FW

A a report by Nepal Rastra Bank (NRB), Nepal’s reveals exports have dipped by 4.8 percent to Rs 77.83 billion in the first 11 months of the last fiscal. A year ago, in the same period, the country had exported goods worth Rs 81.73 billion. Nepal’s imports growth has slowed down, especially after the recent earthquake. However, imports were 11 times higher than exports.

The government is trying to keep its export target unchanged in the 12th and 13th three-year plans at Rs 100 billion. The 13th plan had targeted to maintain trade deficit at 20 per cent of the gross domestic product (GDP). Yet, according to the Commerce Ministry, it stood at 32 per cent during the last fiscal year. The situation shows no sign s of improving even now.

Purusottam Ojha, Former Commerce Secretary, stated lack of necessary infrastructure such as energy and roads and labour-related issues that increase the cost of production, and make Nepali products uncompetitive, was the biggest hurdle to growth. Besides, the government also does not have a comprehensive export promotion strategy, he added.

Moreover, the transportation costs for Nepal are also higher compared to other South Asian countries, being a landlocked country. Exporters, too are disappointed with the budget for this fiscal, as they feel there were no specific measures to address dip in exports.

Ashok Kumar Agrawal, General Secretary of the Garment Association of Nepal (GAN) said that they had demanded that the government treat export sector like agriculture and offer similar incentives, but there were no such measures introduced in the budget, which was a disappointment.

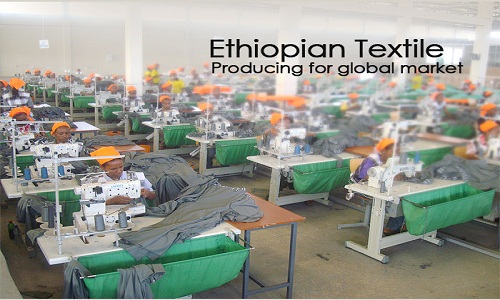

Africa is fast emerging as a sourcing alternative for some of the world’s top brands. For a long time, these brands were sourcing from Asian countries such as Bangladesh, Sri Lanka and India. But minimum wages have clouded the picture. The minimum wage in Bangladesh is at least three times that of Ethiopia’s garment sector, which actually has no minimum wage for workers.

Most countries in Africa that produce their own cotton are benefiting from the recently renewed free-trade agreement with the US, under the Africa Growth and Opportunity Act. The continent has suddenly become a magnet for world’s major clothing companies.

AGOA’s positive impact on sub-Saharan Africa’s clothing industry has led to textile plants being opened across the region. Light manufacturing traditionally moves around in the global economy and, as far as the textile industry is concerned, there is a distinct possibility of that kind of a move from Asia mainly because of rising labor costs.

For now, Ethiopia seems to be a favorite sourcing destination for clothing companies. It’s a country with a rich fashion sense and a century-old textile industry. Cotton cultivation by most African countries shortens the production period, which is why US retail chains such as Walmart are increasingly stocking clothing made in Africa.

The maiden edition of New York of Milano Unica held from July 21 to 23 attracted a lot of visitors as this was first Italian textile fair held in the US. The show took place within the context of Texworld and Apparel Sourcing and attracted 1,300 customers representing 700 companies. It covered fabrics, fashion, textile, apparel, clothing and fashion accessories. Some 80 companies from Italy unveiled their fabric collections.

Italian textile trade fair Milano Unica opens its doors twice a year in Milan to reveal the latest premium fabrics from the spring/summer and autumn/winter collections for men’s and women’s fashion. The first Milano Unica outside Europe took place in China in March 2012. The Italian format has been a successful part of Intertextile Shanghai ever since. New York is its third venue outside Italy.

Milano Unica combines the experience, quality and tradition of three prestigious Italian exhibitions, Ideabiella, Moda In, Shirt Avenue. Made in Italy textiles have always been an international reference point for top-end clothing production. The United States in 2014 emerged the third biggest destination for Italian fabric exports. In the first four months of the year, export growth of Italian fabrics to the US market was 18.8 per cent compared to the same period last year.

www.texworldusa.com/newyork/en/for-attendees/milano-unica.html

Importing countries need to put pressure

While there has been unrest and propaganda over increasing minimum wages of apparel factory workers in countries like Bangladesh, Sri Lanka, India and Cambodia, there is no rulebook followed as far as minimum wage are concerned in countries like Ethiopia. So while a worker in Bangladesh earns $68, in Ethiopia, its just $23 a month.

Country Reports on Human Rights Practices for 2014 state that the largest group of wage earners in Ethiopia earned a monthly minimum wage of 420 birrbirr, which is around $23, for a 48-hour work week and $43 in Ghana. Wages in Bangladeshi factories, on the other hand, are significantly higher due to constant agitation by the garment workers as well as the international community.

Even in Cambodia, last year, leading international fashion brands such as H&M, Inditex, C&A, N Brown, Tchibo, Next Retail, Primark and New Look, indicated that they are willing to pay higher rates for garments made in Cambodia if the government decides to increase minimum wage rate for garment workers after agitated Cambodian garment factory workers launched a new campaign seeking an increase of their monthly minimum wage to $177 from $100 effective 2015.

Africa emerges strong, must compete for survival

With global brands shifting their attention to African countries for sourcing requirements, and Africa being a major cotton producer is one of the few places in the world, garment makers can establish the entire supply chain from fiber to factory in one location.

Unlike Bangladesh, African countries also have duty-free access to the US apparel market under the African Growth and Opportunity Act (Agoa). Both jurisdictions have duty-free access to the EU, so African countries still tend to be outcompeted there.

With the help of global brands and government, Africa can look into resolving the challenges and emerge a strong sourcing destination, before it faces Bangladesh-like situation.

The inclusion of a variety of knitted fabrics in an export incentive scheme has boosted knit production in India. Cotton fabric exports went up by about 10 per cent, this year because of the inclusion of the fabric when it was sold to Bangladesh and Sri Lanka. This was noted in the introduction of a new list on the Merchandise Exports from India Scheme (MEIS), which rewards producers with a financial incentive equivalent to two per cent of the total amount of exports.

As R K Dalmia, Chairman, The Cotton Textiles Export Promotion Council (Texprocil) and senior president, Century Textiles points out that Bangladesh and Sri Lanka were two main destinations for India’s cotton fabrics, which get converted into garments and are then exported to Europe and the US. Due to the lack of the conversion value, cotton fabrics are not exported from India directly to Europe and the US. Thus, inclusion of cotton fabric into MEIS would increase India’s competitiveness in Bangladesh and Sri Lanka, in comparison to other countries, which also includes China, he added.

Bangladesh and Sri Lanka, according to latest figure, hold 28 per cent of India’s cotton fabric shipments. Exports to Bangladesh rose by 11.2 per cent to $440 million last year, while those to Sri Lanka increased by 0.2 per cent to $245 million for the same period. However, India’s total exports of cotton fabric, soared by 16.3 per cent to reach $2.46 billion in 2014.

UBM may acquire Mexico's leading textiles and apparel fair, Intermoda Fashion Group SA, fully or partially, by September this year. One of the fair’s five owners, on condition of anonymity said that they were holding talks and exploring three options: a partial or full sale, a 50/50 joint venture company or a marketing alliance.

There were three companies in race for the acquisition, though UBM was leading since the global firm is expected to complete due diligence in 10 days. The firms in dialogue, other than UBM, were Reed Exhibitions and Messe Frankfurt. The final deal will rely on which UBM offer matches shareholders’ expectations. As per reports, UBM has sent its executives from its Advanstar fashion division to conduct the due diligence in Guadalajara, which is the second largest city of Mexico.

Also, it has been said that though Intermoda’s five owners are open to all options, they are in favour of a 50/50 joint venture over an outright sale. There’s speculation that the joint venture would help Intermoda internationalise its base and boost its revenues from $5.2 million currently, to $6.5 million.

Intermoda, a 30-year-old group, in its attempt to move beyond its core area of business, which is apparel sourcing, has added raw material suppliers recently. It accounts for just 10 per cent of the total business.

Lenzing has launched a tencel fiber indigo chambray collection called Tencel 24: Day into Night. New women’s wear collection is a platform to showcase the breadth and beauty of the most recognizable type of fabrics made out of tencel.

Tencel 24: Day into Night is a new chambray indigo fiber mostly aimed at women’s apparel. The modern slants on tencel is in line with Lenzing’s commitment to fiber innovation and environmental responsibility. The Tencel 24: Day into Night collection is a conscious effort to show that adopting new environmentally responsible laundry techniques does not mean sacrificing aesthetic excellence.

To create the collection’s fresh take on classic product, Lenzing partnered with Jeanologia, a leader in sustainable garment processing technologies. Chambray indigo fabrics made with tencel fiber provide the perfect canvas for these cutting-edge finishing techniques and resulted in aesthetics which previously would not have been possible to achieve.

The Tencel 24: Day into Night collection uses complementary fiber blends across five fabrics made out of tencel fibers. The collection showcases a versatile flow of garment styles from bottoms to tops, casual to formal. Lenzing works closely with other brands across the supply chain to effectively create new fabrics and products and get them to market quickly.

www.lenzing.com/

Indonesia recently hiked import duty on a wide range of manufactured goods. This, the government hopes, will boost the domestic industry given the current economic slowdown. Business groups are elated with this decision. The Indonesian Textile Association (API) chairman, Ade Sudrajat, has stated that a rise in tariff would benefit domestic manufacturing, which would allow fairer competition between locally made and foreign goods.

The effort is to try and harmonise tariffs by imposing higher duties on finished goods and less on raw materials and intermediate goods. The textiles industry faces a great amount of production costs. These are due to higher energy costs and labour wages, which in turn, hamper competition with cheaper exports. Manufacturers in the textile industry have felt the impact of higher costs and weak demand too.

In the first quarter, textile industry cut down production by 20 per cent. Throughout the second quarter, it maintained low output, decreasing factory utilisation. Experts feel the duty rise would help revise the inharmonious tariff system. It could even be advantageous to the local industry by pushing up sales and encouraging production, consequently, lowering costs.

Tirupur's Comprehensive Economic Partnership Agreement (CEPA) with Canada and Australia has not yet been implemented. Now, exporters, from the region have urged the Centre to expedite the process and to conclude CEPA by September this year as committed earlier. A Sakthivel, President, Tirupur Exporters Association (TEA), and other industry representatives recently met Union commerce minister, Nirmala Sitharaman and requested the government to address export-related issues. Ready-made garments worth $16.82 billion were exported in 2014-15, of which, garments worth $7.23 billion were exported to the EU.

Main competition in this region for India is Bangladesh, which enjoys duty-free market in the region due to its least developed country status. The country exported about $15 billion in 2014-15 to the EU market alone, this was more than double of Indian exports.

For India, its main competitors are Bangladesh and Cambodia as they both enjoy the least developed countries tariff treatment. Pakistan and Vietnam also continue to get benefits under the General Preference Tariff (GPT). However, India imposes normal customs duty, about 20 per cent for exports to Canada. CEPA could help exporters compete with these countries effectively.

TE A also stated that it would help to include European Free Trade Association (EFTA) States, such as Norway, Switzerland, Iceland, and Liechtenstein, from country group C to country group A and make them eligible for MEIS reward rate at 2 per cent of FOB value of exports. This would help increase India's competitiveness in these countries.

Since it was established two years ago, Thailand and Vietnam’s strategic partnership is going strong and both the countries noted efficient cooperation. Vietnamese PM, Nguyen Tan Dung’s visit was concluded with a statement of 15 points, along with his counterpart host, Prayut Chan-ocha. Both recently chaired the third meeting of inter-cabinet executives with the participation of the main holders of each country.

The two leaders expressed their common intention that the trade should reach $20 billion by 2020. Dung encouraged Thailand to invest in areas of mutual interest such as maritime tourism, textiles and garments, footwear, agriculture, mechanics and chemistry. Both agreed to strengthen cooperation in labour, culture, sports, education, aquifers, science and technology, and connectivity. They also agreed to open terrestrial and coastal transportation along with Cambodia. Several agreements were signed, including those on recruitment and labour cooperation, and also about bringing together of their respective provinces.

The joint statement also devoted a space towards effective implementation of the Declaration on the Conduct of Parties in the East or South China Sea, the mutual trust there, and the exercise of self-restraint and non-use or threat of force to settle differences.