FW

Garment and knitwear exporters in Tirupur are pitching for a free trade agreement with the EU. They also want a separate trade pact with Britain after it voted to leave the EU. Europe makes up 46 per cent of Tirupur’s apparel exports, of which Britain's share is 40 per cent.

A free trade agreement (FTA) is necessary to boost exports, including garment exports, to the UK. Britain's exit would significantly dilute the relevance of the EU FTA for Tirupur. The only way to expand business in the UK after Brexit would be through bilateral talks, which would mean a fresh round of negotiations. India currently enjoys a 12.5 per cent tariff preference in the EU under its Generalised scheme of preferences program. But the export sop would now be impacted for textile shipments to the UK.

While Europe is an important market for Indian exporters, it is more or less saturated and they have to work to enter China and Southeast Asia in the coming years as there will be greater penetration for high-end products there. The approval of Rs 6,000 crores special package for the textile and apparel sectors would help textile exporters to enter China and south east Asia.

The British Fashion Council (BFC) has announced eight emerging designers who will receive Newgen support, sponsored by Topshop, to showcase their collections at London Fashion Week (LFW) on September 16- 20, 2016. Ashley Williams, Danielle Romeril, Faustine Steinmetz, Marta Jakubowski, Molly Goddard, Ryan Lo and Sadie Williams will all continue to receive support this season. In addition to the seven designers, one new designer will receive Newgen support for the first time; Royal Academy of Art graduate Paula Knorr whose women's wear brand is now in its third season.

Meanwhile, Ashley Williams, Ryan Lo and Molly Goddard will host catwalk shows while the other designers will host static presentations. Each of the Newgen designers will be allocated a dedicated pop-up showroom space within the Designer Showrooms at Brewer Street Car Park, taking residence after their show or presentation to host press and buyers appointments.

Sarah Mower, BFC Ambassador for Emerging Talent, Chief Critic, VogueRunway.com and Chair of the Newgen committee commented that discovering, supporting and mentoring Newgen is the most vital and effective work the British Fashion Council does. The designers who graduate through this scheme are the lifeblood of London and its reputation as a creative hotbed with business credentials developed at a very early stage. This generation is thinking of new ways of presenting and is natural communicators of the digital age – they are all individualists with exciting, optimistic ideas which are a delight to see.

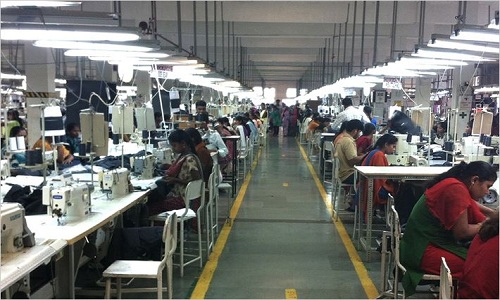

"With bold labour reforms, implementation of GST, robust export infrastructure coupled with innovation & technology, Indian textile and apparel industry has the potential to fundamentally change its trajectory, create over 50 million jobs, bring social transformation and gain global dominance. At the same time, moving an entire industry and creating millions of jobs seems a herculean task. These are some of the observations of a study on the ‘Indian Apparel, Made-ups & Textile Industry’ commissioned by the Confederation of Indian Industry (CII) to identify the key catalysts that will enable breakout growth."

With bold labour reforms, implementation of GST, robust export infrastructure coupled with innovation & technology, Indian textile and apparel industry has the potential to fundamentally change its trajectory, create over 50 million jobs, bring social transformation and gain global dominance. At the same time, moving an entire industry and creating millions of jobs seems a herculean task. These are some of the observations of a study on the ‘Indian Apparel, Made-ups & Textile Industry’ commissioned by the Confederation of Indian Industry (CII) to identify the key catalysts that will enable breakout growth.

The study says, the industry today is ominous and opportune. With an increase in wages and the Yuan gaining strength, industry is shifting its base away from China, creating a potential market of $280+ billion for other countries to capture. The shift is already happening in the apparel sector, large shifts are expected in fabric and yarn sourcing as well. Though Bangladesh and Vietnam are the current frontrunners, emergence of hubs in Africa (e.g. Ethiopia) and a strong resurgence seen for manufacturing in the US, the future landscape could be dramatically different.

Huge employment opportunity

Tapping this opportunity can bring immense social and economic benefits. The sector is the largest industrial employer of women in the country and can provide quick employability to a large mass of workers. If the industry achieves breakout growth, the study estimates another 50 million jobs to be created by 2025 - 35-40 million of which will be employing women. Potential economic benefits are sizeable as well. The study further estimates that the industry can triple in size over the next 10 years, get $150 billion annually in foreign exchange, and spur the apparel, made-ups and textile industry to reach $300 billion by 2025. The domestic market will also grow at least 2.5 times to become around $150 billion in size.

Chandrajit Banerjee, Director General, CII believes, India is uniquely positioned to capitalise on this opportunity. India is the only country in the world other than China to have the entire value chain from fiber to fashion, both in cotton and synthetics, an abundant and young labour force, a vibrant domestic market and a good starting point in exports (2nd largest exporter of textiles, apparel and made-ups in the world).

The study underlines the shifts in global apparel, made-ups and textile industry are going to be shaped by four major factors a) cost competitiveness, especially in labour/wage structures and energy structures per unit of output b) Ease of market access (both in terms of tariffs/duties and time to market) c) Ease of doing business and d) Technical innovations.

CII’s 6-point agenda

Game-changers for the Indian apparel, made-ups and textiles industry as per the CII 6-point agenda are the following:

• Build scale, as the industry is currently highly fragmented and lacks scale. Being highly labour intensive, introduce flexible labour laws; job linked support schemes, innovative hub and spoke models for apparel / textile parks to employ labour in hinterlands and introduce PPP models for Industry to provide scale and create jobs.

• Bridge the operating cost gap, especially on synthetics. Entrepreneurs need to aggressively drive up productivity by investing in world class facilities, process improvements and build a culture of manufacturing excellence. Simplified tax structures and neutral implementation of GST for both cotton and synthetic products will give the much required boost to the industry.

• Infrastructure, especially at ports, import facilities and clearance procedures should be streamlined to cut turnaround times. Signing FTAs with major markets like the European Union can equalise market access positions with key competitors like Bangladesh.

• Increase investments in technology, especially processing and technical textiles either through capital subsidy or technology partnerships. The A-TUFS released in December 2015 has taken welcome steps in this respect.

• To actualise ‘Make-in-India’ movement, government can create a comprehensive umbrella of support schemes under the 'Make-in-India' banner. Entrepreneurs need to advertise the made-in-India aspect aggressively, over-invest in quality and make their products worthy of putting up 'Proudly Indian' labels.

• Finally, Indian entrepreneurs need to invest both financial and human resources on technology and innovation to address the constantly evolving markets. Investments are required in technical textiles, processing, and apparel making in particular. India needs to create its own 'silicon-valleys' for technical textiles, with a full ecosystem of investors, start-ups, production facilities and ultra-fast clearances. Ease of doing business is equally critical for innovation.

After Brexit, economists predict some major economic consequences. According to them, a weak pound will benefit wool exports. Paul S Hughes, Director at Standard Wool UK, ‘the weak sterling, should in the short to medium term, assist carpet manufactures and spinners with operations here in the UK, when exporting to the USA and Europe’.

Hughes believes, the UK domestic market is still a consumer of carpet, however, the retail sector has been relatively poor over recent months, which is expected to improve in the short term and concerns within the UK housing market remain a real threat as historically, less house movement equals less carpet sold.

According to Martin Curtis, the UK buys huge quantities of goods from the EU and he cannot imagine any European country not wanting to maintain strong trading links with them. Equally, they export many goods and services to Europe and he does not expect that to change.

Curtis is past director at Curtis Wool Direct and currently involved in the Wool Carpet Focus Group, a new organisation formed to promote Britain’s wool carpets.

British buyers of Bangladeshi garment products have started putting price pressure on manufacturers following the freefall of pound sterling as a result of Brexit. The pound sterling sank as low as $1.35 - its lowest rate against the dollar since September 1985 - before recovering to $1.37. It has also declined sharply in Bangladesh.

June 22, the day before the Brexit, the inter-bank exchange rate of the pound sterling stood at Tk 115.27. The following day it came down to Tk 107.26 and on Monday, it stood at Tk 103.64, meaning the British currency slumped about 10 per cent in the space of five days.

For the UK, a weaker exchange rate means its import bills will swell and so will inflation. But it seems British retailers are not ready to pay more for garments they source from Bangladesh, say exporters. This pressure on price will further affect exporters' margins that have already been squeezed due to a rise in operational and compliance costs, he added.

Analysts believe, the British buyers of Bangladeshi garments will also try to get price benefits out of their devaluating exchange rate. Bangladesh exported goods worth $3.23 billion to the UK in fiscal 2014-15, up 21.28 per cent year-on-year, according to the Export Promotion Bureau (EPB). In the first 11 months of the fiscal year, Bangladesh's export to the UK rose to over $3.4 billion.

The leading event and innovation platform, 55th Dornbirn Man-made Fibers Congress which is scheduled to be from September 20-22, is set to welcome around 800 researchers and technicians from 30 nations. The considerable interest and rising number of participants of retail and brands will complete the innovation network. Like every year, the guiding principle of the event is sustainability, manifested in the content of the lectures, as well as expressed by the fact that Dornbirn-MFC is a certified Green Event.

The thematic focus of the 55th Dornbirn-MFC will be on fibers and textiles in automotive, fibers for nonwovens, latest fiber innovation, finishing and functional additives and textiles.

To facilitate interaction and experience the congress will schedule panel discussions and workshops in the program. The Young Scientist Forum will take place the day before the beginning of the congress. A high-calibre panel discussion will conclude the plenary on the opening day. The closing of the whole congress will be a panel discussion supervised by a well-known marketing professor at the University Niederrhein.

APTMA has expressed great concern over the callous attitude of the Pakistan government in increasing the duty on import of raw cotton from 2 per cent to 3 per cent which along with the additional duty of 1 per cent has increased the incidence of total import duty to 4 per cent. This is at a time when the textile industry is reeling from the effects of a total crop failure in the country.

Incidentally, Pakistan’s cotton production has declined by almost 35 per cent. APTMA has been pleading with the government to totally remove import duty on cotton so that the textile industry can operate in an efficient manner. But instead of accepting reality, they have chosen to increase duty and further exacerbate the industry’s plight. It is not possible for the textile industry to continue to operate in these conditions and contribute to higher exports and provision of yarn to the domestic downstream if they are made to pay such exorbitant amount of duty on its basic raw material. Pakistan has become a net importer of raw cotton and even then the textile industry is trying to remain competitive while contributing to the national exchequer as well provides millions of jobs.

Meanwhile, Tariq Saud, Chairman APTMA said that the government must take account of the situation immediately and move to abolish all duties and taxes on import of raw cotton. The industry is already suffering due to high cost of doing business and acute shortage of energy in the country and now even has to compete with a surge in cotton yarn imports from its regional competitors.

Bangladesh will reduce the rate of tax at source for readymade garment exporters to 0.60 per cent from the proposed 1.50 per cent.The tax rate for jute product exporters may also be set at 0.60 per cent, considering the prospects of the industry. The finance bill 2016 is also set to bring a relief for individual taxpayers as it may raise the income tax rebate on investment in some specific sectors by individuals to 25 per cent from the proposed 20 per cent for the upcoming financial year ’16-’17.

There may also be a reduction in the amount of value added tax to be paid by VAT payers for legal action against assessment of revenue authorities during filing of appeals.

With the FY ’17 Budget, the proposal is that VAT payers have to deposit 50 per cent of the disputed VAT or penalty before making an appeal against the assessment or decisions of field-level VAT officials. Another 50 per cent of the disputed VAT will be required in filling an appeal against the decision of the appeal commissioner.

Currently VAT payers need to pay only 10 per cent of the disputed amount at each stage of appeal.

Major worldwide markets such as the US, China, Japan, India, Canada, Australia and New Zealand are likely to lose interest in the EU, if the full exit of UK from the EU goes ahead. The loss of interest by major markets will be because very few of the people in these countries know any European language, except English.

After Brexit, Ireland will be the only English speaking country left in the EU. This will likely result in a large inflow of EU migrants into Ireland as most EU citizens have English as their second language (very few EU citizens know French, German or other European languages).

For many EU citizens, the possibility of going to the UK without restriction was the cherry on the cake as it was an English speaking country with a good social welfare system and offered a route to other English speaking countries such as the US and Australia through work transfers. However, with Brexit, this facility will go away.

UK's exit will also have its impact on Turkey's plan of joining the EU, which is less likely to materialise now. Holland and Ireland are likely to be the next countries to leave the EU within five years.

Wool manufacturer Botto Giuseppe from Italy has become the prime reference for the Fair Cashmere project set up by US fashion label Maiyet. The raw materials comes from Mongolia, the world's second largest producer of this fiber, and it is environmentally and ethically sustainable.

Maiyet is a US luxury fashion label specialising in rare artisanal products from all over the world. Based in New York, Maiyet buys cashmere directly at source, with no intermediaries. Supporting local goat farmers from the Gobi desert in Mongolia, and improving their quality of life through tangible contributions, are among Maiyet’s objectives. The company also looks after goat vaccination and disinfection.

Fair Cashmere is cradle to cradle certified at the bronze level and is awaiting its gold certification. Cradle to cradle is a rigorous certification system for products that are innovative across their entire supply chain. It tests the process through five criteria to evaluate a product's sustainable development level: waste, health, energy consumption, water resources (in terms of use and pollution) and human resources use.

Since 1876 Botto Giuseppe has been a manufacturer of fine fabrics and yarns. Over the years, it has added jersey and knitwear yarns to its range, and is now a vertically integrated producer from yarns to finished products.