FW

Latest World Trade Organisation (WTO) data indictes, clothing exports from Mexico declined by 9.9 per cent in the last ten years, to 14 billion dollars last year. The value exports fell from $5.1 billion in 2007 to $4 billion in 2017.In 2017, the sector was affected by Donald Trump’s threat to suspend the North American Free-Trade Agreement, which regulates trade relations between Mexico, Canada, and the United States.

Finally, the three governments reached an agreement to create a new agreement, the T-Mec, which has already been ratified by Mexico and is pending the green light of Canada and the United States. The entire Latin American market witnessed a decline during the period. The progress of Southeast Asia undermined the importance of this region as a productive pole for the sector. Foreign sales of clothing from this market have fallen almost every year since 2008, with the only exception of 2019 and 2011, when it was 16.4 billion dollars. The following year, exports fell again by 8 per cent, and have continued to decline until they reached 14 billion dollars last year.

Inditex plans to expand its store network by opening new stores in the following months. The company currently has 63 points of sale of its Zara, Massimo Dutti and Bershka chains in the United Kingdom. In the first six months of the current year, the Spanish giant expanded its retail space in the British by 7 per cent.

Inditex also reduced its profit before taxes in the United Kingdom in the first half of its fiscal year. Its profit before tax stood at $28.9 million dollars in the country in the first half of its fiscal year. The group achieved revenues of $ 28.9 million in the first half, compared to $67.1 million in the same period last year. Sales in the country increased by 10 per cent to $1 billion.

VF hopes to drive business forward with its emerging brands Smartwool, Icebreaker and Napapijri. Smartwool is a sock, apparel and accessories brand. Last year, Smartwool revenues grew eight per cent. The company’s new 3D Intraknit collection will be the key driver for Smartwool to scale up its apparel category, especially in markets such as Europe, where distribution is lagging, but also in the US where the brand hopes to expand beyond its core markets.

Ten years ago, Icebreaker was a wholesale-only company, but over the past decade, the brand is now 33 per cent direct-to-consumer (DTC), which has not only helped boost margins but also given Icebreaker better control over the customer experience. Now the brand is looking to grow the DTC channel to 45 per cent over the next four years, and part of that transformation involves the company’s commitment to natural fibers. Icebreaker uses ultra-fine, ethically sourced, sustainable, traceable fiber made with the best factories in the world. Italian-based apparel maker Napapijri has been part of VF since 2004 and has an established customer base in Europe. The upscale apparel brand is generating double-digit growth and has a strong direct-to-consumer channel presence in both owned and partnership stores. The brand’s success is based on a commitment to design and sustainability.

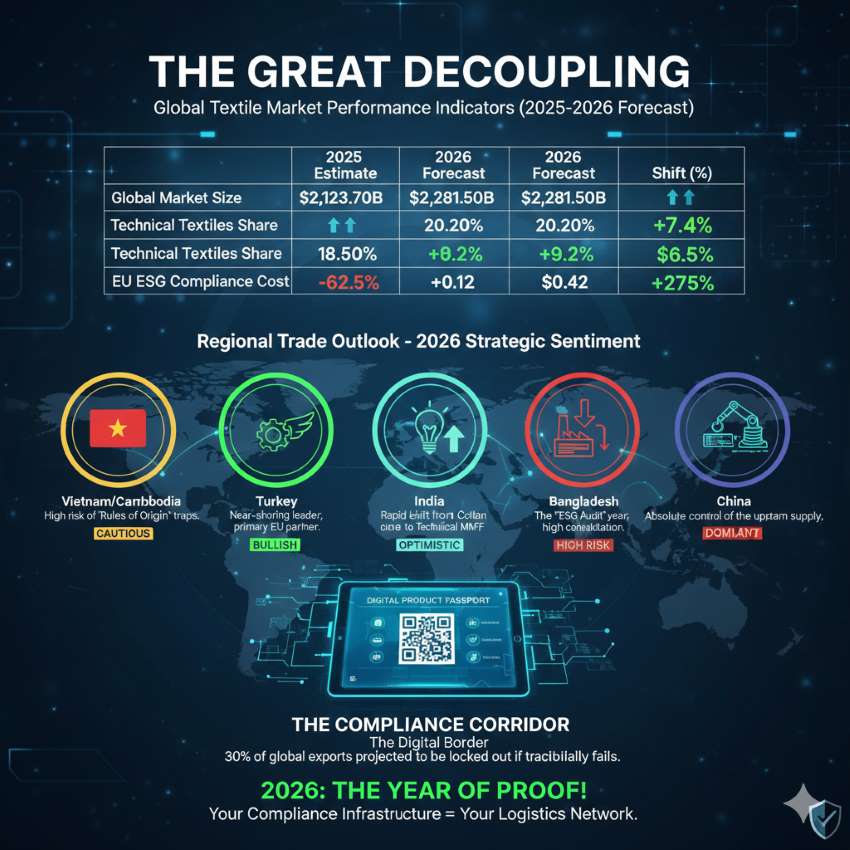

China’s direct investment in Vietnam has surged more than 60 per cent this year. Increasing production costs in China have pushed manufacturers to relocate their factories to Southeast Asian countries which have lower costs. Vietnam is also seen as a country with a better labor supply. Manufacturers considering moving out of China are mainly producers engaged in low-end sectors in manufacturing, including textiles and garments, consumer discretionary and electronics packaging and assembly. But high-end industries, such as electronics and machinery, are also showing signs of relocating to Vietnam.

Vietnam relies on China to propel its rapidly growing economy. China is Vietnam’s biggest trading partner. Vietnam has capitalised on the fallout of the US-China trade war to become a top destination for manufacturers looking to avoid tariffs. China now is the third biggest FDI investor to Vietnam, climbing up from fifth in 2018. Another reason for the Chinese shift to Vietnam is the trade dispute with the US. The trade war is also benefiting countries like Cambodia, Myanmar and Bangladesh. The massive outflow of production from China is going to them. While outerwear is moving into Myanmar and Vietnam, sportswear and bottoms are moving into Cambodia. There has also been an increased general outflow into Bangladesh.

As per global analytical firm GlobalData, though the on-going US-China trade war highlights the country’s need to diversify clothing and footwear sourcing, it is not an easy task given its dominance of apparel supply chains. China is by far the largest clothing and footwear supplier, accounting for 42 per cent of all apparel and 69 per cent of all shoes imported into the US last year. All other countries combined are ill-equipped to handle the sheer volume of capacity that would be required to move production out of China.

China had a 31.3-per-cent share of world apparel exports by value last year. No other country can match the size of its supply base, its range of skills, its quality levels, its product variety and the completeness of its supply chain from raw materials to final products – or has the capacity to absorb its business. China also continues to appeal to apparel buyers as rising wages are largely being offset by efficiency and productivity gains.

In addition, the country plays a key role as a textile supplier, as the world’s largest producer of fiber and fabric and the largest textile exporter, with the value of shipments last year reaching 37.6 per cent of the global total. Its on-going investment in modern spinning, weaving and knitting machinery is also helping to drive better quality, lower production costs and more environmentally-friendly production – and shores up China’s future position as the key supplier of fabric and trims.

Products made by the forced labor of Chinese Muslims detained in camps in the Xinjiang region could be making their way to the US and other countries. Much of the forced labor in Xinjiang is involved in producing cotton rather than finished clothes. This cotton winds its way through a multi-step supply chain that can obscure its origins before potentially being exported to countries such as the US. Xinjiang is also where most of China’s cotton is grown. Cotton products don’t generally ship straight from Xinjiang to the US. Instead, the cotton is turned into yarn and textiles in Xinjiang, other parts of China, or sometimes neighboring countries. US companies buy the yarn, fabrics, or even finished clothes made from the cotton. That’s a huge problem since China is one of the world’s largest cotton producers and its biggest garment exporter. One in three garments the US imports annually comes from China.

Forced labor is a reality in the sprawl of internment camps across Xinjiang in western China. They hold up to an estimated million detainees, most of them Uyghurs and other Muslim minority members, who are said to be deterred from extremism and instead given work to escape poverty.

Birla Cellulose has produced viscose fiber using pre-consumer cotton fabric waste. The innovation has been done through in-house R&D and uses a minimum of 20 per cent pre-consumer industrial fabric waste. Fabrics from the fiber are said to offer excellent attributes similar to virgin fiber. The business will work on further developing products made with more than 50 per cent industrial fabric waste as well as post-consumer clothing as inputs in 2020. This new line of viscose is already being adopted and is available for sale to brands and retailers.

Birla Cellulose is part of Aditya Birla. Birla Cellulose is a leader in manmade cellulose fiber. The launch of recycled viscose fiber is part of its commitment for circularity and sustainable practices. The company is also working on developing fibers using post-consumer clothing as inputs in collaboration with technology providers and brands. Birla Cellulose has been in active collaboration with brands, technology providers and textile chain actors to integrate and enhance value. Going forward, Birla Cellulose will intensify and strengthen its specialty portfolio towards value-added green textile solutions for the future. The business will work on further developing products made with more than 50 per cent industrial fabric waste as well as post-consumer clothing as inputs in 2020.

Bangladesh’s exports of T-shirts fell seven per cent in the first quarter. Reasons include the depreciation of the currency, low work orders and the low price offered by buyers. Buyers have lowered their purchasing price by around ten per cent during the last three months. Most orders for knit products come from Pakistan and India. High-end knit products go to Cambodia and Vietnam.

Bangladesh’s T-shirt exports increased steadily over the last three financial years. Around 80 per cent of the country’s export earnings come from the garment sector. During the last four decades, the industry has gradually become the driving force of the economy. But the basis of this driving force is mainly in five or six products. Garments are exported from Bangladesh mainly under two categories. One is knit, the other is woven. In these two categories, mainly five types of goods are exported. These are T-shirts, trousers, shirts, jackets and sweaters. The country’s readymade garment exports fell by 1.64 per cent in August 2019 because of the Id vacation. Most factories remained closed for at least seven days.

However, demand for T-shirts in Western countries remains high throughout the year. Despite the fact that China remains a key global centre for the production of T-shirts, production is gradually shifting to other countries in Asia.

All Pakistan Textile Mills Association (APTMA) in its letter to Razzak Dawood, Adviser to Prime Minister on Commerce, Textile, Industry & Production and Investment has sought his intervention for elimination of the new change in tax refund mechanism as consumption based refund policy is detrimental for the industry.

As per APTMA, the system cannot be accepted as it will erase the liquidity of around Rs 300 billion as it will remain stuck with the government all the time. If the new system is allowed to continue, it will destroy the industry due to the non-availability of the liquidity. The refund system has been moved to a consumption based refund policy rather than an input based monthly sales tax return on input based system. The policy will permanently transfer approximately 5-6 month value of input on materials from industry to the coffers of FBR. And the total value of sales tax collection is estimated to be Rs 600 billion annually, this means Rs 250 billion.

In addition, the fastest system is currently processing only 42 per cent of the claims made, the rest being referred to the old star system of verification. This will further delay refunds of over Rs 50 billion taking the total transfer from industry to FBR to Rs 300 billion.

The letter also suggests that a very simple way to verify claims is to request FBR to provide the sales tax collected for the first three months and the refunds made pertaining to this period only. This is necessary to include the refunds made for early periods and the irony is that the bulk of those were also made the bonds which were worthless and which position we understand FBR is correcting.

"For long, products Made in India brands have been ridiculed for their low quality. There have been instances where many western retailers have refused to stock collections by Indian designers due to the reputation of these products being assembled in sweatshops and having a ‘hippie dippie’ or bohemian aesthetic."

For long, products Made in India brands have been ridiculed for their low quality. There have been instances where many western retailers have refused to stock collections by Indian designers due to the reputation of these products being assembled in sweatshops and having a ‘hippie dippie’ or bohemian aesthetic.

For long, products Made in India brands have been ridiculed for their low quality. There have been instances where many western retailers have refused to stock collections by Indian designers due to the reputation of these products being assembled in sweatshops and having a ‘hippie dippie’ or bohemian aesthetic.

Many factors like tenuous labor regulations, rampant corruption, low civic engagement, leverage afforded to foreign investors, often one-sided trade policies and a general lack of social consciousness have resulted in India being counted among low-cost manufacturing countries.

Brands reinforce their confidence in Indian products

However, now many global companies hope to mobilise industriesand communities to affect change. They include international players such as Belgian Dries Van Noten, who believe India is capable of producing luxury pieces that can compete on a global scale without impacting their brand’s business.

include international players such as Belgian Dries Van Noten, who believe India is capable of producing luxury pieces that can compete on a global scale without impacting their brand’s business.

Similarly, Miuccia Pradahas remained unaffected with the origin of her pieces as the brand produces on a global level. Now, ‘Made-in-India’ products are coveted and celebrated by brands and consumers alike.

Factories get humanised with more customised offerings

Though many western luxury houses depend on South Asia to embellish their runway dreams, the producers are seldom credited for their work. A case in point is brands by Indian manufacturers such as Arvind and Raymond that create elevated, tailored offerings with meticulous attention to detail.

The continent’s manufacturing hotspots are also changing with Indian factories humanising their manufacturing supply chain so that they lie under the radar. Since 2013, there has been a surge of new-age factories focusing on improving their manufacturing standards and code of conduct.

Indian products global acceptance

Meanwhile, many Asian factories are now being passed over to millennial heirs, who are questioning the operations of their factories and their interactions with local communities. Increasing consumer demand is only putting more pressure on these businesses to evolve. Therefore, dismissing India — which can produce the finest handbags, couture and ready- to-wear — is like dismissing its long cultural heritage. On the other hand, the acceptance of its manufacturing is like accepting its history of offering nimble and articulate products that need to be treated equally with other global counterparts.