FW

Ralph Lauren’s net revenues have grown five per cent. The American fashion retail giant also saw a respectable growth in underlying comparable sales. Bottom line of the brand boosted its operating income by 12.9 per cent over last year. A lot of this is attributed to lower discount rates offered by the company mainly in wholesale channel.

A more focused and disciplined approach in producing new collections over the last few months has helped in not only enhancing its sales but also in building connectivity with consumers. The last few years have been about cutting costs. Ralph Lauren is on the right track. What it needs now is a focused business strategy.

Ralph Lauren has ambitious plans to increase sales by a billion dollars by 2023. Marketing spend will go up by a $100 million over the next five years. The goal is to woo the next generation of consumers and increase gross margins by improving the core product (which makes up 60 per cent of overall revenue), amplifying under-penetrated categories (including women’s, outerwear and denim) and operating with discipline, which constitutes being more careful about discounts and promotions, more strategic when it comes to price, and cutting costs in creative-but-impactful ways.

Huntsman has invested in equipment to boost the research and development services it offers to footwear producers and their manufacturing partners. To enrich its work across the entire footwear value chain and create fully equipped testing and prototyping environments, Huntsman recently purchased machines that give it extra technical support capabilities in the field of polyurethane casting; direct-on production; multi-section injection molding; and TPU injection molding.

Global chemical company Huntsman is a leading developer of innovative polyurethane and thermoplastic polyurethane materials for the footwear industry. Throughout Asia, the Americas and Europe, the business has a number of technical centers that provide specialist support to the footwear industry. Part of a much larger global network of Huntsman innovation and customer care centers, these footwear hubs offer design, prototyping, testing and technical support services to some of the world’s most well-known footwear brands.

Many of the footwear companies Huntsman works with are big global brands. These companies want their material suppliers to have a similar geographic footprint – not just in terms of people, production and supply, but also for the delivery of innovation services and technical support. The recent investments have been made with the needs of these customers in mind.

How committed apparel companies are to fighting harassment and discrimination in their supply chains is uncertain. The $2.4-trillion global apparel industry employs millions of workers globally, mostly women. But women experience specific challenges at work because of gender, including pregnancy-based discrimination and sexual harassment.

There is a desperate need for a binding convention because 59 countries do not even have any specific legal remedies against sexual harassment at work. Even where legal remedies exist, they are often poorly enforced.Social audits are one of the primary tools apparel brands use to monitor conditions in factories across global supply chains, to check gender-based violence or harassment at work.

But social audits are not designed to elicit information about gender-based violence or harassment at work. They are not designed to overcome the specific barriers to reporting such harassment. They do not sufficiently create a safe space for workers who experience such harassment.

Violence against women is one of the most prevalent human rights violations. Gender-based violence makes women all around the world suffer daily and undermines their health, dignity and security. Pressure to meet fast fashion deadlines is leading to women working in factories across Asia being sexually and physically abused.

The world’s leading textile and garment technology exhibition, ITMA 2019, will be complemented by several key forums when it is held in Barcelona in June, two of which are the ITMA-EDANA Nonwovens Forum and Textile Colourant and Chemical Leaders Forum.

Nonwovens, and chemical and colourant forums unveil key speakers

Mr Fritz Mayer, President of CEMATEX, said: “As technological developments are happening at breakneck speed, and collaboration is becoming increasingly necessary in a globalised economy, the industry has to stay abreast of the latest developments and trends. Hence, ITMA will be staging several forums to help participants be ahead of the competition curve.

“The forums also offer a valuable platform for various associations and professionals to connect and network with the right players. This is especially important as collaboration and partnerships from research institutions to technology, chemical and raw material providers and users are increasingly more critical to business success.”

ITMA-EDANA Nonwovens Forum

The Nonwovens Forum is jointly organised by ITMA and EDANA. To be held on 21 June 2019, it will highlight the latest innovations in nonwovens. The theme of the forum is ‘Nonwovens Manufacturing Processes for the 21st Century: More Flexible, More Efficient, More Sustainable’.

Mr Pierre Wiertz, EDANA’s General Manager said: “The nonwovens industry is a bright spark in the textile world. We are glad to be able to collaborate with ITMA to bring these exciting opportunities to visitors who are involved in or have the intention to move into nonwovens manufacturing.”

Providing the latest industry insights will be keynote speaker Mr David Allan, Editor, Nonwovens, RISI (United States). His presentation is titled ‘Global Trends in Nonwoven Processes under Economic and Sustainability Constraints’.

The forum will feature three sessions:

Circular economy/challenges & opportunities for processing bio-based & recycled materials on nonwovens machinery

Latest trends and innovation in nonwoven processes – including hybrids and composites

Innovations in nonwovens technology

In addition, there will be a panel discussion with experts from leading centres of excellence in nonwovens who will exchange their views on the nonwoven processes of the 2030s.

Textile Colourant and Chemical Leaders Forum

The 3rd Textile Colourant and Chemical Leaders Forum @ ITMA 2019 on 23 June will focus on the circular economy and resource sustainability strategy and how innovation will drive future industry success. Launched at ITMA 2011, the forum, is an industry initiative that draws lively participation from dyestuff, colour and chemical professionals from around the world.

Themed ‘Meeting Resource Challenges in the Circular Economy’, the 2019 forum explores how textile chemicals and innovative and cleaner technologies can help create a more sustainable future for the textile and garment industry.

Presentations at the forum are clustered into three sessions:

Resource management and Industry 4.0

Responding to sustainability challenges with innovation

Envisioning the future of the colourant and chemical industry

Chairing the forum is Mr Andrew Filarowski, Technical Director of Society of Dyers and Colourists. He said: “The forum has been an eagerly-awaited event at each ITMA edition as it is an inclusive industry platform that takes in perspectives from all stakeholders of the textile and garment supply chain. Organised by the industry, it allows like-minded industry players to exchange knowledge on the latest innovations and solutions, understand current issues and trends in a global context.”

Speakers confirmed for the forum include Ms Christina Raab, Global Implementation Director of The ZDHC Foundation. She will speak on the role of chemistry for circularity in textile, leather and fibre production. She will also elaborate on ZDHC’s approach and tools to drive the transition and uptake of safer and more circular chemistry, as well as the current state and findings of circular implementation projects from the sector.

Another speaker is Ms Dunja Drmač, Sustainability Officer of the European Apparel and Textile Confederation (EURATEX). Her presentation will enlighten participants on resource sustainability and relevant strategies in the journey towards a circular economy.

In addition to the forums, other knowledge sharing activities include the ITMA Innovation Lab. An important element of the lab is the ITMA Speakers Platform where all ITMA exhibitors have been invited to participate. The Platform will be complemented by a video showcase. A new highlight, the ITMA Innovation Video Showcase will provide a new channel for visitors to learn more about innovative exhibits at ITMA 2019.

Registration for both forums is open at http://www.itma.com. Details of other co-located events at ITMA 2019 can also be found on the website.

ITMA 2019 will be held from 20 to 26 June at Fira de Barcelona, Gran Via venue. The exhibition will feature over 1,600 exhibitors who will be showcasing their latest technologies and sustainable solutions for the entire textile and garment manufacturing value chain, as well as fibres, yarns and fabrics

KARL MAYER has developed a new warp knitting machine with the weft insertion, the TM WEFT, and has successfully launched it at an in-house show held at its Chinese subsidiary in Changzhou. Representatives from more than 10 companies came every day during January 15-18 to attend the machine presentation. These included knitters and weavers as well as finishers interested in moving into textile production. They travelled from all over China, mainly from Jiangsu and Zheijiang, as well as from Shandong and Hebei. They were all impressed by the cost:benefit ratio of the machines on show.

Two models of the TM WEFT, 247”, E 24, were being demonstrated, both producing an interlining, i.e., a traditional fabric with one guide bar and a version having a higher drapabiity for special applications with two guide bars.

Two models of the TM WEFT, 247”, E 24, were being demonstrated, both producing an interlining, i.e., a traditional fabric with one guide bar and a version having a higher drapabiity for special applications with two guide bars.

Both machines were running at an impressive level of stability and at a high speed of 1,500 min-1. The entire concept was well received. The feedback according to Hagen Lotzmann was that “Our customers were impressed by our focus on the functions, easy operation and reliability of the TM WEFT.”

Together with Steffen Trabers from ILLIES China, the company’s agent in the region, the Sales Manager of KARL MAYER Technische Textilien had detailed conversations relating to specific projects. The first machines have already been sold and further orders are expected over the next few months.

With its features and conceptual direction, the TM WEFT, as a basic model, is designed to complement the existing WEFTTRONIC II HKS, which will continue to be available for the high-end market.

KARL MAYER is thus extending its tried-and-tested two product line strategy in its technical textiles business unit.

ROSH-HA`AYIN, Israel, Feb. 11, 2019 (GLOBE NEWSWIRE) -- Kornit Digital Ltd. (NASDAQ: KRNT), a company that develops, designs and markets innovative digital printing solutions for the global printed textile industry, today announced it has received an order from DTG2Go, a Delta Apparel, Inc (NYSE American: DLA) company and leader in the direct-to-garment printing and fulfillment marketplace.

The order follows several months of beta-testing of the recently released Kornit Atlas system by DTG2Go, during which Kornit was able to showcase the enhanced features of the most advanced industrial direct-to-garment solution available on the market. Key features of the Atlas include high volume throughput, attractive cost of ownership and featuring the new NeoPigment™ Eco-Rapid inkset specifically designed for sustainability and retail-quality digital textile printing. Per the agreement, DTG2Go will take delivery of 10 Atlas systems in 2019, along with a significant number of HD upgrades for DTG2Go’s existing Kornit Avalanche systems.

Kornit’s Chief Executive Officer, Ronen Samuel commented, “We are honored to expand our partnership with Delta Apparel as a key technology supplier as they expand their reach with digital printing. Delta’s unique platform strikes at the core of the changing needs in the retail supply chain, by offering a vertically-integrated digital print fulfillment model with quick delivery at an affordable price. The inclusion of the Atlas will greatly enhance the options and capabilities that Delta will be able to offer its customers. The all-new industrial Atlas has leading-edge technology with annual production capacity of over 350,000 impressions and optimizes production efficiency at the best cost of ownership available. We look forward to working collaboratively with Delta to deliver on this order and expand on this important relationship.”

"We are excited about the order with Kornit Digital. This marks another milestone in Delta and Kornit's strategic partnership and we look forward to continuing our close collaboration in 2019,” commented Deborah Merrill, Delta Apparel Inc.’s CFO and President, Delta Group. Ms. Merrill continued, “Many of the new, innovative capabilities of the Kornit Atlas, including the wrinkle detection and pallet ergonomics, present clear productivity benefits. The new NeoPigment™ Eco-Rapid ink used in the Atlas provides impressive brilliance and color gamut, meeting all wash test standards with no discernible scent. We are glad we had the opportunity to beta-test the Kornit Atlas and look forward to it serving as a key component within DTG2Go's production line.

Our recent decision to upgrade our Avalanche printers to the HD technology will allow us to use Eco-Rapid ink on these systems and enjoy its benefits. We see the Eco-Rapid ink as a strategic enabler that should help us increase our market share in digital print.

Lastly, we look forward to testing Kornit's new polyester printing technology in the coming weeks. The ability to digitally print on 100% polyester fabric and other poly-blends is key to our strategy and should create significant growth opportunities for DTG2Go. We see a strong demand for digital printing on polyester, and are thrilled to be the first to introduce to the market high-end polyester products with unmatched print quality."

About Kornit

Kornit Digital (NASDAQ:KRNT) develops, manufactures and markets industrial digital printing technologies for the garment, apparel and textile industries. Kornit delivers complete solutions, including digital printing systems, inks, consumables, software and after-sales support. Leading the digital direct-to-garment printing market with its exclusive eco-friendly NeoPigmentTM printing process, Kornit caters directly to the changing needs of the textile printing value chain. Kornit’s technology enables innovative business models based on web-to-print, on-demand and mass customization concepts. With its immense experience in the direct-to-garment market, Kornit also offers a revolutionary approach to the roll-to-roll textile printing industry: Digitally printing with a single ink set onto multiple types of fabric with no additional finishing processes. Founded in 2003, Kornit Digital is a global company, headquartered in Israel with offices in the USA, Europe and Asia Pacific, and serves customers in more than 100 countries worldwide. For more information, visit Kornit Digital at www.kornit.com.

About Delta Apparel, Inc.

Delta Apparel, Inc., along with its operating subsidiaries, Salt Life, LLC, M. J. Soffe, LLC, and DTG2Go, LLC, is an international design, marketing, manufacturing, and sourcing company that features a diverse portfolio of core activewear and lifestyle apparel and related accessory products. The Company specializes in selling casual and athletic products through a variety of distribution channels and distribution tiers, including department stores, mid and mass channels, e-retailers, sporting goods and outdoor retailers, independent and specialty stores, and the U.S. military. The Company’s products are also made available direct-to-consumer at its branded retail stores and on its websites at www.saltlife.com,www.coastapparel.com, www.soffe.com and www.deltaapparel.com. The Company’s operations are located throughout the United States, Honduras, El Salvador, and Mexico, and it employs approximately 7,800 people worldwide. Additional information about the Company is available at www.deltaapparelinc.com.

Gopinath Bala, CEO and Technical Director, SAF, and Regina Brückner, CEO, Brückner. © Brückner Textile Technologies

Gopinath Bala, CEO and Technical Director, SAF, and Regina Brückner, CEO, Brückner. © Brückner Textile Technologies

A state of the art Brückner multi-purpose coating line for technical textiles has been successfully commissioned and is operating since the beginning of 2018 at Sri Venkatalakshmi Spinners (SVS) in Udumalpet, a textile town about 70 km from Coimbatore City, in the South of India. SVS was established in 1980 and now focuses primarily on the spinning of different yarn qualities, the manufacturing of various types of fabrics by weaving, circular knitting and warp knitting, and the manufacturing of various coated materials and technical textiles.

SVS strives to maintain its environmental sustainability efforts by generating its own electric power through grid-connected wind mill and it is currently working on a large-scale LT photovoltaic power generator project. After a careful consideration of today’s business, the change in the technological environment and its capability, SVS has established a modern coating infrastructure to become an integrated value-added manufacturer of technical textile products.

The company started its technical textiles production in December 2017 under the name of SVS Advanced Fabrics – (SAF). The project is one of the most modern and advanced production units in India. The company currently mainly specialises in high-tech preparation for digital printing, automotive fabrics, functional textiles for sports and leisure, as well as fabrics for architectural purposes.

Panoramic view of the state-of-the-art technical textile plant at SVS Advanced Fabrics (SAF) with the multi-purpose Brückner coating line. © Brückner Textile Technologies

SAF has partnered with Brückner Textile Technologies to ensure that the machine will be customised exactly to the company’s needs. Brückner’s local partner, Voltas (Textile Machinery Division) supports the customer with the troubleshooting and spare parts supply. The modern Brückner coating line is equipped with the best in class heat consistency, environmentally friendly heated with LPG fuel.

An integrated Zimmer, Austria coating head with a high precision magnet roller coating head and a screen coating and printing facility, ensures in combination with a Mahlo (Germany) QMS weight measurement system that the coated products (mainly preparation for printing) always meet the specifications consistently at high levels, the company says.

“SVS choose Brückner because it was the clear leader and a strong knowledge partner with a very long history of experience in the technical textiles industry,” explained Gopinath Bala, CEO and Technical Director.

“Brückner had adopted to technical textiles and started providing machinery to the industry way back when Europe started its ventures in technical textiles. SAF is a new company venturing into technical textiles, having a strong knowledge partner in various spectrum of products and processes to support us was the main reason for us to choose to partner with Brückner. Additionally, Brückner’s equipment is of a very high quality, precisely engineered, low-maintenance and consumes the lowest energy levels.”

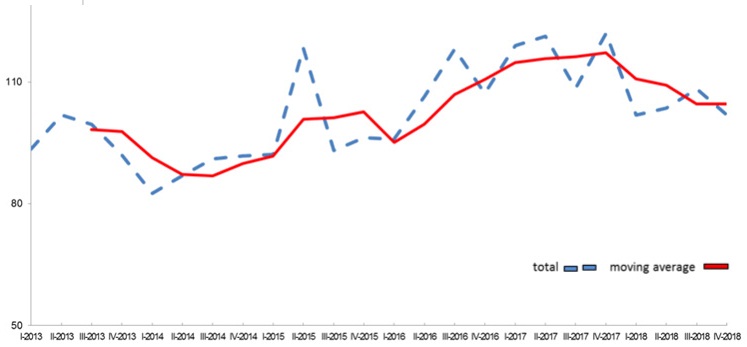

The orders index for textile machinery for the period ranging from October to December 2018, as compiled by ACIMIT, the Association of Italian Textile Machinery Manufacturers, fell compared to the same period for 2017. The index value stood at 101.9 points (basis: 2015 =100).

Orders gathered by Italian machinery builders were thus negative both in Italy and abroad. On the domestic front, the index stood at an absolute value of 148 points, that is, fully 12% less than the same period for October to December 2017. However, foreign markets were even further down at -16%, with the index standing at an absolute value of 98.1 points.

ACIMIT president Alessandro Zucchi commented, “The evolution of the domestic market reflects an overall sense of uncertainty that has accompanied the new national budget legislation, not to mention the comparison with a record fourth quarter for 2017.” Zucchi added that, “On foreign markets, our machinery manufacturers are having to face geopolitical situations that have considerably slowed investments. Turkey, Iran, and even China, all primary markets for our sector, have recorded a drop in demand for textile machinery, for a variety of reasons.”

“Based on preliminary results elaborated by our Association,” concludes ACIMIT’s president, “2018 closed with a downswing both in terms of foreign sales and total production. The overall sentiment for 2019 isn’t very positive either, but the entire sector is putting its trust in ITMA, the primary trade fair for the entire world textile machinery industry, held every four years. This year, the fair will be held in Barcelona

"As per Sanjay Kumar Jain, Chairman, CITI, India’s cotton yarn and fabric exports are struggling due to the duty disadvantage faced by exporters in major markets. There has been continuous decline in cotton yarn and fabric exports from 2013-14 to 2017-18. India’s export of cotton yarn declined 25 per cent from $4,570 million in 2013-14 to $3,443 million in 2017-18. Fabric exports, during the same period, declined 7 per cent from $4,941 million to $4,598 million. China, the largest importer of cotton yarn has shifted focus from India to Vietnam, Indonesia as these countries offer duty free access, while Indian yarn carries a 3.5 import duty."

As per Sanjay Kumar Jain, Chairman, CITI, India’s cotton yarn and fabric exports are struggling due to the duty disadvantage faced by exporters in major markets. There has been continuous decline in cotton yarn and fabric exports from 2013-14 to 2017-18. India’s export of cotton yarn declined 25 per cent from $4,570 million in 2013-14 to $3,443 million in 2017-18. Fabric exports, during the same period, declined 7 per cent from $4,941 million to $4,598 million.

As per Sanjay Kumar Jain, Chairman, CITI, India’s cotton yarn and fabric exports are struggling due to the duty disadvantage faced by exporters in major markets. There has been continuous decline in cotton yarn and fabric exports from 2013-14 to 2017-18. India’s export of cotton yarn declined 25 per cent from $4,570 million in 2013-14 to $3,443 million in 2017-18. Fabric exports, during the same period, declined 7 per cent from $4,941 million to $4,598 million.

China, the largest importer of cotton yarn has shifted focus from India to Vietnam, Indonesia as these countries offer duty free access, while Indian yarn carries a 3.5 import duty. There has been a decline in India’s cotton yarn exports to China by 48 per cent from 2013-17 while exports from Vietnam and Indonesia have increased at a remarkable rate of 129 per cent and 55 per cent respectively in the same period.

Raw cotton exports a loss, import duties add to woes

India’s raw cotton is exported to various markets at zero per cent duty. The country exported $1894 million worth of raw cotton in 2017-18. Export of raw cotton bales instead of value addition by converting to yarn and fabric is leading to loss of valuable foreign exchange, employment and better remuneration to farmers. Similarly, fabric exports from India are at serious disadvantage visà-vis exports from competing countries due to duty differentials in leading exports markets. Markets like EU, China, Turkey and Vietnam impose an import duty in the range of 8-12 per cent on Indian fabric while duty free access is given to countries such as Pakistan, Cambodia, Bangladesh and Cambodia.

The fall in Indian cotton yarn and fabric exports is impacting the entire value chain as there is considerable exportable surplus in the country. As per the Financial Stability Report by RBI, the stressed advanced ratio of textiles sector stood at 18.7 in September 2018.

Report by RBI, the stressed advanced ratio of textiles sector stood at 18.7 in September 2018.

Covering cotton yarn under MEIS to boost exports

Further, Jain highlighted growth in clothing stock has not led to consumption leading to a pressure on the yarn and fabric capacities. Export of garments has declined from $17.4 billion in 2016-17 to $16.7 billion in 2017-18. Jain urged the government to cover cotton yarn under MEIS which will boost India’s exports besides helping it penetrate new markets especially in Africa. Also, farmers will get better price for raw cotton. Cotton yarn is the only segment not covered under MEIS. Hence, despite abundant raw materials and second largest cotton spinning infrastructure in the world, cotton yarn exports are struggling in the absence of government support.

Increase in MEIS for fabric needed

Jain urged the government to enhance MEIS for fabric from 2 to 4 per cent on par with made ups. He said weaving sector is labor intensive like the made ups and garmenting sectors and mostly carried out in the unorganised sector especially in the rural and semi-urban areas. The sector employs women substantially. Hence, if MEIS rate for fabrics is increased from 2 to 4 per cent, exports of fabrics will increase by $1 billion per annum. He urged the government to consider the plea of textile industry and resolve the issues on an urgent basis.

Uzbekistan will deepen reforms in the textile industry to fully reprocess raw cotton domestically and increase the export potential of the country. Stimulating measures will be provided for enterprises engaged in exports of textile products.

Uzbekistan, the world's sixth largest cotton producer, produced 2.3 million tons of raw cotton in 2018. Traditionally, cotton has been Uzbekistan's most important cash crop. But in recent years the country has been taking serious steps to develop its textile industry to produce value-added products rather than exporting raw cotton.

Uzbekistan’s textile exports were up 41.4 per cent in 2018 from the previous year. The aim is to increase export volumes of textile products to $7billion a year by 2025. New cotton textile companies will receive a number of benefits and preferences. These enterprises will promote efficient and rational use of land, water and other resources, increase in yields and timely harvesting of raw cotton, and also ensure its further in-depth processing and production of products with high added value.

These production facilities will buy raw material directly from farms. So far there was no such mechanism for purchasing raw materials first hand. The country exports cotton mainly to China, Bangladesh, Korea and Russia.