FW

C&A Foundation has halted grants for philanthropic work in Myanmar. The country’s handling of the Rohingya crisis has been cited as the primary reason for this decision. While withdrawing new grants, the foundation will ramp up efforts to support those suffering from gender-related discrimination and human trafficking in the region. It is also increasing support to humanitarian relief and the prevention of gender-based violence and human trafficking among the growing refugee population in Bangladesh.

Myanmar has been the subject of much derision over recent months and years with the ongoing Rohingya crisis and subsequent human rights violations having direct implications on the textile and fashion industries of the nation. In 2016, C&A began its support for initiatives in Myanmar in an attempt to ensure the safety of garment workers through engaging industry stakeholders and the Myanmar government.

C&A was founded in Switzerland in 1841. It is one of the most longest lasting and pioneering retailers in the global fashion business. One of the main focus areas of the foundation is eradicating forced and child labor. C&A Foundation aspires to improve the social, economic and environmental conditions of the cotton and apparel supply chain and as such sees social purpose organisations as key to achieving this mission.

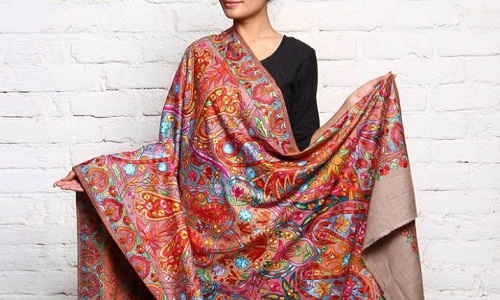

"Pashmina, the heritage and identity of Kashmir, needs an urgent makeover in order to survive its roots. Kashmir’s handloom industry needs to adapt to changing times and not seek protection from the government. The government needs to bring in policies that favour the handloom industry and bring in renaissance. The industry on the other hand needs to be competent enough to stand on its own and carve a niche for itself."

Pashmina, the heritage and identity of Kashmir, needs an urgent makeover in order to survive its roots. Kashmir’s handloom industry needs to adapt to changing times and not seek protection from the government. The government needs to bring in policies that favour the handloom industry and bring in renaissance. The industry on the other hand needs to be competent enough to stand on its own and carve a niche for itself.

Inherent advantages

Pashmina goats in Ladakh produce the finest quality of raw Pashmina fibre in the world. It’s very rare at less than 0.1 per cent of the global supply. The fineness of Pashmina fibre from Changthang in Ladakh is usually between 12.5-14 microns while the best fibre from China is around 15 microns. In fact, the crème-de-la-crème of global luxury brands use 15-15.5 micron Chinese Cashmere. If planned genetic breeding of Pashmina goats in Ladakh to produce finer fibres does not take place, the tradition of Pashmina goat rearing in Ladakh will be extinct in a few years.

The state on its own or through public private partnership model needs to have a Pashmina wool de-hairing plant in Kashmir. Secondly, in order to spin fine yarns on a machine, a synthetic – generally nylon, has to be added to Pashmina in order to give it strength. This synthetic is later removed by an acid bath, which decreases the quality of the final product. The Charkha spun traditional Pashmina yarn is softer and more durable. However, here too it’s a matter of time before the Charkha is replaced, and rightly so. The latest R&D in the top Italian mills has produced fine Pashmina yarn without the addition of synthetic to counts as fine as 140/2nm, a number which any Pashmina trader will tell you is a shocking.

The only way the Charkha will survive for the next few decades, is through genetic makeup based breeding programs and the fineness of the Pashmina goats in Ladakh is worked upon. The Pashmina goat in Ladakh (eastern Changthang) has an average fibre fineness of 12-14 microns – much finer that the best of what Chinese Pashmina goats can offer. Much R&D has not taken place in the west on such fine Pashmina fibres for they have limited access to it. Hence, if the fineness of the Pashmina goat fibre in Ladakh can be worked upon, resulting in lower microns, not only will the Charkha keep spinning in the valley, but Kashmiri businessmen will be able to make better products than the Italians and the nomadic communities of Ladakh could make more money.

For long term survival it is important to create products that machines cannot produce – be it through design or by quality – all energy should be focussed on that. Apart from the power looms, which produce lower quality fabrics than the charkha-spun handloom-woven ones, the focus must be on getting basic regulations in place such as strong textile labelling. One can sell a synthetic scarf labelled as 100 per cent Pashmina and it is legal. Textile labelling is mandatory in almost every country of the world and should be implemented as a must-have here too. Every product should be sold with a label that declares fibre content (100 per cent Pashmina, 50 per cent Pashmina, etc.) and whether it is hand-woven or not.

Positives steps in the right direction

A positive step was taken by the state by establishing the Pashmina Testing and Quality Control Centre (PTQCC), ‘The Lab’. Another good initiative was getting the Geographical Indication or GI Mark, which prohibits anyone from using the term ‘Kashmir Pashmina’ unless it’s lab-tested and has a non-removable sticker on it placed by the PTQCC. Now, the government needs to advertise the GI sticker at the right channels pan-India, not on local Kashmiri radio, so that the major customer, i.e. the north Indian female knows about it and will look to buy a Charkha-spun handloom-woven Kashmir Pashmina shawl with a GI label.

"China’s home textile market will receive a fillip at the Spring edition of Intertextile Shanghai Home Textiles that takes place from March 14 to 16, 2018. The three-day show allows industry players to get a head start during China’s peak home textiles finished products sourcing season, which is growing strongly. Contributing to over half of the sales of home textiles, the bedding products market in China grew 52.5 per cent from 2011 to 2016, reaching $18.3 billion. Since the market is expected to grow 5.9 per cent annually from 2017 to 2021 and reach $24.3 billion, there lies abundant opportunities for the industry to capture."

China’s home textile market will receive a fillip at the Spring edition of Intertextile Shanghai Home Textiles that takes place from March 14 to 16, 2018. The three-day show allows industry players to get a head start during China’s peak home textiles finished products sourcing season, which is growing strongly. Contributing to over half of the sales of home textiles, the bedding products market in China grew 52.5 per cent from 2011 to 2016, reaching $18.3 billion. Since the market is expected to grow 5.9 per cent annually from 2017 to 2021 and reach $24.3 billion, there lies abundant opportunities for the industry to capture. The March show will be held at the National Exhibition and Convention Centre in China, with over 200 exhibitors showing a wide range of products including bedding and towels, carpets & rugs, table & kitchen linen, machinery & technology, design & styling and more.

Machinery Equipment Zone

Competition in the textile market has always been fierce but companies can stand out by utilising latest technology. To cater to this, the ‘Machinery Equipment Zone’ gathers top suppliers with world-class expertise to present a variety of textile solutions. Richpeace Group from Hong Kong, which specialises in sewing and cutting machines, is one of the highlighted exhibitors in the zone. It will showcase its High Speed Fully Automatic Quilt Production line that includes a fibre line, high speed quilting machine and four-sides sewing machine. The system can also be equipped with a binding machine, hemming machine, folding and packing system as well as a hanging system to form a fully automatic production line. The Swedish firm Eton Systems is another supplier slated to draw tremendous traction. Its flexible material handling system – Eton Systems 5000 – has helped thousands of companies around the world to increase their efficiency, save floor space and improve the management of their entire production process.

Suppliers’ get together

Apart from machinery, buyers can expect to find all kinds of finished products presented by a number of domestic and overseas big names. These include seven domestic pavilions showcasing specialised products from their regions and will house famous Chinese companies such as Cotton Field Home, A-Fontane and Mercury Home Textiles. The presence of a number of foreign suppliers will also further enrich the fair’s diversity. Cotton USA, for instance, is a regular participant and will showcase its new, innovative home textile technologies that can be utilised in towels, bed linen, pillowcases and bathrobes. Furthermore, Bemberg, the eco-friendly fibre made from cotton linter will be featured in Asahi Kasei Corporation’s booth at this year’s show.

Intertextile Shanghai Home Textiles – Spring Edition 2018 is held concurrently with four other textile events: Intertextile Shanghai Apparel Fabrics – Spring Edition, Yarn Expo Spring, CHIC and PH Value. Intertextile Shanghai Home Textiles – Spring Edition is organised by Messe Frankfurt (HK) Ltd; the Sub-Council of Textile Industry, CCPIT; and the China Home Textile Association (CHTA).

The 2018 Autumn edition of Intertextile Shanghai Apparel Fabrics will take place September 27 to 29 instead of its usual October timing.

The 2017 fair played host to 4,538 exhibitors from 32 countries and regions, and 77,883 trade buyers from 102 countries and regions.

After extensive consultation with all stakeholders over the past year, the organisers came to the decision to bring forward the autumn edition to September. The autumn/winter sourcing season has steadily moved earlier in the year, and this change in timing was necessary to ensure Intertextile Shanghai remains the leading business platform for both suppliers and buyers in the global apparel fabrics and accessories industry.

As in previous editions, Intertextile Shanghai Apparel Fabrics will be held concurrently with Yarn Expo Autumn, fashion garment fair Chic and knitting fair PH Value, making this the most comprehensive sourcing platform in the global industry.

More details of the autumn edition will be announced after the conclusion of the spring edition, March 14 to 16, where some 3,300 exhibitors and around 70,000 trade buyers are expected to converge.

During the first half of the current marketing year, cotton shipments from the US have lagged compared to the same period previous year. This is the second lowest level in the last decade and well below the 38 per cent decadal average. As of last week in January, accumulated exports this season were just 32.5 per cent of the new forecast.

Several factors are likely to pressure US exports in the coming months. In Australia, the cotton crop is expected to be the largest in six years, and harvest appears to have begun appreciably earlier than usual, which may enable early export shipments. As a result, US exports may face fiercer competition from Australia.

US exports would also be affected due to an increase in cotton production in Mexico this year. The doubling of the Mexican crop this year is expected to curtail imports in the second half of the season relative to the first half of the season. As such, US shipments to that major market may slow noticeably.

Also, since the beginning of cotton year 2018, implementation of new US trucking regulations has reportedly caused delays in transporting cotton from US warehouses, a situation which may not be entirely resolved and backlogs cleared before the end of the season.

Hugotag a specialist French finisher of silk fabrics to many of the world’s most prestigious luxury brands is now using Monforts Montex 8500 stenter which provides major benefits to Hugotag.

The five-chamber Montex 8500 machine is equipped with a newly developed 24-inch visualisation monitor, providing total, intuitive automation and surveillance via the Monforts Qualitex 800 system.

The key parameters for Hugotag include homogenous drying over the length and width of the machine and precise control of the tension of the fabric because silk has a natural elasticity even without the addition of elastane. The Monforts stenter allows Hugotag to completely control the tension from the fabric entry right through to the winding machines.

As a result of the extremely specialist nature of handling such delicate fabrics, the Monforts line has been equipped with a number of additional features, including special needle chain devices for dealing with knitted silk fabrics, a steamer unit, a computerised weft-straightening device and associated controls, and a horizontal combined chain.

The stentering chain is completely sealed – to avoid any grease or oil coming into contact with the fabrics at any time – and fitted with long-lasting lubricated bearings.

Special attention has also been paid to energy recovery, with low energy consumption IE3 motors and the integration of a full heat recovery system into the line.

Hugotag was formed by the merger five years ago of two former silk businesses – Tag and Hugo Soie.

For the third quarter home textile firm Welspun India saw a 47.07 per cent decline in consolidated net profit. Total income in the quarter fell 7.06 per cent compared to the same period last year. The fall in income is attributed to the decline on account of volume decline due to customer destocking coupled with goods and service tax impact on duty drawback.

Welspun has been taking steps to be prepared for the future in terms of its brands, channels, innovation, traceability solutions, sustainability solutions and many other areas. Welspun is a Mumbai-based terry towel producer. It is looking at helping cotton farmers grow better quality cotton and also encourage them try organic cotton. Welspun is guiding and mentoring farmers on right practices, right seed and right pesticides. Cotton farmers are being mentored on the kind of crops to grow after cotton harvest so as to help them improve the overall soil nutrients like nitrogen. The company is looking to cover at least a fifth of farmers supplying cotton to it by 2021.

Welspun India targets doubling revenue by 2022. The US continues to be a key market for Welspun. Currently the US contributes around 65 per cent to its business, with 25 per cent to 30 per cent coming in from the rest of the world, and five per cent from India.

Tintex, the Portuguese textile manufacturer has reported significant interest from international fashion brands at the recent ISPO show in Munich. There were numerous enquiries from buyers for its recently launched B.Cork water-based laminated fabrics. First launched at Performance Days in November, the laminated fabric coating made from cork can be used for woven or knit fabrics and is breathable as well as environmentally friendly — on the basis that cork would have otherwise gone straight to landfills.

B.Cork is fully commercialised with a patent-pending for the accompanying water-based lamination technique and is free from formaldehyde and solvents. The company says the coating is suitable for applications on both knits and woven textiles, along with all of Tintex’s ‘smart fibre bases’. Cork, even without the added benefit of being sourced as a pre-consumer waste product, is becoming an increasingly popular material for brands that place environmental issues high on its agenda.

Abel Coelho of Tintex says all the material comes from the waste produced during cork manufacturing in the drinks industry. Tintex also launched Fabric 4846 at ISPO, which the company says is a blend of tencel, smartcell and elastane clean fit by Roica. The fabric aims to combine Tencel’s moisture management properties with zinc oxide’s healing properties from Smartcell, making up a knit activewear.

The redefining of Tencel brand is a key milestone for Lenzing’s new brand strategy to enhance product offerings, foster connection with customers and consumers, and drive consumer demand. Tencel is well positioned to be a major growth engine in the textile sector, with a brand portfolio comprising Tencel Active, Tencel Denim, Tencel Home, Tencel Intimate, and Tencel Luxe, all enabled by two versatile and highly compatible fibers, Tencel Modal and Tencel Lyocell.

Tencel is adopted as Lenzing’s textile specialty brand for apparel and home applications, and is aimed to help create a unique and differentiating brand in the modal and lyocell fiber markets. The redefined Tencel product brand, along with the tagline Feels so right, will enable Lenzing to embark on communication around messages that move beyond fiber types and characteristics towards everyday use and benefits that brands and consumers value.

Since 2015, Lenzing has been migrating into a specialty fiber business with a strong focus on innovation, quality and sustainability. New swing tags and marketing materials will be launched at the retail level to provide clarity on product benefit claims containing Tencel branded fibers. The swing tags, along with more detailed guidelines on B2B and B2C use, are now available on Lenzing’s new e-branding service platform, which caters to B2B customers and retail partners, offering faster, more sustainable and more user-friendly solutions for certification and licensing.

Pakistan’s textile exports rose 10 per cent in December 2017 compared to December 2016. Textile exports during the first six months of the current fiscal year were up 8.07 per cent compared to July-December 2016. Among the reasons for the increase are flow of cash under the PM's incentive package, payment of sales tax refunds as well as the depreciation of the local currency, which improved exporters’ liquidity situation.

Also, 50 per cent of the rate of drawback of local taxes and levies was to be provided, without condition of increment, and the remaining 50 per cent to be provided if the exporter achieves an increase of ten per cent or more in exports during fiscal year 2017-18 as compared to fiscal year 2016-17. An additional two per cent was allowed for exports to nontraditional markets - Africa, Latin America, non- EU countries, Commonwealth of Independent States and Oceania.

Major measures have been introduced to facilitate duty drawback of local taxes. The energy cost in Pakistan is more than 30 per cent of the total conversion cost in the spinning, weaving and processing industries. Industrial gas tariff in Pakistan is about 100 per cent whereas the electricity tariff is about 50 per cent higher than their regional competitors’.