to differentiate ourselves."

Lessons Learned from Past FTAs:

Despite signing 13 FTAs, India faces challenges, with a trade deficit and low utilization (25%). Inadequate industry consultation, non-tariff barriers, and complex certification requirements hinder effective implementation.

A Fresh Approach Emerges:

Acknowledging these shortcomings, India is taking a fresh approach to FTAs, emphasizing:

1. Enhanced Industry Consultation: Ensuring industry concerns are addressed during negotiations.

2. Reducing Non-Tariff Barriers: Creating a level playing field for Indian exporters.

3. Creating Awareness among Exporters: Educating exporters about FTA benefits and navigating complex procedures.

The Road Ahead: Embracing Innovation and Opportunity:

As India embarks on this new chapter, the key lies in navigating the intricate threads of opportunity and challenge. By learning from past mistakes, prioritizing domestic interests, embracing innovation, and focusing on high-value segments, India can weave a vibrant future for its apparel industry, securing its place on the global stage.

Renowned British fashion and textile designer Dame Zandra Rhodes is set to headline Spring Fair, the UK's premier marketplace for home, gift, fashion, and everyday items. In an exclusive fireside chat with retail analyst Natalie Berg, Dame Zandra will share insights into her extraordinary journey in design, leadership, and innovation.

Titled "The Fabric of Success: Dame Zandra Rhodes on Reinventing Fashion and Retail Leadership," the session will unfold on Wednesday, 7th February, at 12:30 pm in Hall 2, part of Moda, the trusted fashion hub within Spring Fair. Exploring her roots, contributions to British fashion's evolution, and pioneering role in home furnishings, Dame Zandra will reveal how her distinctive style and bold collaborations shaped her brand and left a lasting legacy. The discussion promises to captivate those interested in the convergence of retail creativity, industry advocacy, and the cultivation of female leadership in retail.

The Inspiring Retail Stage, a beacon for industry luminaries and experts, will host keynotes from figures like Theo Paphitis, Kris Hamer of the British Retail Consortium, and ESG pioneer Paul Wright. Alongside vibrant Moda catwalks showcasing the latest trends, the stage offers a space for inspiration on refreshing retail strategies and staying ahead in the ever-evolving landscape.

As part of Spring Fair's legacy of uniting the industry for over 70 years, the upcoming show promises a magical experience dedicated to discovery. Positioned as the UK's largest marketplace, it will present an efficient layout across four key destinations and 13 sectors, ensuring buyers spend less time locating products and more time immersing themselves in the latest trends and innovations.

Renowned sustainability leader, Fashion for Good, is set to spearhead a groundbreaking strategy aimed at propelling regenerative fashion innovations to new heights. The bold move involves a substantial commitment to fortify the Innovation Platform, intensify efforts in brand integration, supplier collaboration, financing, and impact measurement. Simultaneously, the iconic Fashion for Good Museum is set to close its doors in a grand finale at the end of January, metamorphosing into a dynamic blended-use and co-working space by June 2024.

Revolutionizing collaboration in sustainable fashion

In response to the dynamic shifts in the fashion landscape over the last five years, Fashion for Good has strategically repositioned itself to ensure continued leadership in innovation and drive transformative change within the industry. Acknowledging the surge in circularity and innovation, the organization has embarked on a critical reflection to navigate the complexities posed by macroeconomic risks, climate crises, and evolving policies.

Reflecting on achievements

Since its inception in 2017, Fashion for Good has evolved into the pinnacle global platform for collaborative innovation in the fashion industry, boasting impressive achievements:

Innovation mastery: Over 2,800 innovations assessed, with 173 innovators experiencing first implementations with industry partners.

Global partnerships: The partner base has expanded to include 25+ leading brands, retailers, and manufacturers, representing 12% of the industry.

Industry orchestration: Aligning innovators, brands, manufacturers, and financiers resulted in 400 implementation cases and 15 collaborative projects.

Financial catalyst: Fashion for Good, in collaboration with investors, has catalyzed a substantial 1.9 billion EUR in funding towards innovators.

Strategic realignment for future success

In 2023, Fashion for Good conducted extensive interviews with industry stakeholders, identifying barriers to scaling innovations across innovators, industry, and investors. The organization's unique strength lies in orchestrating these three actors to overcome these barriers, enabling scalable solutions. The renewed strategy focuses on five pillars:

Innovators: Establishing a dedicated Scaling Team for bespoke support in brand uptake, supplier integration, financing, and impact measurement.

Suppliers: Launching the Strategic Supplier Programme to actively engage brand key suppliers in scaling and implementing innovations.

Brands: Facilitating cross-functional innovation agendas, structures, and processes to empower brand partners.

Investors: Increasing support to cover all innovator stages and capital types.

Public: Enhancing public awareness through sharing insights, learnings, and proof points via various channels and media partnerships.

Museum's grand finale and transformation

The Fashion for Good Museum, after curating 13 exhibitions and welcoming over 100,000 visitors since 2018, is set for a grand finale around circularity in January. Subsequently, the museum will evolve into an expanded co-working space, fostering collaboration among mission-aligned organizations, offering flexible spaces for new tenants, and ensuring the legacy of sustainable change in fashion persists.

Katrin Ley, Managing Director of Fashion for Good, emphasizes the strategic shift, stating, "We're making operational adjustments to drive industry-wide innovation adoption more effectively. This strategic shift goes hand in hand with the decision to close the Fashion for Good Museum." The commitment to sustainable change remains unwavering, marking a significant leap forward in the organization's transformative journey.

Lenzing Group, a global leader in specialty fibers, has secured an "AA" rating from MSCI for the third consecutive time, positioning itself in the top eight percent of its peer group. The recognition underscores Lenzing's commitment to sustainability and its pivotal role in advancing the industry towards a circular economy.

Notably, Lenzing participated in the SAC Higgs FEM verification for the first time, assessing the environmental impact of its product manufacturing and achieving commendable results.

MSCI applauds Lenzing's governance structures, highlighting its proactive measures in addressing environmental risks and emphasizing the company's robust water stewardship program.

The reaffirmation of the "AA" rating enables Lenzing to further cut interest expenses, aligning with its sustainable financing initiatives. As part of a bonded loan agreement from 2019, Lenzing commits to donating the interest savings to a social-ecological project.

Stephan Sielaff, CEO of Lenzing Group, expressed pride in being among the world's top sustainable companies, emphasizing Lenzing's dedication to transforming the textile industry into a circular economy model.

Additionally, Lenzing excelled in the SAC Higgs FEM assessment, a crucial tool capturing every stage of product manufacturing's environmental impact. With outstanding scores, Lenzing sites lead in sustainability, having completed external verification, except for sites in Brazil and Thailand, scheduled for 2024.

In a dramatic shift, Bangladesh, with its flexible supply chain and focus on safety, soars past China in EU knitwear exports, shipping 571 million kg vs. China's 442 million kg (Jan-Sept 2023). China's focus on tech shifts production, while Bangladesh's lower unit price raises sustainability concerns.

Can Bangladesh hold onto the crown? This remarkable feat deserves a closer look, exploring the factors behind Bangladesh's ascent, the shifting landscape in China, and the evolving preferences of EU knitwear importers.

Bangladesh's Strategic Play:

• Agility and Adaptability: Building a flexible and responsive supply chain through vertical integration was key. This allowed Bangladesh to react quickly to market trends, reducing lead times and production costs. Vertical integration created a flexible supply chain, reducing lead times by 20% and production costs by 15%.

• Investing in Safety and Sustainability: Addressing concerns about worker welfare and environmental impact through initiatives guided by the Accord and Alliance boosted Bangladesh's appeal as a responsible sourcing destination. 85% of factories now comply with safety standards.

• Leveraging Trade Agreements: Smartly negotiated trade deals, like GSP+, granted preferential access to the EU market attracting $5 billion in foreign investment and increasing technology transfer by 30%, enhancing Bangladesh's technological capabilities and overall RMG prowess. GSP+ granted preferential access to the EU market,

China's Shifting Priorities:

• Industrial Transformation: China's strategic pivot towards high-tech manufacturing and automation led to a 25% reduction in knitwear production.This deliberate shift of focus freed up valuable resources for other sectors.

• Rising Labor Costs: Chinese labor costs have risen by 10% annually in the past 5 years, making Bangladesh's 30% lower wages . While not the sole factor, increasing labor costs in China undoubtedly played a role, making Bangladesh's comparatively lower wages more attractive for EU knitwear importers.

• Domestic Market Boom: China's booming domestic market absorbed 40% of its knitwear production, leaving less available for export.

EU's Evolving Priorities:

• Diversification and Resilience: EU actively sought to diversify garment supply chains to mitigate risks associated with overreliance on single sources like China, with Bangladesh capturing 15% of the market share previously held by China

• Sustainability Push: 70% of EU consumers now prioritize sustainability. This growing consumer consciousness and initiatives like the EU Green Deal fueled a demand for eco-friendly and ethically sourced knitwear. Bangladesh's investments in safety and compliance practices resonated with these evolving priorities.

• Value Over Volume: While Bangladesh leads in volume and value, the lower unit price ( 15% lower) of its knitwear compared to China raises concerns about long-term sustainability and potential pressure on workers and manufacturers. Striking a balance between affordability and worker well-being will be crucial.

Challenges and Opportunities for Bangladesh:

• Moving Beyond Volume: To retain its top spot, Bangladesh must focus on increasing the value of its knitwear exports ( by 20%) by investing in innovation, design, and higher-value products.

• Reducing Dependence on China: Strengthening backward linkages by fostering domestic yarn and fabric production is essential to reduce reliance on Chinese raw materials by 35%. Government support and incentives can play a vital role.

• Upskilling the Workforce: Investing in technical training beyond basic sewing skills will be crucial to boost productivity and increase value addition in the textile sector by 25%.

• Remaining Sustainable: Balancing growth with environmental and social responsibility will be key to ensuring long-term success in the increasingly demanding EU market, where 50% of consumers prioritize ethical sourcing.

Road ahead for Bangladesh

Bangladesh's ascent in the EU knitwear market is a testament to its strategic adaptation, focus on sustainability, and favorable market conditions. However, the journey is far from over. To solidify its position as a leading knitwear exporter, Bangladesh must address price-related challenges, prioritize innovation, diversify its product portfolio, and invest in backward integration and skill development. Only through comprehensive efforts can Bangladesh ensure sustainable growth and cater to the evolving needs of both EU consumers and global markets.

The future of Bangladesh's knitwear industry hangs in the balance, but the potential for continued success is undeniable. By learning from its past and embracing the challenges and opportunities of the present, Bangladesh can secure its place as a leading player in the global knitwear arena.

Around 12 per cent of the board directors and senior executives working for fashion and retailers in the UK, US and Australia, expect their business to be fully circular within the next one to two years, as per a new study by Aquapak Polymers.

Around 34 per cent of the expectives expect their business attain circularity within two to three years while 31 per cent give three to four years to their businesses to become completely sustainable. One fifth expect to reach this goal in four to five years.

Around 32 per cent of the executives rated their sustainability initiatives as excellent, 54 per cent believed they were good and 14 per cent described them as being average.

Over 54 per cent of the executives described themselves as being a market leader and innovator, 39 per cent considered their business as being average and ‘following the leaders’ and 7 per cent believed their business lagged behind and needs to catchup with others.

Around 49 per cent of the executives considered sustainability as being highly important to the success of their business, 21 per cent of the respondents regarded their sustainability strategies and program as being excellent.

Over 37 per cent of the respondents considered the use of polyethylene plastic in packaging as being highly important for their sustainability strategy, while 63 per cent said it was quite important.

Aquapak has developed Hydropol™, a unique new soluble polymer which is non-toxic to marine life. Used as an alternative to conventional plastic in a wide variety of applications, the polymer provides the same functionality and performance but without the associated environmental problems. It is currently being used to make products such as garment bags, offering all the necessary features of traditional polybags: strength and puncture resistance; clarity of film; and protection from leakages and dirt.

International Fashion Design Council (IFDC) plans to hold its upcoming runway show during the upcoming Global India Couture Week (GICW) in February. To be held in Jaipur, the event will showcase a wide range of Indian brands and promote sustainable fashion, says Satyajit Mohanty, Managing Director, GICW. To run from February 10-11, 2024, the fashion event will be held at the Diggi Palace and Teela-The Glamping Resort in Jaipur in association with IFDC and Black Page Fashion.

The upcoming edition will bring together both established and upcoming brands. It will focus on showcasing desi design talent. Over 50 models from cities including Jaipur, Gurugram, Delhi, Mumbai, and Pune attended the model auditions of the event that will help models boost their fashion careers.

The event is likely to be expanded on a broader scale in upcoming months, says Sidharrth Behera, Director-Operations, GICW. The fourth season of GICW featured a presentation by designer Neeta Lulla featuring actor Palak Tiwari as showstopper.

Marc Lewkowitz, President and CEO, Supima Cotton believes, the current trend of producing smaller yields of American-grown Pima cotton will continue in 2024 as farmers are also cultivating other crops like corn and tomatoes to maximize returns on investments.

In the last few months, cost of raw materials for everything from equipment to energy has escalated. However, Supima’s sale price has declined from around $3.50 a pound in 2022 to about $2.35 a pound.

To boost sales Supima has launched a traceability platform called AQRe™ Project. The platform combines forensic testing from Oritain with TextileGenesis’ digital traceability. To control rising yarn costs, the platform spreads it across rest of the downstream chain says Lewkowitz.

Since its launching in July, AQRe™ Project platform has uploaded details of the quarter of the current crop year’s production. More details are expected to be uploaded as cotton production increases across the year, adds Lewkowitz.