FW

The area under cotton in India has reduced. The reduction in area is primarily in the two major cotton growing states of Gujarat and Maharashtra. Deficit rains and pest pressures have prompted farmers to either plant alternate crops, or delay/abandon planting altogether. The planted area is four per cent lower than last year.

In central Maharashtra a significant part of the cotton area has shifted to soybeans and fodder maize. The number of rainy days in July in major cotton districts has ranged between 5 to 15 days, prompting farmers to either delay planting or plant alternate crops. But farmers continue to prefer planting BT cotton due to its relative drought tolerance over competing crops, and wide planting window. The plants are in the early vegetative stage, with farmers mostly undertaking weeding operations.

In Saurashtra, Gujarat, farmers have replanted cotton in major cotton growing districts as lack of adequate moisture in July led to crop failure. Farmers have shifted acreage from groundnut to cotton due to poor price realization from groundnuts last year.

While there is a marginal increase in cotton acreage, the prolonged dry spell is affecting plant development, and is expected to have a significant impact on cotton yields if rains are not received in the next 15 days.

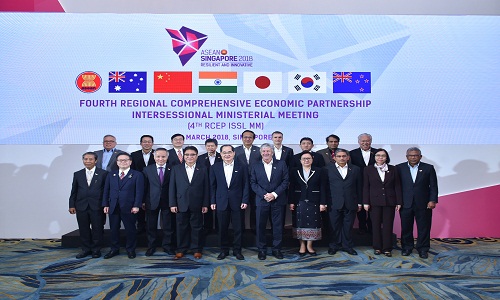

"The messy state of Indian democracy has made it difficult to achieve a modest consensus on the Regional Comprehensive Economic Partnership or RCEP - a giant trade deal that weaves India, the Association of Southeast Asian Nations (ASEAN), Oceania, China, Japan and Korea together. The country has to arrive at constructive decision by August-end, when ministers from the 16 RCEP countries meet in Singapore. If New Delhi’s negotiators fail to achieve a consensus by then, the remaining 15 countries will have to move ahead without it. For many Indians though, this wouldn’t be much of a tragedy. India’s goods trade deficit with China was 60 per cent of its overall trade deficit. According to Indian policymakers, much of what’s being imported is sub-standard and susceptible to anti-dumping legislation. So far, 214 separate investigations have been opened against China for exporting substandard goods, which has worried policymakers about the effectiveness of the anti-dumping measures."

The messy state of Indian democracy has made it difficult to achieve a modest consensus on the Regional Comprehensive Economic Partnership or RCEP - a giant trade deal that weaves India, the Association of Southeast Asian Nations (ASEAN), Oceania, China, Japan and Korea together. The country has to arrive at constructive decision by August-end, when ministers from the 16 RCEP countries meet in Singapore. If New Delhi’s negotiators fail to achieve a consensus by then, the remaining 15 countries will have to move ahead without it.

The messy state of Indian democracy has made it difficult to achieve a modest consensus on the Regional Comprehensive Economic Partnership or RCEP - a giant trade deal that weaves India, the Association of Southeast Asian Nations (ASEAN), Oceania, China, Japan and Korea together. The country has to arrive at constructive decision by August-end, when ministers from the 16 RCEP countries meet in Singapore. If New Delhi’s negotiators fail to achieve a consensus by then, the remaining 15 countries will have to move ahead without it.

For many Indians though, this wouldn’t be much of a tragedy. India’s goods trade deficit with China was 60 per cent of its overall trade deficit. According to Indian policymakers, much of what’s being imported is sub-standard and susceptible to anti-dumping legislation. So far, 214 separate investigations have been opened against China for exporting substandard goods, which has worried policymakers about the effectiveness of the anti-dumping measures.

More conducive measures required

India’s main concern is that RCEP’s focus on reducing goods’ tariffs is not adequate and the deal needs to open services trade simultaneously. It also needs to accord greater freedom of movement to professionals who are a major source of foreign currency for India. The real constraints of trade growth are non-tariff barriers which make competing in the Chinese domestic market such a nightmare.

to accord greater freedom of movement to professionals who are a major source of foreign currency for India. The real constraints of trade growth are non-tariff barriers which make competing in the Chinese domestic market such a nightmare.

However, certain Indian sectors have panicked about competition. One of them is steel -- which is slowly recovering after years of pummeling thanks to Chinese overcapacity. Dairy producers obsess about Australia and New Zealand. Manufacturers worry about everyone.

The problem is that, at the moment, RCEP is the only proposed deal. India needs to arrive at a more positive, forward-looking approach by the end of the month or it must abandon its ambition to infiltrate global supply chains. This could be disastrous as the country will shortly have the world’s largest workforce but a mere a 2 percent share of world trade.

Therefore, instead of being concerned about China’s overcapacity and its ability to dump goods, India must show to the world that a regional trade agreement that prevents countries from bringing fair, transparent and temporary anti-dumping actions is in nobody’s interest.

Need for a positive approach

India has raised tariffs on 400 products over the past two years, which is a major departure from a generation-long trend towards greater openness. It has unilaterally scrapped investor protection treaties with almost 60 countries. Even the government’s choice of economic policy advisers reflects a new distrust of the world. The American-educated economists who defined the Modi government’s initial years have been eased out, not entirely gracefully.

As the country retreats from the turnpike of world trade to the dirt road of autarky, it will be poorer in both the medium- and long-term. Therefore if the government wants to reassure the world that India isn’t willing to put up with the dirt road, then it needs to find a way to be more positive about RCEP.

Sri Lanka and Bangladesh apparel makers are planning to jointly develop jute based eco-friendly apparel. Colombo-based Academy of Design (AOD) will provide the creative input for the initiative.

Bangladesh's apparel industry enjoys cheap labour and scale, while Sri Lanka specialises in synthetic fabrics, functional and smart clothing and wearable tech. The soil and water conditions in Bangladesh are optimal for the cultivation of jute while Sri Lanka possesses the expertise around design and innovation.

Since the last two years businesses in Sri Lanka are shifting gear from being competitors to collaborators. There are discussions being held between the tech industries of the two countries for combining the vertical capabilities of Sri Lanka combined in IT with the horizontal capabilities of Bangladesh.

Despite the downfall in apparel sector as indicated by the apparel export data, many textile companies are planning to expand their capacities. Prominent among these include fabric producers, apparel manufacturers, trims, ink and chemical suppliers etc. While some of the others are either diversifying into the overseas markets, or entering from export to domestic or vice versa, adding new buyers in their existing markets.

Some of these companies include Chiripal Group and Splenora Textures, which are setting up denim fabric manufacturing facilities. Similarly, in Bengaluru, leading kidswear manufacturers such as First Steps Babywear and liaison offices such as Stars Design are expanding their facilities. In Ludhiana, garment manufacturers like Million Exports, KG Exports, Bawa Knit Fab have announced investment plans. In Delhi-NCR, Noida Apparel Export Cluster is setting up an apparel park which will increase and ease garment manufacturing and exports in Noida.

According to exports, Vietnam’s textile and garment industry is performing well abroad, but struggling at home. The Vietnam Association of Retailers estimates over 200 foreign fashion brands to be present in Vietnam, accounting for more than 60 percent of the market share from medium-end to high-end products.

Vietnam’s local companies such as Viet Thy, Foci, Sai Gon 2, Ninomaxx and PT 2000, have forced to narrow their production scale. For instance, Sai Gon 2 Garment Joint Stock Company launched 70-80 new products before but has made only about a half of this number at present. In order to survive in the market, Foci has been forced to cut all new investments and narrowed the store system. The company is now focusing on selling uniforms and developing more online sales.

As against this, Swedish fashion firm Hennes & Mauritz AB (H&M) plans to increase the number of its stores to six next month. Zara has also opened its stores in Hanoi and HCM City. While fashion brands such as Mango, Stradivarius, Massimo Dutti and Topshop has recently joined Vietnam’s market.

Moldova is wooing Indian investors in textiles, agriculture and a few other sectors as it plans to open an embassy in India in 2019. Moldova is interested in an economic and trade agreement and a foreign investment promotion and protection agreement with India.

A visa agreement is also needed as Indians need an invitation from Moldova to visit the country now. If a company invests more than a million dollars in a free economic zone in Moldova, it does not have to pay taxes for three years. In September, a delegation of textile business representatives will visit India to explore cooperation avenues.

As manufacturing moves to lower cost countries, Moldova remains an attractive proposition for investment in a sector which already accounts for 1.5 per cent of general GDP and 30 per cent of manufacturing GDP. The textile/apparel cluster employs over 21,000 workers and has become one of the leading exporting sectors in the country.

The country’s proximity to the EU is a key element among its strategic advantages as a supplier of textiles and apparel to consumer markets. Moldova produces knitted and woven apparel, lingerie and nightwear, protective clothing and carpets. More than 250 enterprises are active in the sector.

Spinnova, based in Finland, is a sustainable fiber company developing textile fiber directly out of pulp without harmful chemical processes. It has recently attracted new financing and investments, stepping into the next phase of the company’s growth story. Developing the world’s most sustainable textile fiber, the company will ramp up its pilot factory in Finland.

The investments will turn Spinnova into a new, Finnish export superstar. They will combine high-level sustainability and huge potential; for good as well as for profits.

The development of the Spinnova fiber has exceeded expectations. In addition to Finnish design house Marimekko, Spinnova has joint product development underway with several other partners. The fiber innovation has raised wide interest from global textile brands, many of which have committed to challenging sustainability goals.

Thanks to its financiers, starting the pilot factory and product development work are moving full speed ahead. Licensing the technology now being developed in Finland is the company’s most likely future business model, so piloting the technology concept on an industrial scale is now Spinnova’s main priority.

Spinnova’s majority shareholder is Brazilian cellulose company Fibria, which invested five million euro in the company in 2017. Spinnova’s ownership base has also changed.

Kay Ventures has teamed up with Hydra Micro Business Solutions to convert Karur into a global knitwear center. Karur is a hub for quality made ups and home textiles in Tamil Nadu. Tirupur is another major cluster known for cotton knitwear. Though these towns are just 100 km apart, growth of Tirupur has been phenomenal. While Karur’s export turnover is Rs 4000 crores a year, Tirupur has breached the Rs 40,000 crore mark. One of the key factors behind this stark difference is the size of segments they cater to. The size of the clothing sector is many times more than the home textiles market.

However, this is set to change because knitwear made an unnoticed entry into Karur sometime in 2016. Hydra is an economic framework that makes it possible for multiple entities to collaborate, think and function like a single entity on a single platform.

The Kay Ventures knitwear cluster in Karur annually produces 7.50 million pieces of knitwear, predominantly for leading domestic brands and export. Efforts are under way to increase the capacity to 20 million pieces per annum to accommodate more orders in the near term. Kay aims at expanding its knitwear capacity to 10,000 machines in the next four years.

Over 50 brands at INDX Intimate Apparel SS19 this year featured LYCRA fiber and fabrics technologies such as LYCRA fiber, LYCRA SPORT, LYCRA XTRA LIFE fiber and LYCRA BEAUTY fiber. Even established names such as Freya Active and Truimph incorporated the LYCRA technology into some of their ranges to further boost consumer trust in their products.

Acclaimed brands, Jockey and Sloggi also incorporated LYCRA fiber technology in many of their ranges to help influence the purchasing decision in this challenging category.

Another striking technology that the event featured was the LYCRA XTRA LIFE which has been incorporated by many popular brands such as Freya, Fantasie, Curvy Kate and David Swimwear in their swimwear to make it more durable and lasts at least one full season.

This year LYCRA brand also sponsored the event’s coffee plaza as well as its INDX networking reception.The LYCRA branding helped the coffee plaza to stand out and made it an easy place to meet potential new business prospects.

Cotton will be procured directly from farmers in Rajasthan by the Cotton Corporation of India (CCI) at the minimum support price (MSP) in the next cotton season and payments made to their accounts. Rajasthan is the first cotton-growing state in North India to make direct transaction mandatory for procurement at MSP.

The cotton season starts in October. Earlier, much of the cotton purchased by the CCI came through middlemen or aggregators in Punjab, Haryana and Rajasthan, with farmers not getting the government-set MSP. Over 12,000 farmers have been registered in Shree Ganganagar district and the process is under way in Hanumangarh and Bhilwara districts. India recently raised the MSP on medium-staple fiber cotton by 28 per cent and on long-staple by 26 per cent.

The hike is expected to help firm up prices in India compared to the last season, when those were lower compared with the global market. The CCI has started arrangements for ginning and storage of cotton for the ensuing harvesting season. Cotton availability for the 2017-18 season is estimated to be 416 lakh bales. This includes an opening stock of 36 lakh bales. Cotton in India is one of the most important commercial fibers and commodities exported due to its uses in the textile industry, mattresses etc.