FW

The textile industry in Bangladesh says the fiscal targets set in the budget are unrealistic. It says the government hasn’t properly implemented the annual development program. It wants the government to withdraw the tax on education in private institutions.

The objectives of the budget appear to be high revenue growth targeted for underwriting overreaching expenditure, harmonisation of taxes and tariffs to support selected domestic sectors and higher allocations for building physical infrastructure and capacities.

However reform initiatives need to be given the highest priority if the current macroeconomic stability is to be translated into a journey of higher growth trajectory.Since projects remain behind schedule and get extended, no project other than the mega ones would be extended for more than two years.

To break the decade-long six per cent GDP growth barrier, the establishment of five independent commissions would be of great importance. The commissions are statistical validation, agriculture price, local government financing, public expenditure review and financial sector reform.

Private sector investment, which is the engine for growth, has not taken off the past few years due to insecurity, poor democracy and a lack of business-friendly environment. The continuous recapitalisation of state banks with taxpayers' money has been criticised as it sends out a wrong signal and encourages culprits to embezzle money again and again.

The Competition Commission has approved the Rs 233-crore deal for the acquisition of Birla Textile Mills (BTM) by Sutlej Textiles and Industries.The consideration for purchase of BTM from Chambal works out to be Rs 232.63 crores (including net current assets) subject to closing and other adjustments, if any. The Competition Commission of India (CCI) has communicated its approval.

Birla Textile Mills is the textile division of Chambal Fertilisers and Chemicals located at Baddi, Himachal Pradesh. Birla Textile Mills is well equipped with most modern state of the art textile machineries and sophisticated quality control equipment.

Sutlej Textiles and Industries, the flagship company of the KK Birla Group, had received the approval from its board of directors to acquire Birla Textile Mills in March this year.

On June 12, 2015, Sutlej Textiles and Industries closed at Rs 343.60, down Rs 6.4, or 1.83 per cent. The 52-week high of the share was Rs 445.45 and the 52-week low was Rs 292.30.

The company's trailing 12-month EPS was at Rs 70.48 per share as per the quarter ended March 2015. The stock's price-to-earnings ratio was 4.88. The latest book value of the company is Rs 352.78 per share. At current value, the price-to-book value of the company is 0.97.

www.birlatextile.com/

Seed companies have challenged the Maharashtra government’s decision to reduce the price of genetically modified (Bt) cotton seed. The state government had announced a price cut by 10.5 per cent on June 8 .

Seed producers say the price cut has hurt them and has hit their ability to service farmers. They say unless they are adequately paid, they would not be able to invest in research and development. At the beginning of the season, seed producers had urged the government to raise cotton seed prices in tune with the increase in input costs.

Seed companies say while the cost of seed production has increased by 10 to 15 per cent in the past four years due to a proportionate rise in labor, fertiliser and other input costs, their prices have remained unchanged. They say the price cut would force many seed-producing companies to shut their business.

The companies made requests to Telangana, Andhra Pradesh and Maharashtra to raise prices. All these states said farmers’ condition was not favorable in the country and seed producers agreed with this assessment. However while Telangana and Andhra Pradesh did not take any further action, the Maharashtra government went ahead and lowered the price.

Of 250 companies engaged in seed production across the country, 104 are based in Maharashtra.

The Mafatlal Industries (MIL) has been awarded India's No.1 Brand in 2014 under India’s Best Textile Company category by the No.1 Brand Awards Council. In a statement, Rajiv Dayal, Managing Director of Mafatlal Industries, the flagship company of the Arvind Mafatlal Group, said, “We are delighted to receive this award.”

MIL is the owner of trademark and copyright in the intellectual properties of all name, font and style of Mafatlal, Mafatlal Suitings, Mafatlal Fabrics.

MIL, incepted in 1905, has two vertically integrated composite mills at Navasari and Nadiad in Gujarat. Company’s product portfolio consists of yarn dyed and piece dyed shirtings, fibre dyed suitings in various polyester, viscose, cotton and woollen blends, voiles, prints, linens, bleached white fabrics, rubia, poplins, cambric, women’s garments, value added and fashion denims, school uniform fabrics, corporate/institutional uniforms, bed & bath linen and readymade garments.

After celebrating its milestone 10th anniversary last year, Interfilière Shanghai is back on October 12-13, 2015 at the Shanghai Exhibition Center. The event will showcase intimates and swimwear, and continue to bring incomparable business opportunities and market insight to the industry. The expertise of Eurovet gathered since its inception over 50 years ago has positioned its shows globally as the must-attend events, and the 11th Interfilière Shanghai will once again play a leading role in bringing high quality business inspiration for professionals worldwide.

Over the past 10 years, Interfilière Shanghai has grown impressively with participating exhibitors growing by five times. In 2014 it saw 275 exhibitors from 16 countries. Nearly 7,300 visitors from 53 countries visited, while 76 per cent of them were from Mainland China.

In 2015, Interfilière exhibitors will be clearly spread over seven product-based sectors not only in West and East wing, but also in the Central hall. In addition, seven sectors will be renamed to be identical to its sister show, Interfilière Paris. New sector names are Lace it (Lace), Brod’cust (Embroidery), Neoskin (Fabric), Access’Folies (Accessories), Creative (Textile Design), OEM/ODM, Hi’Tech (Machinery/ software).

Following the successful launch of last year, Interfilière Shanghai will create the beach forum once again, 100 per cent dedicated to beachwear and swimwear. General trend forum will solely focus on intimates, loungewear and sportswear. These two forums will enable visitors to build a comprehensive understanding of the coming Spring/Summer 2017 trends through a sophisticated showcase of the latest cutting-edge products from exhibitors.

China's has formulated a standard for infants’ and children's textile products. The new standard is sub-divided into two parts—for infant wear suitable for children aged and under 36 months, and for kidswear suitable for children over three years old and under the age of 14.

Further, in terms of security requirements, children’s clothing is divided into types A, B and C. While A is the best, followed by type B, type C is the basic requirement.

In terms of chemical safety, six kinds of plasticisers and lead, cadmium and two kinds of heavy metals are also included in the list of harmful substances, which makes the standard equivalent to EU standards and higher than US standards.

In terms of mechanical safety, the standard makes detailed provision for cords in different parts of children’s wear. For clothing meant for infants and children below seven years, the standard specifically mentions that there should not be any rope or belt around the neck area.

Accessories, including but not limited to buttons and zippers, must conform to the specified range of tensile strength, and should not contain any sharp edges or points. In addition, the standard has also increased requirements for combustion performance.

Although the standard would be formally implemented from June 1, 2016, a two-year transition period has been announced for the implementation of the standard from June 1, 2016 to May 31, 2018.

During the transition period, products manufactured prior to June 1, 2016, but not meeting the requirements of the new standard would be allowed to be sold in the market. However, beginning June 1, 2018, all products sold in the Chinese domestic market must meet the standard.

The Brazil International Apparel Sourcing show (BIAS 2015) was held May 27 to 29. This is an event that showcases leading Asian apparel manufacturers from India, China, Bangladesh, Pakistan, Indonesia, Vietnam and Sri Lanka for buyers from USA, EU, East Asia, Australia, and New Zealand. Brazil is South America’s largest apparel market.

BIAS 2015 attracted buyers not only from Brazil but also from other South American countries such as Chile, Peru, Uruguay, Colombia, Paraguay and Venezuela.

Sri Lanka made a strong impact on the show. Among the Lankan apparel items showcased at BIAS 2015 were men's and women's jackets, trousers, shirts, boxer shorts, men’s undergarments, women’s and girls’ blouses, dresses, pants, and casual wear.

The Lankan apparel industry has identified Brazil as an important emerging market. The first Lankan delegation to Brazil was in 2014 was led by nine companies. As a result, many business contacts have been directly established with Brazilian brands and international brands and retailers.

The Brazilian apparel market stood at 42 billion dollars in 2013/14 while the second largest South American apparel market, Mexico, was only $14 billion in the same period.

Sri Lanka exported apparels worth 18 million dollars to Brazil in 2014. In 2014, Brazil was the 22nd buyer of Lankan apparels, standing above Saudi Arabia and immediately below Ireland.

cems-apparelsourcing.com/

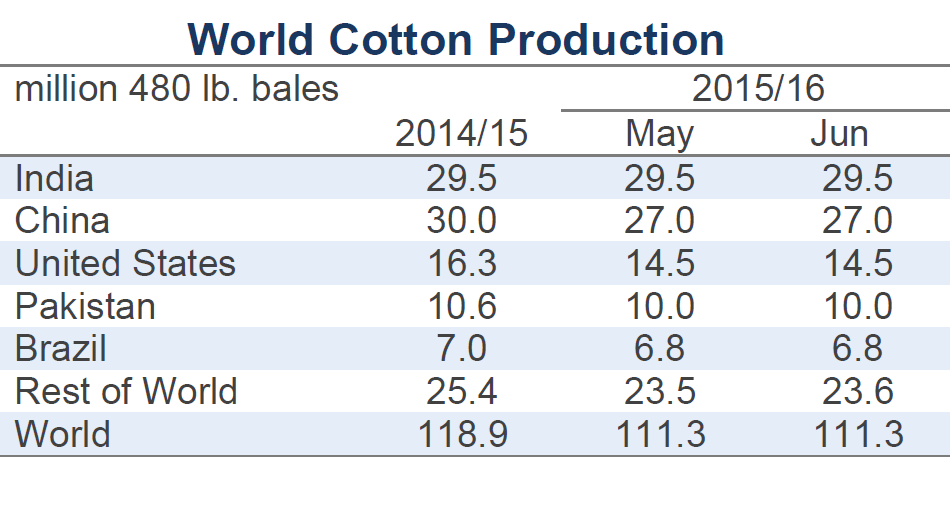

Few significant changes were made to cotton market forecasts for 2015/16 in the latest USDA report. The world production figure increased only 70,000 bales and was essentially unchanged at 111.3 million bales. The world consumption estimate increased only 30,000 bales and was essentially unchanged at 115.3 million bales. The projection for world ending stocks was lowered slightly 217,000 bales from 106.3 million to 106.1 million.

At the country-level, there were no significant changes to 2015/16  harvest forecasts, with only

harvest forecasts, with only

minor revisions made to several West African countries. In terms of mill-use, the only notable country level revision was for Turkey with over 100,000 bales, from 6.3 million to 6.4 million. Trade figures increased 130,000 bales, with the change to global figures primarily resulting from a slight increase to the Turkish import number of over100,000 bales, from 3.6 million to 3.7 million and minor increases in export forecasts from Turkmenistan and West Africa.

Major changes in global cotton outlook

There were several changes made to 2014/15 estimates. The largest was a 500,000 bale reduction to the Indian crop forecast from 30 million to 29.5 million. Along with a 100,000 bale increase to the estimate for Benin, the world production estimate for the current crop year increased 415,000 bales from 118.9 million to 119.3 million. The global mill-use number for 2014/15 was virtually unchanged to over 20,000 bales at 111.5 million, with a slight increase in Turkish consumption offset by minor decreases in Zambia and Zimbabwe. The Turkish import estimate also increased 100,000 bales. In combination with a 300,000 bale increase to the Chinese import figure, these changes lifted the global import figure by 450,000 bales. The corresponding increase in exports was primarily a result of a higher forecast for India with over 300,000 bales, from 3.8 million to 4.1 million.

The 2014/15 crop year can be seen as a period of transition. This transition was made evident by the decreases in prices between the planting and harvesting of last year's crop. The easing in prices was a product of changes in the world's supply and demand situation, with the most significant developments in terms of fundamentals stemming from reforms in Chinese policies. These reforms emphasized increased use of domestic cotton supplies and resulted in sharply lower imports. Since China is the world's largest source of demand, lower Chinese imports were a significant factor contributing to the increase in stocks in many exporting countries in 2014/15. In turn, this increase in available supply was been a primary reason why prices declined.

In the upcoming 2015/16 crop year, it appears that the most important transitions relative to price direction that were made in 2014/15 will be maintained. Significant year-over-year declines in acreage and production are expected and, although it remains a point of contention among cotton analysts, the USDA is also forecasting a relatively strong increase in mill-use to follow the decrease in prices.

Global trade and stockpile direction

While these changes are notable, recent crop years have highlighted the importance of trade and the allocation of stocks to price direction. Examination of forecasts for both trade and stock allocation in 2015/16 suggests only small changes that may not be enough to push prices outside of recent trading ranges. Chinese import demand is predicted to continue to be depressed. At 6.0 million bales, the current forecast calls for imports in 2015/16 to be 25 per cent below the 2014/15 volume and 70 per cent below the average level of imports during the period of aggressive reserve purchases between 2011/12 and 2013/14. Global cotton trade in 2015/16 is expected to total 33.8 million bales, which is only 1 per cent below the total volume in 2014/15.

With the decrease in Chinese imports in 2014/15, stocks outside of China increased to a record level. Despite declines in acreage and production in most countries in 2015/16, stocks outside of China are expected to change little in the coming crop year and are projected to decrease only 2 per cent from 43.4 million to 42.5 million.

Since trade figures and stocks outside of China levels are expected to be stable, it may be appropriate to think of 2015/16 as a period of consolidation, when the most important transitions relative to price direction made in 2014/15 were upheld. Considering that global stocks remain extremely high by historic standards, and assuming China will release reserves if prices move higher, this consolidation may signal the beginning of an era of consistently low prices.

Textile and apparel conglomerate, Arvind Group has partnered with US-headquartered Invista, owner of the Lycra fibre brand, to manufacture stretch denim fabric in India.

As part of this collaboration, Arvind will ensure that all of its denim fabrics are provided with an Arvind-Lycra co-branded hangtag, communicating the benefits to the end consumer. Arvind holds 12-14 percent of the denim market in India with sales of 450 million meters per month. The company is targeting 20-30 percent growth by the end of the year.

Denim maker posted 28 percent decline in standalone net profit at Rs 68 crores for the quarter ended March 31, 2015 against Rs 95 crores in the same period last year. The company's standalone net income increased by 5 per cent to Rs 1,349 crores during the quarter from Rs 1,284 crores reported in the corresponding quarter last year. For the financial year ended March 31, 2015, the company's standalone net profit stood at Rs 377 crores against Rs 361 crores in the previous year. Standalone net income was Rs 5,225 crores. On a consolidated basis, Arvind posted a net profit of Rs 48 crores, down 96 per cent, against Rs 94 crores in the corresponding quarter a year ago.

Bangladesh is hosting Gar Tex Show 2015 from June 11 to 13. This is a garment, textile machinery and equipment fair. Entrepreneurs from six countries, including Bangladesh, are participating in the ongoing fair. About 140 stalls have been set up to showcase the latest garment and textile machinery and technology.

Among the exhibits are automation systems, unit production systems, finishing, fusing, pressing, ironing and steaming equipments, sewing machinery, testing equipment and controls, embroidery equipment, spinning machinery and accessories, steaming machinery, textile screen printing machinery, weaving machinery and accessories, winding machinery, yarn processing. Visitors are: garment, knitwear, textile and leather goods manufacturers, design studios and institutes, apparel brands and labels, buying agents, fashion designers and merchandisers, distributors and agents of textile and garment machinery and accessories, CEOs, engineers and technocrats.

Bangladesh plans to increase focus on garment and textile sector to lead in the world. The government is providing all necessary support to make this sector more vibrant. It continues to make available modern technologies and machineries related to this sector.

The textile and garment industry has been playing a leading and growing role in the Bangladesh economy. World-wide textile and readymade garment players are taking an interest in Bangladesh in their investment planning.

www.tradefairdates.com/The-GarTex-Show-M11818/Dhaka.html