FW

Driven by international health and fitness trends, performance apparel is now one of the fastest growing sectors of the global textile industry. A recent report from Morgan Stanley Research estimates that the performance of the apparel market could add $83 billion dollars in sales by 2020, or more than 30 per cent growth, while Asia is forecast to be the biggest contributor to this sales growth.

Specifically in China, the potential in the sportswear market is huge. According to figures from the Shanghai Sports Bureau, 47 per cent of Chinese did more exercise in 2015 than the year before. They also report that the total sports market is set to be worth RMB 5 trillion ($749 billion) by 2025, of which apparel will constitute a large amount.

To capture the opportunities in this promising market, Functional Lab is making its return at Intertextile Shanghai Apparel Fabrics – Autumn Edition 2016 that would on from October 11 to 13. Exhibitors from China, Hong Kong, Israel, Japan and Korea, including key players such as Unifi, Protect Accessory, Nilit and Toyobo will showcase a broad variety of innovative fabrics with thermo-regulation, moisture wicking, increased durability, elasticity, windproof functions at the National Exhibition and Convention Center (Shanghai).

The US men’s underwear market is estimated to register a CAGR of 5.1 per cent from 2015 to 2021. The women’s lingerie market revenue is anticipated to expand at a CAGR of 5.4 per cent. This growth is attributed to increased proliferation of modern retail formats such as supermarkets, discount stores, and pharmacy stores, rising personal income of households, rising fashion consciousness, change in lifestyle, and rising awareness regarding health and fitness and personal hygiene among men and women in the country.

The mid-range segment is anticipated to contribute the highest in value terms by 2021. By age group, the 65 plus segment is expected to generate the maximum revenue by 2021 in terms of value. Based on prices, revenue from the premium range is expected to register a CAGR of 6.8 per cent over 2015 to 2021. In women’s lingerie, the bra segment is expected to register the highest CAGR in terms of both value and volume between 2015 and 2021. For men the boxer brief segment is expected to remain dominant throughout the forecast period, with a high revenue contribution.

In terms of size, the XXXL size segment is expected to expand at the highest CAGR over the forecast period.

Trident is one of the world’s largest vertically integrated home textile manufacturers with a strong presence in the terry towel segment. Trident exports its products to nearly 70 countries across the globe and 70 per cent of the revenue is earned through exports. Trident is strengthening its presence in new markets like the UK, Italy, France, Japan, Australia, South Africa and Canada.

The company has an installed capacity of 5.55 lakh spindles and 5,500 rotors capable of manufacturing 1,15,200 tons a year of cotton, compact and blended yarns. It has ten manufacturing units. The product range services the needs of the knitting, weaving, denim, hosiery, shirting and suiting segments. Yarn used to account for 60 per cent of its total revenues, whereas in FY’16 higher margin home textiles accounted for 60 per cent of its total textile revenues. In the next two years, the group expects high margin bath and bed linen products to contribute about 80 per cent.

The company has expanded its value-added range such as air rich, low tint, fade-resistant bed and bath linen products to cater to the premium segment. In India Trident is in 260 MBOs and is in all major e-commerce portals.

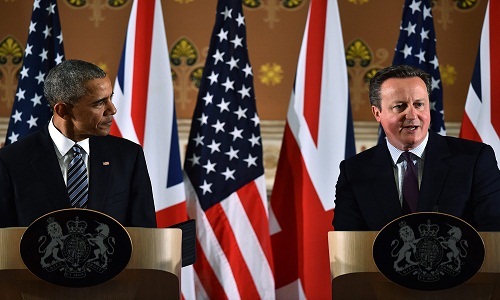

"The US opinion on Brexit and its impact and interests of US with United Kingdom and Europe , will soon be clear as the Senate Foreign Relations Committee is expected to hold a hearing with the Obama Administration. However, as the Obama administration will soon leave office, the hearing may not clarify the complete range of US opinion on the same. The discussion however, is expected to set a clear agenda for the future of US relations with Britain post Brexit."

The US opinion on Brexit and its impact and interests of US with United Kingdom and Europe , will soon be clear as the Senate Foreign Relations Committee is expected to hold a hearing with the Obama Administration. However, as the Obama administration will soon leave office, the hearing may not clarify the complete range of US opinion on the same. The discussion however, is expected to set a clear agenda for the future of US relations with Britain post Brexit. The committee is further expected to highlight the fundamental interest of US and formally conclude a free trade agreement as Britain will regain its freedom to negotiate its own trade agreements post the exit from European Union. The Committee is expected to discuss US’s important interests in Europe that do not relate to the EU most importantly, NATO, which any way will not be affected by Brexit.

Senate hearing to emphasise US interest post Brexit

The Senate hearing gains more significance as US interests and policy changes will have to base its future policies on the impending impact of Brexit. Thus US should have a fundamental interest in clean and quick Brexit. Before the referendum, voters opposing the move asserted that Brexit would cause the British economy to suffer, however, since the referendum, the British economy has strengthened, while the economies of the Eurozone have shown a deflationary spiral. Experts feel, being interdependent economies, the US, the EU, and Britain, need to tackle the uncertainty in business and economy rising over Brexit. Political leaders and policymakers in all 10 of the world’s largest economies, except France and Italy – have already expressed interest in negotiating free trade with Britain after it leaves the EU. In the US, Senators Tom Cotton (R-AR) and Mike Lee (R-UT) introduced the “United Kingdom Trade Continuity Act” on June 30, which would oblige the US. to continue its existing commercial relations with the UK until the US and Britain negotiate a free trade area. The US, therefore, should offer to assist Britain by seconding a trade expert from the office of the US. Trade Representative to Britain’s Department for International Trade. While Britain cannot conclude formal negotiations on any free trade area until it formally exits the EU, it can begin discussions now.

Talks advance for the U.S –UK free trade area

There are also talks of US-UK free trade area which would have the greatest value in practice if it focused on liberalizing trade in high-value goods, avoided any effort to harmonize regulations, clearly aligned the UK with the US as a nation outside the EU’s regulatory reach and sought over time to bring other nations that share the value that the US and Britain place on free, open, and competitive markets into their partnership.

It needs to be emphasized that US interests in Europe have never been limited to economics, rather new immigration rules that Britain will adopt after it leaves the EU will have to be considered by the United Sates.

This year's Stakeholder Conference of Cotton made in Africa (CmiA) and the Competitive African Cotton Initiative (COMPACI) was held from September 7 to 8 in Munich. This was attended by over 100 experts in the textile value chain from over 20 countries. This was also where the two ends of the textile production chain met. Companies and brands like OTTO, Ernsting's family, Engelbert Strauss, Sportscheck and Jack & Jones were at one end while cotton producers from Africa were at the other. They discussed how to achieve sustainability in the field, transparency along the supply chain, and new communication strategies for trading sustainable products. .

Helmut Fischer, Head of the Division "Sustainability Standards" at the Federal Ministry for Economic Cooperation and Development (BMZ), inaugurated this year's annual conference and underlined the importance of CmiA as one of the main standards for sustainable cotton.

Like always, the conference followed the thread from the field of fashion. Since the increased significance of sustainable cotton and textiles is fuelling demand for transparency in the supply chain, therefore Cotton made in Africa offers solutions which can be easily put into practice with the help of new technologies and expert knowledge.

CmiA is an initiative of the Aid by Trade Foundation (AbTF) and has set itself the goal of helping people to help themselves through trade in order to improve the living conditions of cotton farmers and their families in sub-Saharan Africa while on the other hand, COMPACI (Competitive African Cotton Initiative) was founded in 2008 by the Bill and Melinda Gates Foundation and the Federal Ministry for Economic Cooperation and Development (BMZ) on the back of the successful Cotton made in Africa (CmiA) pilot with a view to subsidizing the income of African cotton farmers.

Cinte Techtextil China will open its doors on October 12 upto October 14. The organizers have their final exhibitor line-up and say it happens to be one of the most diverse yet. Besides Belgium, Germany and Italian pavilions there will be a European Zone and Chinese regional pavilions, the Korea and Taiwan Pavilions feature some their best technical textiles and nonwovens suppliers. With around 450 exhibitors from 26 countries and regions set to take part and with the first time participation of the Korea Pavilion, buyers will be presented with a wider range of sourcing options at this edition. .

A report of the Korea Textile Trade Association (KTTA) informs that the Korean technical textiles market is expected to continue growing at around 5 per cent per annum for the not so distant future. This increased demand is partly due to super fibres such as aramid, carbon and PPS fibres of which Korean producers have a price competitiveness compared to other countries. .

KTTA further informs that the special products to watch out for in the pavilions this year would include textiles integrated with ICT elements such as fabrics made from piezoelectric fibre which have sensing properties, as well as high visibility fabrics using LED lights and optical fibres for use in safety clothing. Other products on offer in the pavilion would be fabrics for protective wear, heat & flame resistant yarn and fabrics, reflective fabrics and automotive seat fabrics. .

Two of the big names in this pavilion will be Sam Hwa Machinery and Daejung. While Sam Hwa manufacturers of needle punching machines, as well as nonwoven complete production lines for geotextiles, automotive interiors, artificial leather and more, Daejung produces high tenacity polyester (polypropylene) woven geo textiles, as well as bi-axial and uni-axial woven geo textiles made of polyester multifilament yarn and bi-axial woven geo textiles made of polypropylene multifilament yarn. .

Despite global uncertainty, numbers confirm that the turnover of Italy's women’s wear is on the upswing. Companies in the sector including apparel and outer wear, shirts and leather goods ended last year on a happy note with revenue of €12.8 billion, up 2.5 per cent compared to the 1.4 per cent growth registered by men’s wear.

These figures were issued by Istat in the course of the presentation of the eighth annual Super Salon organised by Pitti Immagine at Milan during the pret-à-porter show. Revenue of women's wear accounted for 24.4 per cent of the entire turnover of the textile and fashion industry. This can be considered as one of the feathers in the cap of the country’s textile manufacturing industry.

Meanwhile Italy’s domestic demand has been gradually falling. It was 2.9 per cent in 2015 though a bit above the 2014 level. But foreign markets are encouraging the sector. Last year, exports rose 5 per cent in value surpassing €7.7 billion. Exports account for 60.4 per cent of revenue in the sector and are generating a trade surplus of more than €3.4 billion.

This year started significantly on a number of fronts but for women's fashion, Made in Italy was edged out at least in terms of exports. The dip is due to a slowdown in the U.S. which fell 1.4 per cent in the first six months of the year while disappointing results came from Japan (-1.2 per cent) and South Korea (-2 per cent).

The Trans Pacific Partnership may lower demand for some US textile exports. The TPP would allow western hemisphere apparel manufacturers to use yarn and fabric made anywhere in the TPP region and still enjoy preferential access to the US market. So many Vietnamese textile manufacturers could, at some future time, compete with US exporters in Mexico and Central America.

More than a third of US textile production is exported, mostly to western hemisphere nations. US textile manufacturers produce yarn, thread, and fabric for apparel, home furnishings, and various industrial applications. US manufacturers of industrial textiles may experience more direct competition from Japan, also a leading producer of industrial textiles.

TPP includes a yarn-forward rule of origin that would allow a garment to enter the US duty-free only if yarn production, fabric production, and cutting and sewing of the finished garment all occur within the TPP region. However, 187 fibers, yarns, and fabrics in short supply in TPP member countries could be sourced from outside the region, including China.

Products of western hemisphere nations have duty-free access to the US provided they incorporate US-made yarns and fabrics. However, TPP’s 11 non-US members would also have duty-free access to the US market for textiles and apparel.

A new report from technology consultancy Cientifica brings reveals how smart textiles are creating a fourth industrial revolution for the textiles and fashion industry. It is expected to be worth more than $130 billion by 2025. Cientifica founded as CMP Cientifica in Madrid in 1997 to meet advanced analytical needs of the European Space Agency, says the rapid adoption of smart textile technologies has the ability to make the current generation of wearables from Apple and Samsung quickly obsolete while providing significant opportunities in the sportswear market.

Instead of attaching a sensor to a garment, the sensor is increasingly the garment itself, providing significant opportunities in health and wellbeing, sports, medical monitoring, fashion and entertainment. The report tracks more than a hundred the leading companies in a sector predicted to show triple digit growth. It also examines issues ranging from data acquisition to energy storage and generation.

Advances in nanotechnology, organic electronics and conducting polymers are creating a range of textile-based technologies with the ability to sense and react to the world around. This includes monitoring biometric data such as heart rate and respiration, or environmental factors such as temperature and the presence of toxic gases. These textiles also have the ability to provide real time feedback in the form of haptic feedback, changes in color, temperature or electrical stimuli.

The report identifies third generation wearables as representing a significant opportunity for new and established textile companies to add significant value without having to directly compete with Apple, Samsung and Intel. The rise of textile wearables also represents a significant opportunity for manufacturers of the advanced materials used in their manufacture. Toray, Panasonic, Covestro, DuPont and Toyobo are said to be already suppling the necessary materials, while researchers are creating sensing and energy storage technologies, from flexible batteries to graphene super capacitors which will power tomorrows wearables. The report details the latest advances and their applications.

The 19th edition of Techtextil Symposium will be held in Germany, May 9 to 12, 2017. It will revolve around technical textiles, functional garment fabrics and their multifarious applications. Each area of application has specific requirements with regard to the properties and production of technical textiles. Textiles are the key to new solutions in fields such as architecture, medicine and safety.

Renowned experts will present latest research results as well as new products and applications. In addition to the proven lecture format, discussions and workshops will facilitate an active exchange of ideas for the first time.

The symposium permits an interactive debate about current problems and innovative visions of the future, and opens up new perspectives for participants. The focus of Techtextil Symposium will be on new developments, trends and potential areas of application for technical textiles and nonwovens. Emphasis will be given to both processing and new products. Special themes include apparel textiles, including smart textiles and wearables, bio materials, bio-degradable materials, printing technologies, such as 3D and digital printing, modern marketing tools for launching products onto the market and the internet of things with regard to textile machines and sustainability.

At Techtextil 2015, 34,000 trade visitors saw new products being shown by 1,389 exhibitors.