FW

Trade shows in Berlin Fashion Week 2018 are emerging as the drivers of change, repositioning and reviewing their concepts to adapt to the ever changing fashion industry. Premium has been boosting its exhibitors for months to fully exploit their brand power for its upcoming edition, taking place from January 15-17, 2019.

Panorama, which launched its own online magazine last year, wants to have a more visitor-friendly setting and a broader view into the fashion world, using its Fashiontech conference to stand out from the crowd.

Meanwhile, Messe Frankfurt has brought together its eco-fashion formats under one roof and will be launching its Neonyt concept at Kraftwerk on Köpenicker Straße, where Fashiontech will also take place, during the next edition of the German capital's Mercedes Benz Fashion Week.

Berliner Salon and Vogue Salon have also changed their location. Now in their ninth season, the Fall/Winter 2019/20 collections will be presented for the first time in the St. Elisabeth Church in Mitte.More than 3,000 brands and even more collections will be showcased to buyers in the capital over the four-day period.

With 1,000 brands and around 1,800 Fall/Winter 2019/20 collections, Premium will be debuting its new format at Gleisdreieck over 24,000 square metres of show space.

The Fédération de la Haute Couture et de la Mode, French fashion’s governing body, has added a dozen new brands to its next ready-to-wear season. The first three houses to be added to its much-coveted official runway schedule include two fledgling brands, Cyclas of Japan and Rokh from Britain. The Fédération also welcomed back Lacoste, the historic French label founded in 1933.

Additionally, the Fédération announced that a further nine houses have been included in its official calendar for next season, scheduled from February 25 to March 5.

These nine new brands include Faith Connexion of France; Karim Adduchi of Holland; Kimhekim of Korea; Kristina Fidelskaya of Ukraine; Walk of Shame of Russia; Maison Mai of China; Cukovy of Hungary; Magda Butrym of Poland; and Savoar Fer from France.

The Council of Fashion Designers of America (CFDA) has teamed up with fashion giant PVH Corp – owners of brands such as Calvin Klein and Tommy Hilfiger -- to explore the subject of inclusion and diversity across the US fashion sector. The result is an extensive report dubbed ‘Insider/Outsider' that spans all areas of inclusion and diversity, such as abilities, age, gender, race, ethnicity and sexual orientation.

According to a questionnaire conducted as part of the research, 41 per cent of executive-level employees at fashion companies rated their organisation three out of a possible five in terms of the diversity (difference) within their organisation. However, 56 percent had taken a professional class or workshop related to I&D in the workplace in the past.

The CFDA and PVH have pledged to focus efforts on making the US fashion industry a more inclusive and diverse sector, concluding: In 2019, the CFDA will continue the work we have been doing in the area of Inclusion and Diversity. The focus of the work will be on Peer-to-Peer Mentorship, Business Networking Opportunities, Educational Programming and Leadership Skillset Training. PVH will enhance its education and awareness programs, as well as amplifying its I&D Councils and Business Resource Groups. The organisation will continue to collaborate with external partners to help foster a collectively inclusive and diverse environment in our own workplace and across the industry.

Asean is expected to benefit from the trade dispute between the US and China. The impact will be felt strongly in sectors like: information and communication technology (ICT), automotives and readymade garments. These sectors also constitute major segments in US-China bilateral trade.

Bangladesh, India and Vietnam will gain from the trade tension in readymade garments. India has the potential to attract the apparel market. Mild benefits may go to Pakistan and Sri Lanka.

The US has imposed tariffs on ICT, being its largest import from China. Malaysia and Vietnam will benefit the most, especially in the manufacturing of consumer goods such as mobile phones and laptops. Major ICT companies such as Dell, Sony, Panasonic, Samsung and Intel have their presence in these countries. The presence of a strong trade infrastructure, corporate laws, and an SEZ environment makes Malaysia and Vietnam potential locations for the ICT industry. Benefits may accrue to India, Indonesia and Thailand, given their ICT exports-oriented market.

Thailand and Malaysia will benefit most from the trade dislocation in automotives. In Thailand, trade links in the automotive sector are well diversified with exports to the US, Japan and other Asean counterparts. The medium term benefits will be reaped by India, Indonesia, the Philippines and Vietnam.

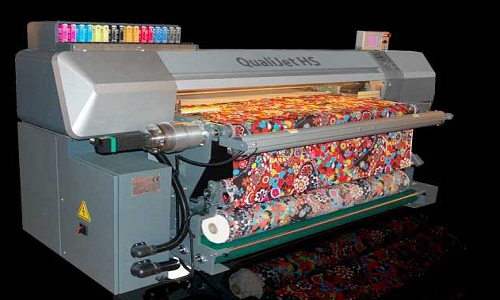

"Conventional textile printing is giving way to digital printing inorder to accommodate short runs, fast turnarounds, or new products. The market is supported by a complex and well-established textile supply chain, of which printers are only a very small component. Commercial printers therefore, need to focus on more accessible textile segments similar to applications they already produce, such as textile-based sign and display graphics and direct-to-garment (DTG)."

Conventional textile printing is giving way to digital printing inorder to accommodate short runs, fast turnarounds, or new products. The market is supported by a complex and well-established textile supply chain, of which printers are only a very small component. Commercial printers therefore, need to focus on more accessible textile segments similar to applications they already produce, such as textile-based sign and display graphics and direct-to-garment (DTG).

Conventional textile printing is giving way to digital printing inorder to accommodate short runs, fast turnarounds, or new products. The market is supported by a complex and well-established textile supply chain, of which printers are only a very small component. Commercial printers therefore, need to focus on more accessible textile segments similar to applications they already produce, such as textile-based sign and display graphics and direct-to-garment (DTG).

Textile signage market to grow

Keypoint Intelligence – InfoTrends’ wide-format consulting service reportsthe market for soft signage is expected to see a compound annual growth rate (CAGR) of 6 per cent between 2017 and 2022, reaching 91.3 million square meters of output by the end of the forecast period. While more than 70 per cent of the market’s output is produced using sublimation, latex and UV printing technologies are increasingly being used to create sign and display applications on textiles. To take advantage of this market opportunity, print service providers must match their offerings to the demand within their existing customer base or their target markets.

Higher profit margins for soft signage applications

The first step is evaluating the vertical markets served to determine which applications are most appropriate and which ones establish the production requirements. For example, universities need banners and backlit signs that do not require complex contour cutting. However, trade events require a mix of small and large format signs that have a range of finishing including silicon edging to contour cutting, along with a wide range of mounting options.

requirements. For example, universities need banners and backlit signs that do not require complex contour cutting. However, trade events require a mix of small and large format signs that have a range of finishing including silicon edging to contour cutting, along with a wide range of mounting options.

Soft signage applications have higher profit margins in relation to most other commercial printing applications. Based on the 2017 estimated street price of $60.2/m from InfoTrends’ Wide Format Application Forecast, PSPs can expect a profit margin in the range of 40 per cent to 60 per cent. These margins are difficult to find in commercial applications.

DTG printing witnesses new developments

InfoTrends says the DTG market will experience a strong CAGR of 13 per cent between 2016 and 2021, reaching a global value of nearly $10 billion. This segment is also witnessing new developments. The use of synthetic fibers (eg, polyester) is growing leading suppliers to seek ways to print directly into these materials. The market recently introduced a new pigment-based technology that enables the printing of white ink, followed by CMYK. Although it will take some time for this new technology to mature, it opens the door for DTG production in cotton, cotton blends, as well as synthetic materials.

Market awareness important for success

Though a promising area of development, digital printing has its share of challenges. There is a bit of a learning curve associated with understanding the different substrates, inks, software, equipment, and finishing requirements. Knowing which markets are addressable based on business current expertise and resources can increase the chances of success. For commercial printers that are hoping to expand into the tempting world of textiles, it is best to start by focusing on applications with similar printing processes that can be sold to existing or adjacent customers.

Vietnam’s garment exports are set to rise 14.8 per cent this year. Garment exports to the United States rose 12 per cent in the January-October period while exports to China surged 40 per cent. US retailers are diversifying their product sourcing to keep costs under control amid an escalating trade dispute with China.

Vietnam is home to over 6,000 textile and garment factories which employ around three million people and these figures are likely to grow, thanks to a plethora of Vietnamese free trade agreements. Vietnam has signed around a dozen free trade agreements that will remove or reduce taxes on several imports and exports. Among these are the CPTPP, EU-Vietnam FTA and Asean-Hong Kong FTA.

Foreign investors have come into Vietnam’s garment and textile production in the first eight months of this year. Most investors are from Japan, South Korea, Taiwan and China, and they have been upping their investment in Vietnam for years. It already attracts the highest consistent growth rates of foreign direct investment among Asean nations.

Vietnam could be one of the major beneficiaries of the escalating US-China trade spat. The country will be the prime beneficiary of increased cross-border investment in the Asia Pacific. The country has had consistent positive growth over recent years.

Revenues of the global winter wear market are expected to increase at a CAGR of 5.8 per cent during 2018 to 2027. Favorable trade policies, growing apparel production globally, rise in per capita income, favorable demographics, and shifting consumer preference to branded products will boost the demand for winter wear during the forecast period. Other key factors driving the growth of the winter wear market are population density, downstream industry effectiveness, and changing economic policies as well as business legislation. Abundant availability of raw materials such as wool, silk, cotton, and others is another driver of the winter wear market.

Companies across the globe are focusing on the launch of new products with latest fashion and high quality along with expanding market presence through establishing new manufacturing facilities as well as sales channels to reach potential customers. Manufacturers have also adopted various key differentiation strategies to have a competitive edge.

Factors such as increasing population, rise in adoption of e-commerce have led to a surge in the growth of the B2C. Consumers are seeking products online. Growth of the global online sales channel along with a widening winter wear product portfolio through new product launches is projected to further accelerate the growth of the global winter wear market.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has officially come into effect. The 11-member agreement accounts for 13 per cent of global GDP and 14 per cent of world trade. CPTPP took shape after the US pulled out of the Trans-Pacific Partnership (TPP).

Now, it is possible the US will rejoin the new accord. The US' real income under the original TPP would have increased by 0.5 per cent of its GDP. After the US pulled out, the country not only gave up those gains but also lost an additional $2 billion in income because US firms suffered a disadvantage in TPP markets.

A survey finds that 61 per cent of Americans want the US to participate in the CPTPP. The US will not be reluctant to participate in the free trade deal if the agreements benefit it the most. The Trans-Pacific Partnership aimed to shape new rules for world trade excluding China.

To form an alternative to TPP, 16 countries, including China, Japan and Asean members, launched negotiations in 2012 on the Regional Comprehensive Economic Partnership (RCEP). The talks are expected to make substantive progress in 2019. Once completed, the agreement will cover 3.4 billion people and about 32 per cent of the global economy.

Tommy Hilfiger's next show will be held in Paris, on March 2 during the Paris Womenswear Fashion Week that will be held from Feb. 25 to March 5. It will allow the label to show off the fruits of its collaboration with American actress and singer, Zendaya. Tommy Hilfiger chose Paris for its next show, following a string of previous events in Shanghai, Milan, London, Los Angeles and New York. The brand will present a see-now-buy-now collection, in line with its current strategy.

The event will showcase Tommy Hilfiger's latest creative collaboration. It will also showcase the first pieces from the spring 2019 line ‘TommyXZendaya.’ All of the looks shown on the catwalk will be available for sale after the show in over 70 countries, via the label's stores, partners and e-commerce store.

Turkey’s textile and ready wear exports rose 3.8 per cent in 2018. This year, the textile and apparel sector aims to boost exports by around 10 per cent. Turkish exporters are aiming for a five per cent share of the global market. The target is to make the sector, which is currently the seventh-biggest exporter globally, among one of the world's top five.

Africa is a strategic target market. The sector's exports to Africa are up 13.5 per cent year on year. Textile exports to the Americas also picked up last year, along with those to the EU, Turkey’s main trading partner. Turkey is advantageously placed, next to the European market.

South America and the Far East have been identified as this year’s targets. Projects will be carried out for the Japanese and South Korean markets. In 2018 textile and raw materials and ready-wear sectors combined constituted nearly 16 per cent of Turkey’s total exports. The textile and apparel sector plans to turn Turkey’s currency advantage to an opportunity in 2019 and work through its target thanks to Turkish brands instead of contract manufacturing.

Turkey can do quick product turnarounds thanks to its integrated facilities, strong design infrastructure, experience, knowhow, and qualified labor force.