FW

The halt in new orders by western clothing and footwear companies to the violence-hit Bangladesh has significant implications for the Indian textile industry, which supplies raw materials and other inputs to Bangladesh.

According to industry insiders, while India continues to receive more inquiries for clothing, its cotton shipments to Bangladesh are on a decline. M. Rafeeque Ahmed, Chairman, Chennai-based Farida Group, confirms, there are no new orders from Western companies. The workers and the administration are working overtime to complete pending orders. Some items are being sourced from India to fulfill the orders, along with technicians also being hired from India.

Much of Bangladesh's production is concentrated in Chittagong and Dhaka, areas that are relatively distant from the protest sites, highlights Ahmed.Though there were some disruptions in August, western orders are expected to resume soon, he adds citing Bangladesh’s favorable duty climate as a least developed country (LDC).

ChandrimaChatterjee, Secretary General, Confederation of Indian Textile Industry (CITI), notes,Western companies consider India as an alternative sourcing destination. However, its capacity to deliver currently faces qualitative and quantitative mismatches between Indian and Bangladeshi product offerings,she adds.

Although there are inquiries for clothing from India, the reduction in raw material exports to Bangladesh has impacted the Indian textile industry negatively, Chatterjee points out. However, initiatives like the PM Mitra and PLI schemes will continue to strengthen India's textile sector, she affirms.

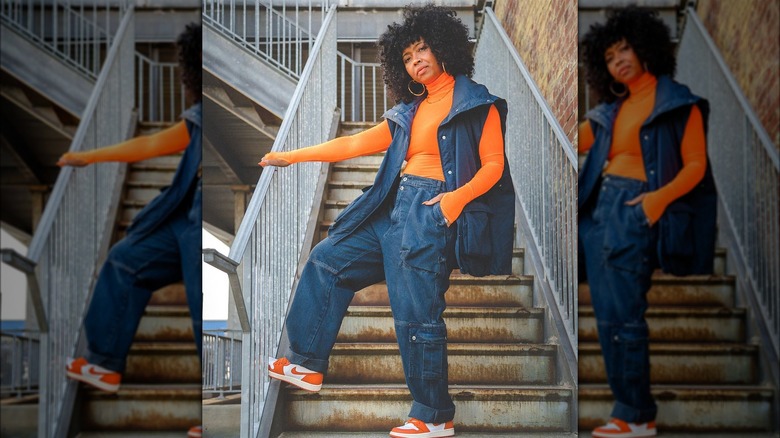

The fashion industry has always been a mirror reflecting societal shifts, and the battle for style supremacy is now being fought between two distinct generations: Gen Z and Millennials. While they share a passion for clothing, their approaches to fashion, shopping habits, and style preferences couldn’t be more different.

The digital divide

Born between the late 1990s and early 2010s, Gen Zers are the true digital natives. Raised in an era dominated by smartphones and social media, their fashion sense is deeply influenced by online platforms. Gen Z is the driving force behind fast fashion, with a penchant for trendy, affordable pieces. They are heavily influenced by social media influencers, often copying their outfits and purchasing similar items. Despite their love for fast fashion, a growing segment of Gen Z is becoming increasingly conscious of sustainability. They seek out brands with ethical practices and are willing to pay a premium for eco-friendly fashion. They are also is challenging traditional gender norms in fashion. They embrace gender-neutral clothing and experiment with different styles, expressing their individuality through their attire.

Born between the early 1980s and late 1990s, Millennials were the first generation to grow up with the internet. While they are comfortable with technology, their relationship with fashion is different from their younger counterparts. Millennials tend to be more brand-conscious and prioritize quality over quantity. They are willing to invest in classic pieces that can be worn for years to come. Unlike Gen Z, who prefer online shopping, Millennials enjoy the in-store experience. They appreciate the ability to touch and try on clothes before making a purchase. Millennials popularized the athleisure trend, blurring the lines between workout wear and everyday fashion. They are comfortable in casual, yet stylish clothing.

Interestingly, both generations are increasingly conscious of sustainability and ethical fashion, but their approaches differ. Gen Z is more likely to prioritize eco-friendly brands and second-hand shopping. They are also more vocal about demanding transparency from fashion brands. Millennials are also interested in sustainability but are more likely to focus on reducing waste and extending the life of their clothes. They are also more likely to buy from brands with a strong corporate social responsibility track record.

The style gap

However, the differences in fashion preferences between Gen Z and Millennials have created a noticeable style gap. Gen Z is all about bold colors, oversized silhouettes, and experimental fashion, while Millennials lean towards classic, minimalist styles with a focus on comfort. And, there is also a growing overlap between the two generations. Both groups are embracing athleisure, and there is a shared interest in sustainable fashion. Brands are responding to this difference and how.

Zara this fast-fashion brand for example, caters to both Gen Z and Millennials, but its marketing strategies differ for each group. For Gen Z, Zara focuses on social media influencers and limited-edition collections, while for Millennials, the emphasis is on quality materials and timeless designs.

Similarly Adidas the sportswear brand has successfully bridged the gap between the two generations by offering a wide range of products that appeal to both groups. Their collaborations with fashion designers have helped them stay relevant with Gen Z, while their classic styles continue to resonate with Millennials.

At the same time, there are some brands who focus more on one category. Shein this fast-fashion giant has successfully tapped into the Gen Z market with its affordable prices, trendy styles, and strong social media presence. Everlane on the other hand has resonated with Millennials by focusing on transparency, sustainability, and high-quality basics.

As the fashion industry goes through a transformation, driven by evolving preferences of Gen Z and Millennials, there are distinct differences in their shopping habits and style choices, both generations are shaping the future of fashion. As these generations continue to mature, it will be interesting to see how their styles evolve and whether the gap between them will narrow.

The US economy has shown mixed signals in recent months, impacting consumer buying behavior and the apparel industry. Inflation, fluctuating import prices, and shifting consumer priorities have all contributed to a complex market environment. The Consumer Price Index (CPI) for apparel rose by 3.6 per cent year-over-year in July, following a 3 per cent increase in June, according to Cotton Incorporated's analysis. This increase reflects a broader inflationary trend impacting the US economy, potentially affecting consumer buying behavior.

Consumer spending shifts amid economic uncertainty

Despite persistent inflation, consumer spending remains resilient. However, Cotton Inc.'s Market Research Director, Melissa Paschall, notes a shift in priorities: "Consumers are still spending, but they're becoming more discerning about where their dollars go. We're seeing a move towards value-driven purchases and a focus on essential items."

Price volatility in apparel imports

The fluctuating US dollar and ongoing supply chain disruptions have contributed to price volatility in apparel imports. The import price index for apparel increased 3.8 per cent in the second quarter of 2023, highlighting the ongoing challenges faced by the industry.

For example, major retailers like Gap Inc. and American Eagle Outfitters have reported mixed results in recent quarters. While sales remain steady, rising costs are squeezing profit margins. As Gap Inc.'s CEO, Sonia Syngal, stated in a recent earnings call, "We're navigating a challenging environment, balancing strong consumer demand with persistent inflationary pressures."

Key findings

Inflationary pressures: The Consumer Price Index (CPI) has remained high, particularly for apparel imports. This is attributed to factors such as rising transportation costs, supply chain disruptions, and the ongoing impact of global events.

Consumer resilience: Despite inflationary pressures, consumer spending has remained relatively robust. However, there's a notable shift toward value-seeking behavior and a focus on essential purchases.

Apparel imports: The cost of apparel imports has fluctuated, impacting both retailers and consumers. A rise in import prices has led to price increases for certain apparel categories.

Cotton demand: Demand for cotton-based apparel has been mixed. While cotton's natural properties and comfort appeal to consumers, price sensitivity and competition from synthetic fibers remain challenges. Gary Adams, National Cotton Council opines, "Inflation and supply chain disruptions continue to impact the cotton industry. However, strong demand for US cotton remains a positive indicator."

The US economy is navigating a period of uncertainty, with inflation and shifting consumer priorities impacting the apparel industry. While consumer spending has remained resilient, there's a growing emphasis on value and essential purchases. The apparel industry needs to adapt to this evolving landscape by focusing on innovation, sustainability, and providing compelling value propositions to consumers.

The future of the apparel industry is intertwined with the overall health of the US economy. As the economy continues to evolve, the apparel sector will need to remain agile, innovative, and responsive to changing consumer needs and preferences. The role of cotton, with its natural properties and sustainability attributes, remains crucial in providing consumers with comfortable, durable, and eco-friendly apparel choices.

At a meeting of the Steering Committee held on Aug,28, 2024, Rahul Mehta, Chief Mentor, CMAI, emphasised on the significance of the trade show, Bharat Tex 2025, saying, it will showcase the entire textile value chain.

Scheduled from Feb 14-17, 2025, the Bharat Tex 2025 expo has a unique ability to present a holistic view of the textile industry, from fiber to finished garment, all under one roof. It offers international buyers a rare chance to experience the full breadth of India’s textile capabilities, Mehta remarked.

He also highlighted the event’s focus on sustainability stating, it will emphasiseIndia’s advancements in sustainable textiles. With the global demand for eco-friendly products on the rise, India is positioning itself as a leader in sustainable manufacturing, he added.

Besides highlighting India’s prowess in garments and fabrics, Bharat Tex 2024 showcases the country’s extensive capabilities across the entire textile sector. Last year’s edition of the event had significant impact on global trade while this year’s event is also expected to attract a substantial number of buyers, Mehta affirmed.

It will play a crucial role in supporting the government’s ambitious target of achieving $100 billion in textile exports, he added.

Reopening of the Malungushi Textiles Factory, a China-Zambia joint venture in Kabwe, central Zambia commenced recently with the arriving of the first batch of equipment and machinery. The factory is set to resume production after a hiatus of 17 years, creating approximately 500 direct jobs.

Once one of Zambia's largest textile companies, Mulungushi Textiles was originally established as a joint venture between the Zambian defense ministry and China's Qingdao Textiles, with support from the Chinese government. The factory ceased operations in 2007.

The decision to redevelop Mulungushi Textiles was announced during Zambian President HakaindeHichilema's state visit to China in September last year, which focused on establishing a comprehensive strategic cooperative partnership between the two nations.

During the reopening ceremony of the textile unit, ChipokaMulenga, Commerce, Trade, and Industry Minister, Zambia, highlighted, revival of the factory would not only stimulate economic development in the Central Province and surrounding regions but also revitalise the domestic cotton industry.

Historically, Mulungushi's core operations included spinning, ginning, garment manufacturing, weaving, dyeing, and printing cotton materials for the country's defense forces and Zambia Police Service. The company also exported to neighboring countries within the Common Market for East and Southern Africa (COMESA), benefiting from a duty-free facility on imports created by the United States.

Set to return from Sep 03-07 in Seoul, South Korea, the upcoming edition of Seoul Fashion Week will focus on the theme of sustainable fashion. The fashion week will feature a variety of programs focusing on sustainability, with participation from companies like Hyosung TNC, JejuSamdasoo, and the fashion brand Partsparts.

JejuSamdasoo will present its collaborative designs on the runway alongwith the designer brand July Column. The showcased items are crafted from recycled fibers made from empty PET bottles supplied by JejuSamdasoo and repurposed materials from July Column’s existing collections. This show is scheduled for Sep 4 at the Dongdaemun Design Plaza (DDP) in Jung District, central Seoul.

Fashion brand Partsparts will hold a special exhibition titled ‘Zero Waste, Fashion and Sustainability’ from Sep 03-07 at DDP JandiSarangbang in Jung District. The exhibition will highlight the brand’s zero-waste philosophy, featuring its innovative design patterns, self-developed material ‘New Neoprene,’ and seamless bonding techniques aimed at reducing fabric waste. Additionally, from Sep 06-07, the brand will offer a hands-on experience for the public and students, allowing participants to create eco-friendly bags using leftover fabric from its production process.

Seoul Fashion Week is a bi-annual event showcasing brands' Spring/Summer (S/S) and Fall/Winter (F/W) collections. Organised by the Seoul Metropolitan Government, the upcoming fashion week will feature the brands' S/S’2025 collections. Events will be held across multiple locations in Seoul, including the main venue DDP in Jung District, Seongsu-dong in Seongdong District, Cheongdam-dong in southern Seoul, and Hannam-dong in central Seoul.

Textile and apparel (T&A) exports by the United States witnessed a 3.17 per cent declineto $11.5 billion during H1, FY2024. Beginning in the first quarter of the year, this decline persisted throughout the following months, reflecting a broader trend of decreasing exports that had already been notable in 2023. Meanwhile, imports by the country also contracted, largely due to ongoing inflationary pressures.

The primary destinations for T&A exports from the United States remained Mexico and Canada who imported textiles and clothing worth $6.1 billion and $4.2 billion from the country respectively during this period. Exports to the European Union dropped by 11.2 per cent over the six months to $1.2 billion. Exports to China remained constant at $361 million, outpacing the Dominican Republic, the UK, and Japan in market size.

Similarly, T&A imports by the United States also declined by 3.58 per cent to $49.3 billion in H1, FY24. Inflation was one of the primary reasons of this decline, causing concerns among both consumers and brands, despite signs of a slowdown since July. China remained the largest exporter of T&A to the US, with exports worth $11.1 billion in H1, 2024.

China was followed by Vietnam with exports worth $7.2 billion to the US. India exported T&A products worth $4.7 billion to the US while exports by Bangladesh dropped by 10.6 percent.With exports worth $2.8 billion to the US, the European Union experienced a 2.9 percent decline and was the fifth largest supplier, leading Indonesia, Mexico, Cambodia, and Pakistan.

Fashion retailer has renewed its partnership with Tata Consultancy Services (TCS) for an additional five years to transform its technology operations to support its ambitious global expansion plans.

An international fashion retailer with a presence in 17 countries across Europe and the US, Primark seeks to build a more resilient, reliable, and efficient IT operating environment. TCS will support Primark's transition to a more agile, product-based operating model through automation and the adoption of intelligent automation and Devops technologies.

This new approach will streamline application development, testing, and maintenance processes, ultimately reducing time-to-market for Primark's products and aligning with its growth strategies.

Andrew Brothers, Chief Information Officer, Primark, emphasises, this collaboration ensures that the retailer is able to respond swiftly to market trends and customer demands, thus continuing to offer high-quality products at competitive prices.

Shekar Krishnan, Vice President and Head of Retail UK and Europe , TCS, adds. the partnership supports Primark's mission to provide affordable fashion globally and helps them achieve their growth vision through innovation and technology.

Luxury fashion house, Lanvin Group registered a 20 per cent Y-o-Y decline in revenue to €171 million in H1, FY24, The firm’s gross profit margin fell by 1 per cent to 57.5 per cent. Its adjusted EBITDA also decreased by €1 million due to proactive cost management, leading to a loss of €42.1 million.

Despite these setbacks, the gross profit margins of the group’s brands including Lanvin, St. John, and Caruso improved significantly asthey benefitted from a better full-price sell-through and strategic inventory management. The group faced difficulties in the global luxury market, particularly in the EMEA region and Greater China, as well as a weakened wholesale channel. However, the Lanvin brand experienced strong growth in the APAC region outside of Greater China.

Revenues of the brand Wolford declined by 28 per cent to €43 million due to significant shipping delays caused by integration issues with a new logistics provider, and the challenging wholesale market in Europe further impacted its performance. Its gross profit margin fell from 72 per cent to 63 per cent.

Brand Sergio Rossi’s revenue contracted by 38 per cent to €20 million, with a 49 per cent decline in EMEA and a 22 per cent drop in APAC, including a 34 per cent decline in Greater China. Despite these challenges, the brand’s gross profit margin remained relatively stable at 50 per cent.

St. John’s revenue decreased by 14 per cent to €40 million, with consistent declines across distribution channels.The brand’s largest market, North America registered a 10 per cent decline in revenues, while revenues from APAC declined by 46 per cent due to general market softness. However, the brand's gross profit margin increased significantly from 62 per cent to 69 per cent, driven by better full-price sell-through and an improved channel mix.

Currently, Lanvin Group is focusing on initiatives to increase retail and digital traffic and implement operational cost efficiencies to improve DTC profitability as it navigates through a challenging market environment in 2024.

Newly launched upcycling service, Newless is revolutionising sustainable fashion by offering a 'bespoke' experience to customers to transforms preloved garments into custom, fashion-forward pieces. Through this initiative, the brand makes upcycling more accessible and appealing to a wider audience, thereby helping reduce the environmental impact of the fashion industry.

Recogniaing that unworn clothes are often left forgotten in wardrobes, and consumers often find it challenging to shift from fast fashion to sustainable alternatives, Newless offers an easy and creative solution. The company revitalises old garments, providing designers an opportunity in the sustainable fashion market.

Founded by Anita Shannon, Newless employs emerging UK designers to reconstruct old, outdated and undesirable garments into pieces to be cherished by their owners. Through this initiative, Newless aims to demonstrate that upcycling cannot just be fun, accessible, and affordable, but can also offer a stylish, lower-impact alternative.

Newless has already hosted several successful pop-up events in collaboration with organisations and brands in London, showcasing the appeal and potential of upcycled fashion.