FW

Having concluded on January 9, 2026, the National Textiles Ministers’ Conference has established a high-stakes framework to elevate India into a premier global textile authority. During the summit, Pabitra Margherita, Minister of State for Textiles, outlined an ambitious fiscal roadmap aiming for a $350 billion textile economy and $100 billion in annual exports by 2030. This strategy emphasizes a structural transition toward high-growth segments such as Man-Made Fiber (MMF) and technical textiles to diversify beyond the traditional cotton-dominant portfolio.

Regional integration and industrial scaling

A cornerstone of the new roadmap is the District-Led Textiles Transformation (DLTT) Plan, unveiled to convert 100 high-potential districts into global export champions. This initiative is designed to synchronize state-level investor policies with federal objectives, utilizing the PM-MITRA mega parks to achieve economies of scale. Minister Margherita underscored the North-Eastern region's pivotal role, noting it currently accounts for 52 per cent of India’s handloom production. By integrating regional craftsmanship with global value chains, the Ministry intends to brand indigenous textiles as a premium international category.

Sustainability and statistical governance

The conference also saw the launch of the Tex-RAMPS scheme, a Rs 305 crore initiative focused on enhancing the credibility of textile research and data monitoring through 2031. Furthermore, the release of ‘India’s Textile Atlas: State Compendium 2025’ provides a data-driven baseline for future infrastructure and technology upgrades. As the global market shifts toward ESG compliance, India is positioning its manufacturing clusters to adopt zero-liquid-discharge and green chemistry, securing a competitive edge in Western markets.

The Ministry of Textiles oversees the entire value chain from fiber production to retail exports. It currently manages the Rs 10,683 crore PLI scheme and seven PM-MITRA parks. Contributing 2.3 per cent to India’s GDP, the sector is undergoing a technology-led modernization to triple export volumes and achieve carbon neutrality by 2030.

The global apparel export landscape is entering a period of high-intensity volatility as manufacturers grapple with escalating trade barriers. Recent policy shifts in the United States, including a baseline 50 per cent tariff hike on key textile categories, have forced a structural reassessment of pricing models. For many exporters, the financial burden is no longer absorbable within existing 8 per cent–15 per cent margins. This has led to a defensive market posture where suppliers are front-loading shipments to hedge against further escalations, while simultaneously absorbing significant tariff costs to prevent long-term buyer attrition.

Competitive realignment and regional shifts

The imposition of reciprocal duties has catalyzed a rapid realignment of sourcing preferences. American retailers are increasingly diverting orders to nations like Vietnam and Bangladesh, where duty structures remain comparatively lower at 15 per cent–20 per cent. Consequently, industrial clusters that previously dominated specific niches, such as knitwear hubs, are reporting a 30 per cent growth in working capital requirements. To maintain factory utilization, manufacturers are diversifying into alternative markets - including the UK, UAE, and Germany - where recent free trade agreements offer a necessary, albeit partial, cushion against North American protectionism.

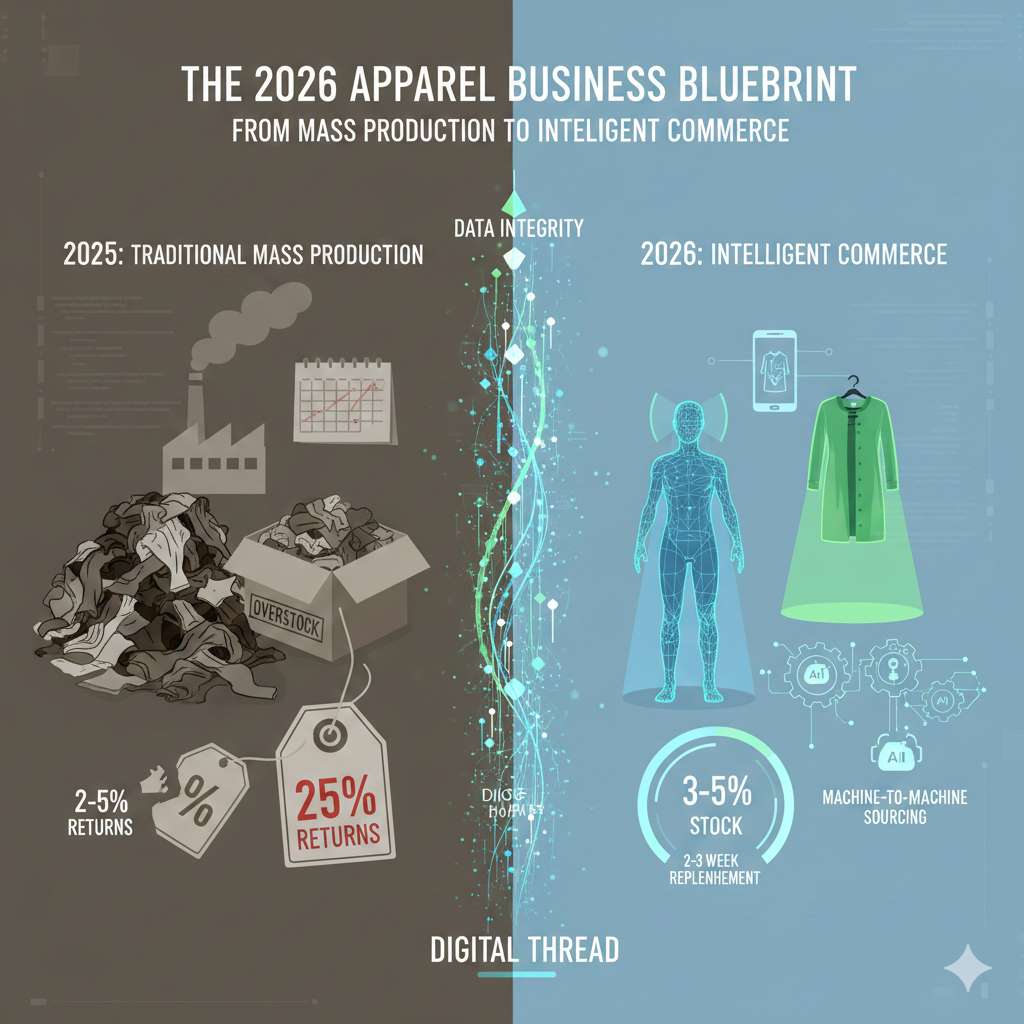

Strategic transition towards value-added segments

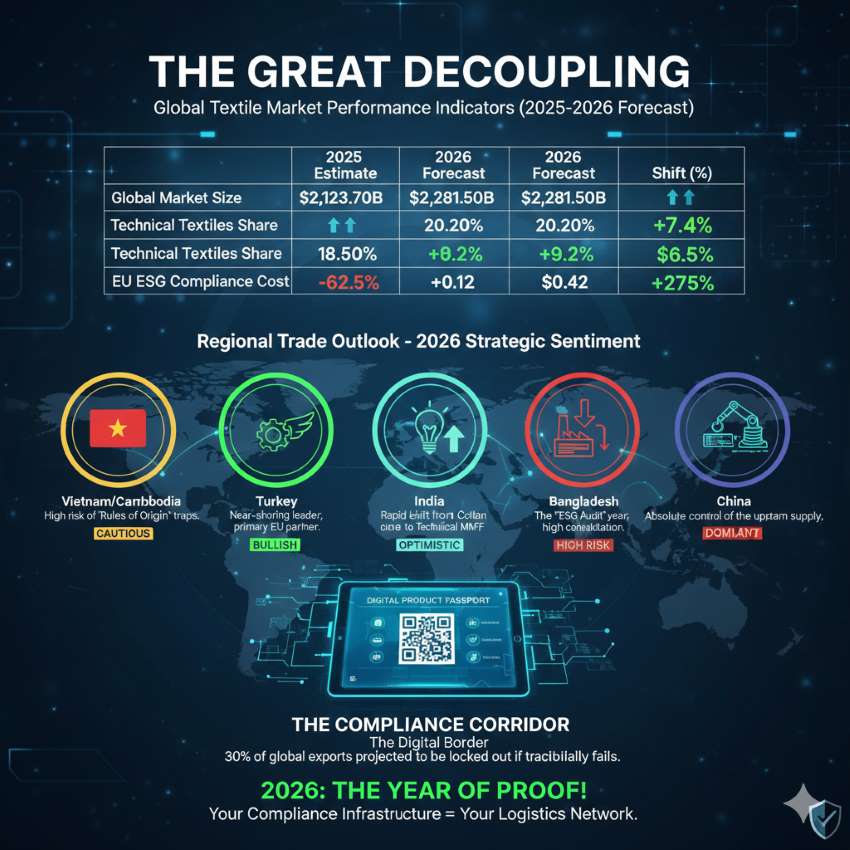

In response to these external pressures, the industry is transitioning from high-volume basic commodities to specialized, technical textiles and synthetic fibers. Rating agencies have revised the sector's outlook to negative, predicting a 200–300 basis point contraction in operating margins for the FY26. To mitigate this, firms are leveraging data-driven logistics and investing in integrated manufacturing parks to lower operational overheads. The current climate underscores a decisive shift: survival in the 2026 trade environment depends on localized supply chain resilience and the ability to navigate a fragmented global regulatory framework.

This labor-intensive sector serves as a cornerstone of global industrial output, employing millions across emerging economies. Specializing in ready-made garments, home textiles, and technical fabrics, the industry is currently undergoing a digital and sustainable transformation. With global exports valued at over $37 billion annually for lead players, companies are now prioritizing market diversification and high-margin product innovation to sustain long-term financial viability amidst rising geopolitical trade tensions.

The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) has formally entered a knowledge partnership with the Bangladesh–China Green Textile Expo 2026, scheduled for May 14–16 in Dhaka. This strategic alliance with the Chinese Enterprises Association in Bangladesh (CEAB) and Savor International Limited arrives at a critical juncture. As Bangladesh prepares for its LDC graduation in 2026, the industry faces a potential 30 per cent decline in EU exports if it fails to align with emerging ESG mandates, specifically the European Sustainability Reporting Standard (ESRS).

Industrial modernization and supply chain resilience

China currently anchors roughly 80 per cent of Bangladesh’s textile supply chain, providing the lion's share of machinery, man-made fibers (MMF), and chemical solutions. This partnership aims to transition that dependency into a collaboration for high-value growth. With global buyers increasingly demanding measurable carbon reductions, the expo will serve as a commercial bridge for the 240+ LEED-certified factories in Bangladesh to access next-generation Chinese water-efficiency and energy-saving systems.

Navigating fiscal headwinds and global compliance

The sector is currently navigating a complex fiscal landscape; RMG exports declined 2.63 per cent to $19.37 billion in H1, FY2025-26. To counteract this, industry leaders are prioritizing technical textiles and automation. Sajed Karim, Chairman-Trade Fair Committee, BGMEA, emphasized, this collaboration is less about volume and more about ‘future-ready’ manufacturing that can withstand tightening international environmental scrutiny.

BGMEA represents over 4,000 garment factories, driving 81.5 per cent of national export earnings. Under its ‘Sustainability Vision 2030,’ the association aims to reduce GHG emissions by 30 per cent and source 50 per cent of materials sustainably. Following a 9 per cent growth in FY24, the group is now focusing on transitioning from cotton to high-margin MMF apparel.

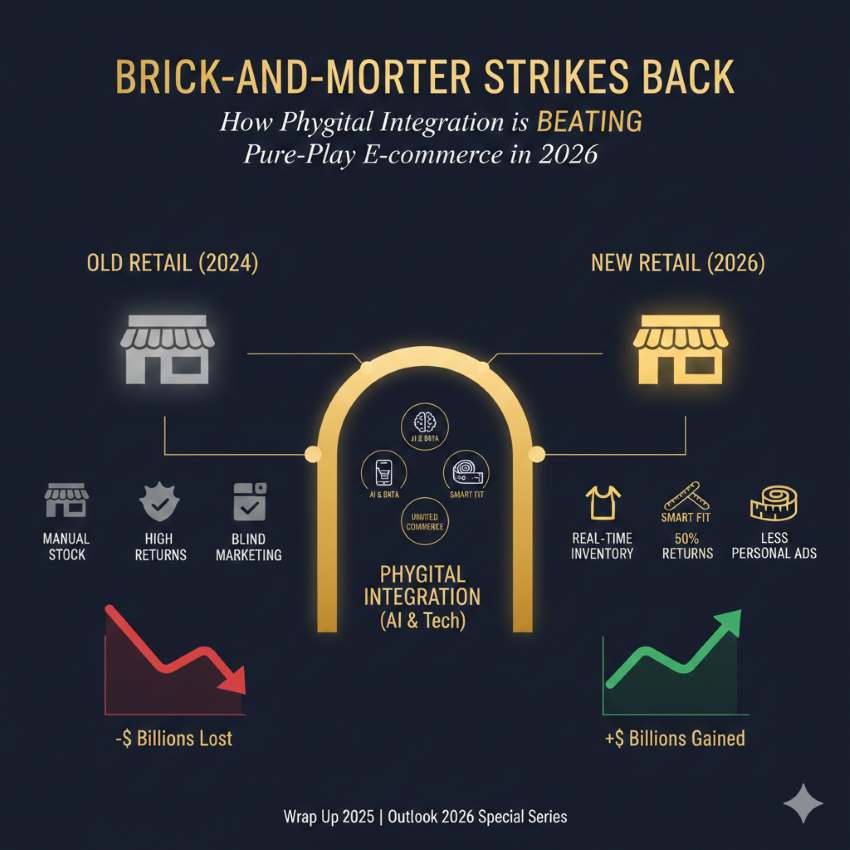

Macy’s Inc has initiated a fresh wave of store closures across 12 states, marking a decisive step in its ‘A Bold New Chapter’ restructuring strategy. As of January 9, 2026, the retail giant confirmed 14 underperforming locations will begin liquidation sales, with most expected to shutter by the end of the first quarter. This contraction is part of a broader objective to decommission approximately 150 legacy department stores by 2027 to redirect capital toward higher-margin nameplates.

Strategic capital realignment

The downsizing reflects a fundamental transition in the group's revenue model. While total net sales for the namesake brand dipped 2.3 per cent in the latest fiscal report, the company's ‘Reimagine 125’ locations - optimized stores with elevated merchandising - saw comparable sales grow by 2.7 per cent. Management is increasingly prioritizing its luxury banners; Bloomingdale’s recently posted a 9 per cent growth in comparable sales, its strongest performance in over three years. By shedding underproductive square footage, Macy’s aims to fund 15 new Bloomingdale’s locations and 30 Bluemercury doors.

Navigating retail volatility

Retail analysts note, the consolidation comes as digital transactions now influence nearly 50 per cent of discretionary apparel purchases. Tony Spring, CEO emphasized, these targeted adjustments are essential for maintaining the firm's $2.4 billion liquidity cushion. Despite the closures, Macy's reported a narrowed adjusted net income of $26 million for Q3 2025, signaling that the leaner operational footprint is beginning to stabilize the balance sheet against a softening holiday market.

Macy’s Inc operates approximately 450 namesake stores, 60 Bloomingdale’s locations, and 170 Bluemercury specialty beauty shops. Founded in 1858, the New York-based retailer is currently converting from a traditional department store model to a luxury-and-digital-first enterprise. The company reported FY25 revenues of approximately $21.5 billion, focusing on high-growth urban hubs and omnichannel fulfillment.

Projected to reach $6.53 billion by 2032, the Gulf Cooperation Council (GCC) home textiles market has seen a major entry from India as a premium subsidiary of D’Decor Exports, Sansaar formalized a B2B distribution partnership with Bru Textile’s Fabric Library. This alliance, finalized in late 2025, utilizes a sophisticated logistics framework to place high-end upholstery and drapery across elite trade counters in Dubai and the wider region.

Capitalizing on luxury real estate demand

The expansion aligns with a rise in the number of Middle Eastern residential projects, where homeowners in markets like the UAE typically allocate 7 per cent to 10 per cent of property value toward interior renovations. Sarah Arora, Co-founder, Sansaar, noted, the partnership leverages regional expertise to bridge the gap between Indian manufacturing excellence and the GCC’s appetite for bespoke, luxury textiles. By integrating with Fabric Library’s established ecosystem, Sansaar bypasses traditional retail barriers, securing direct access to the region’s high-growth hospitality and premium residential sectors.

Sustainability and manufacturing scale

Sansaar’s market entry is backed by D’Decor’s industrial capacity, which produces over 100,000 meters of fabric daily. The brand is targeting a $60 million (Rs 500-crore) revenue benchmark within three years, fueled by a 35 per cent Y-o-Y growth in its initial phase. Leveraging advanced robotic warehousing and zero-liquid-discharge manufacturing, the brand meets the GCC’s increasing demand for ‘conscious luxury’ - a segment where 60 per cent of consumers now prioritize eco-friendly textiles.

Established in 1999, D’Decor Exports is the world’s largest producer of woven upholstery and curtain fabrics, operating in 65 countries. Its venture, Sansaar, focuses on sustainable luxury and high-performance textiles. The group reported revenues of approximately $115 million (Rs 958 crore) for FY25, maintaining a robust 17.5 per cent operating margin.

A strategic breakthrough in Washington has set a new course for the $36 billion Bangladeshi apparel sector as it navigates the 20 per cent US reciprocal tariff framework. On January 8, 2026, National Security Adviser Dr. Khalilur Rahman and US Trade Representative (USTR) Jamieson Greer discussed an innovative preferential trade arrangement. The proposed scheme would grant tariff-free access to the US market for Bangladeshi apparel exports in direct proportion to the volume of US-produced cotton and man-made fiber (MMF) inputs imported by Dhaka.

Balancing trade deficits through supply chain integration

The initiative seeks to narrow the bilateral trade gap, which stood at approximately $6.1 billion in 2024, by incentivizing Bangladeshi manufacturers to source raw materials from American producers. Under this ‘square-meter for square-meter’ logic, for every unit of US textile input imported, an equivalent volume of finished garments would enter the US duty-free. This addresses a critical pain point; currently, apparel with US content remains subject to the same high reciprocal duties as other goods. By eliminating these costs, the deal could protect nearly $1 billion in annual exports that analysts previously warned were at risk due to tariff-induced pricing shifts.

Strategic compliance and regional competitiveness

This proposal arrives as Bangladesh prepares for its LDC graduation in late 2026, a transition that threatens its duty-free status in other major markets. Ambassador Greer’s commitment to raising these specific tariff reductions with the White House suggests a pivot toward bilateralism to maintain Bangladesh’s position as the third-largest apparel supplier to the US. If executed, the agreement will not only lower the effective 20 per cent tariff but also solidify a resilient, vertically integrated supply chain that bridges American cotton fields with Bangladeshi sewing floors, shielding the sector from regional competitors like Vietnam and India.

The United States is the single largest destination for Bangladeshi readymade garments (RMG), accounting for roughly 18 per cent of the country’s total apparel exports. Bangladesh is also a top-five global market for US cotton exports, enjoying zero-tariff entry for raw fiber. Current growth plans focus on diversifying into MMF-based technical textiles to sustain a 10 per cent annual export increase.

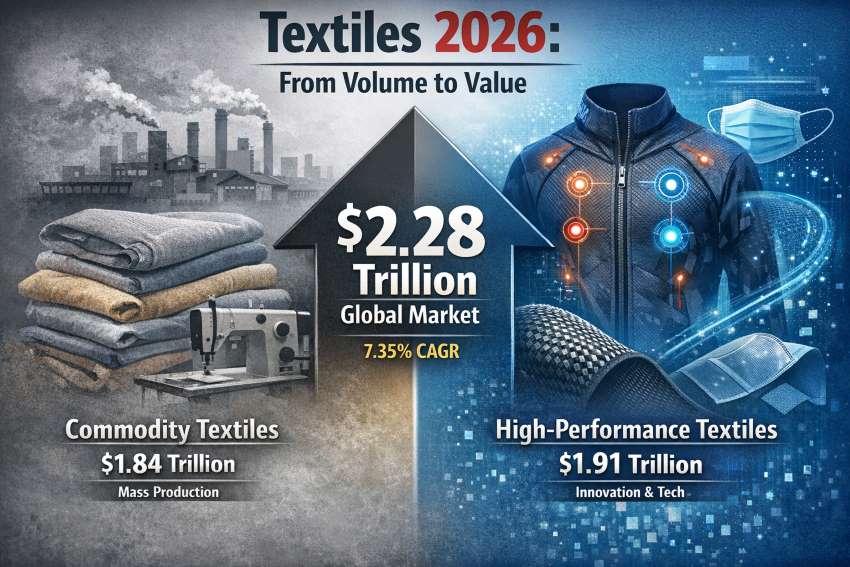

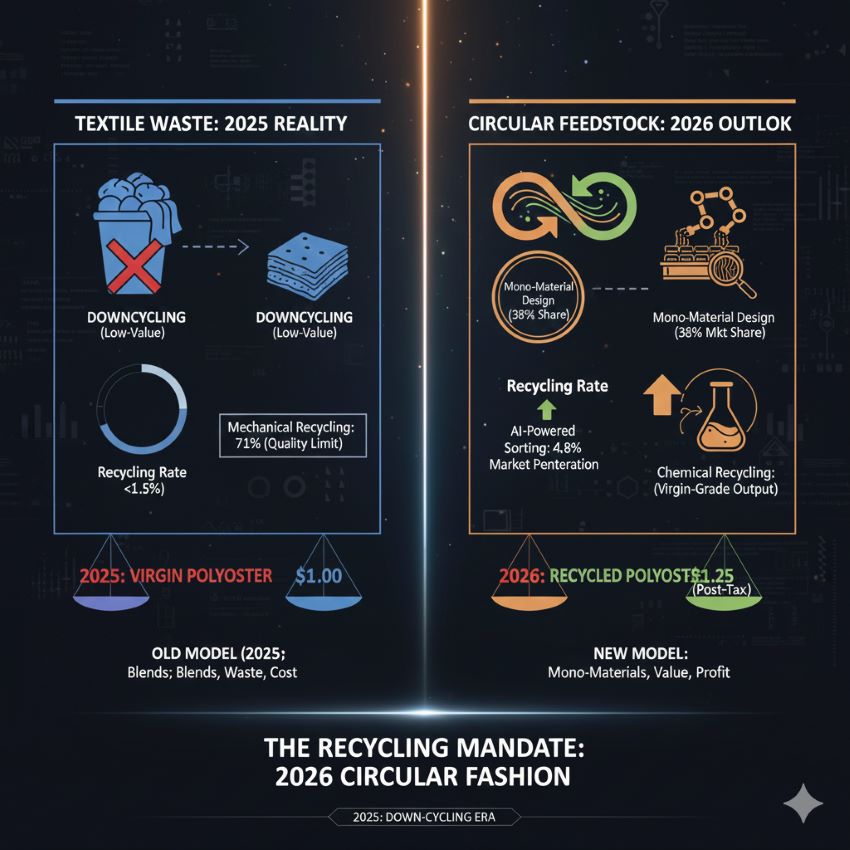

The value of the global textile yarn industry is projected to rise from $82.4 billion in 2025 to $127.4 billion by 2034. This expansion is increasingly defined by a structural shift toward technical performance and verified sustainability. As the Asia-Pacific region maintains its dominance with a 63.5 per cent market share, the industry is navigating a transition where the traditional focus on volume is being superseded by the demand for functional, blended, and recycled fibers. Industrial data confirms, recycled polyester and bio-based cellulosics are no longer niche offerings but essential components for brands aiming to meet stringent ESG targets and upcoming EU traceability mandates.

Industry analysts highlight, the integration of air-jet spinning and automated digital monitoring has significantly enhanced yarn uniformity while reducing energy overheads, a critical factor as raw material price volatility persists. In the Middle East and Africa, a projected 6.7 per cent CAGR reflects a strategic pivot toward non-oil industrialization, with Turkey emerging as a pivotal hub for high-quality cotton and speciality blends. Meanwhile, the North American and European sectors are prioritizing high-value technical textiles for automotive and medical applications. This global landscape presents a clear opportunity for manufacturers to adopt circular models, converting post-consumer waste into high-tenacity yarns that align with the rising ‘prosumer’ preference for garment longevity and environmental accountability.

The global textile yarn industry specializes in the production of natural, synthetic, and blended fibers for apparel, home, and industrial applications. Dominating the Asia-Pacific and European luxury markets, the sector is currently scaling recycled yarn capacities to achieve 2034 growth targets while addressing raw material price volatility through technological innovation.

American apparel production is experiencing a strategic revival as the Council of Fashion Designers of America (CFDA) launches a nationwide manufacturing expansion. Backed by the Ralph Lauren Corporation and the New York State Department of State, the initiative targets a critical gap in the domestic supply chain. With the US textile and apparel market projected to reach $395 billion by 2028, these programs address the urgent need for modernized infrastructure. By providing matching grants via the CFDA x NY Forward Grant Fund and the US Fashion Manufacturing Fund, the sector aims to reverse decades of offshoring, focusing on high-tech equipment upgrades and specialized workforce training to bolster local resilience.

Capitalizing on the nearshoring advantage

The economic rationale for reshoring has strengthened as global logistics costs and carbon-border adjustments shift the competitive landscape. Data indicates, localized production can reduce lead times by up to 40 per cent, allowing brands to respond more effectively to the "on-demand" retail model. The partnership builds on the Fashion Manufacturing Initiative's decade-long success, which has already facilitated grants to 54 factories and supported over 2,000 jobs.

Strengthening domestic manufacturing ensures designers have the agile local partners required for a modern economy, states Steven Kolb, CEO, CFDA. This movement is particularly vital as retailers face increasing pressure to verify labor standards and reduce their environmental footprint through shorter transport distances.

Technology and the future workforce

A significant challenge remains the technical skill gap within the aging domestic manufacturing base. To counter this, the new funds prioritize digital fabrication and automation technologies. Industry analysts note that US apparel manufacturing output has stabilized, with a renewed focus on ‘premium’ and ‘custom’ segments where speed-to-market justifies higher domestic labor costs. By integrating advanced robotics and sustainable dyeing processes, the CFDA is positioning the American garment district as a global hub for high-value innovation rather than high-volume assembly. This strategic capital injection is expected to act as a catalyst for broader private investment, ensuring American fashion maintains its cultural and commercial sovereignty.

CFDA is a non-profit trade association representing over 450 leading American designers. It focuses on strengthening the impact of American fashion in the global economy through manufacturing initiatives, professional development, and sustainability advocacy. Its growth plans center on nationwide supply chain resilience and fostering digital innovation within US garment districts.

The UK retail landscape witnessed a stark divergence in performance during the critical 2025 Christmas window, as market-leading agility clashed with structural headwinds. Next PLC emerged as the definitive victor, reporting a 10.6 per cent growth in full-price sales for the nine weeks ending December 27. Exceeding internal forecasts by £51 million, this performance was propelled by a 38.3 per cent leap in international online revenue and improved stock availability following prior-year supply chain disruptions. In contrast, Primark struggled against weak consumer sentiment in Continental Europe, seeing like-for-like sales retreat 2.7 per cent across its global estate.

Value and volume: The supermarket fashion hedge

While fashion-forward retailers like Next capitalized on ‘investment dressing,’ grocery giants successfully leveraged their ‘one-stop-shop’ appeal. Tesco’s F&F clothing brand recorded a robust 4.4 per cent sales increase during the six-week festive peak, benefiting from a 23-basis-point gain in overall UK market share. Similarly, Sainsbury’s Tu Clothing outperformed the broader market by 10 percentage points in volume, driven by record-breaking sales of seasonal nightwear. This ‘supermarket growth’ highlights a consumer shift toward affordable indulgence and convenience, contrasting sharply with Marks & Spencer, where clothing and home sales dipped 2.5 per cent as the brand continued to navigate the recovery phase of a disruptive cyber-attack from earlier in the year.

Strategic outlook: Profitability amidst volatility

As the sector enters 2026, the focus has shifted from top-line growth to margin protection. Next has raised its pre-tax profit guidance for the fifth time this year to £1.15 billion, reflecting strong cash generation. Conversely, Primark owner ABF warned of adjusted operating profits falling below last year’s levels due to increased markdowns required to clear excess inventory. The industry now faces a ‘normalization’ period; while Next forecasts continued 4.5 per cent growth through 2027, the broader market remains cautious, balancing the benefits of high-speed digital fabrication against rising employment costs and fragile consumer confidence.

Next is a FTSE 100 omnichannel retailer specializing in clothing, footwear, and home products. Operating over 500 stores and a dominant online platform, it serves key markets in the UK and Europe. With a 2026 profit outlook of £1.15 billion, Next remains a benchmark for retail resilience and logistical excellence since its 1982 rebranding.

The global high-end fashion market is entering a transformative phase, with projections indicating a rise to $450 billion by 2031, supported by a consistent 5.5 per cent CAGR. As of early 2026, the industry has successfully navigated the ‘post-elevation’ era, where traditional exclusivity is being augmented by hyper-personalization. While the United States remains a resilient stronghold for luxury spend, the Asia-Pacific region has emerged as the primary growth engine. This shift is powered by a mobile-first middle class and a burgeoning ‘prosumer’ base in markets like India and China, where high-end fashion is increasingly viewed as a lifestyle investment rather than a discretionary purchase.

The rise of AI-driven scarcity and craftsmanship

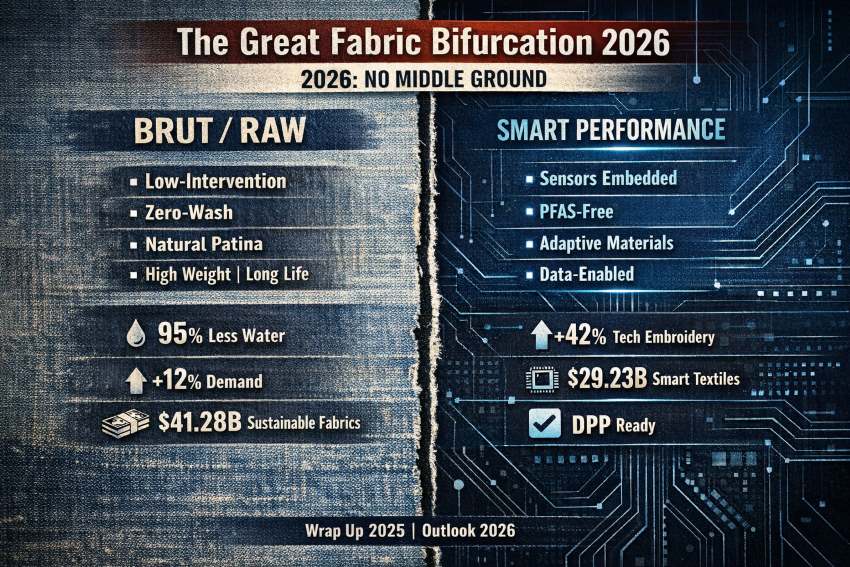

To maintain a robust 19 per cent EBIT margin amidst rising operational costs, leading fashion houses are integrating Generative AI for demand forecasting and supply chain orchestration. Unlike the mass-market use of automation, luxury brands like LVMH and Prada are leveraging technology to protect scarcity - ensuring artisanal supply perfectly meets demand while reducing inventory waste by up to 20 per cent. This ‘smart craftsmanship’ is further supported by the industry-wide adoption of Digital Product Passports (DPP), which provide blockchain-verified provenance. These tools allow brands to justify premium price points by offering transparent, traceable accounts of craftsmanship and sustainability to a skeptical, value-conscious Gen Z audience.

Navigating geopolitical headwinds and resale growth

Despite the optimistic valuation, 2026 presents significant structural challenges, including tightening ESG regulations and a complex global tariff landscape. Analysts from McKinsey note that nearly 46 per cent of fashion executives anticipate ‘challenging’ conditions due to trade disputes. Consequently, many brands are diversifying into the luxury resale market, which is currently growing three times faster than firsthand retail. By launching in-house ‘pre-loved’ programs, heritage brands are effectively capturing secondary market value, building long-term loyalty, and insulating themselves against the volatility of the primary production cycle.

Global Luxury Insights is a market intelligence initiative providing data-driven analysis of the high-end apparel and retail sectors. Focused on major hubs in Europe, North America, and Asia-Pacific, it assists stakeholders in navigating digital transformation and ESG compliance. Since its inception, the platform has guided strategic alliances for top-tier fashion houses, focusing on sustainable growth and long-term financial resilience.